Inflection point of the cycle and policy resonance: The allocation value of E Fund Chemical Industry ETF stands out

Author: Litchi

The chemical industry is at a crossroads of reshaping supply-demand dynamics and cyclical reversal. Against the backdrop of deepening "anti-involution" policies and bottoming capital expenditures, the E Fund Chemical Industry ETF (516570) has recently demonstrated strong capital attraction, with 14 consecutive days of net inflows totaling over 1.4 billion yuan, reflecting strong market consensus on the sector's recovery.

I. Core Logic: Supply-Side "Anti-Involution" Accelerates Industry Consolidation

The chemical industry is undergoing a profound transformation from "scale expansion" to "high-quality development."

Policy-Driven Supply-Demand Optimization: Since 2026, domestic "anti-involution" policies have effectively curbed cutthroat price competition in homogeneous products through technological upgrades and equipment renewal. The CSI Petrochemical Industry Index tracked by E Fund Chemical Industry ETF (516570) focuses on industry leaders with scale advantages and technological barriers, poised to benefit first from supply-side structural improvements.

Capital Expenditure Inflection Point Confirmed: Year-on-year growth in industry construction projects has turned negative, and the peak of new capacity additions has passed. With rising capacity utilization, chemical prices are rebounding from lows, driving the profitability of E Fund Chemical Industry ETF (516570) constituents into a recovery cycle.

II. Capital Flows: 14 Consecutive Days of Net Inflows, Record Highs in Size and Shares

Market capital is often a "leading indicator" of industry momentum.

Strong Capital Attraction: As of early February 2026, E Fund Chemical Industry ETF (516570) has shown significant capital magnetism, with 14 consecutive trading days of net subscriptions totaling approximately 1.449 billion yuan.

Liquidity and Cost-Effectiveness: The fund's latest shares and size have hit record highs since inception. Notably, its combined management fee (0.15%) and custody fee (0.05%) total just 0.20% annually, offering clear cost advantages for long-term investors.

III. Sector Allocation: Dual Attributes of "High Dividend" and "High Growth"

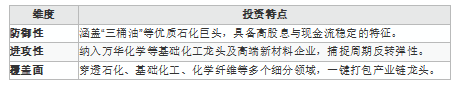

The unique index methodology of E Fund Chemical Industry ETF (516570) lends it resilience in volatile markets.

Expert Perspective: How to Allocate E Fund Chemical Industry ETF (516570)?

1. Tactical Trading: Monitor PPI and chemical price trends. Capture sector beta during early recovery phases.

2. Dollar-Cost Averaging: Given the sector's cyclicality, consider phased investments through E Fund Chemical Industry ETF (516570) and its feeder funds (Class A: 020104; Class C: 020105) to average costs.

Risk Disclosures:

1. Cyclical Volatility: Macroeconomic fluctuations may impact demand recovery and NAV.

2. Raw Material Risks: Price swings in crude oil etc. directly affect downstream margins.

3. Policy Risks: Tighter environmental/safety regulations may raise operational costs.

Past performance does not predict future results. Invest with caution.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.