BEKE delivered solid performance this quarter, but its stock price still fell, reflecting lingering macro uncertainties in the property market.

Due to overlapping with Alibaba's earnings release last night, we'll briefly comment on BEKE's performance first and provide a detailed analysis later.

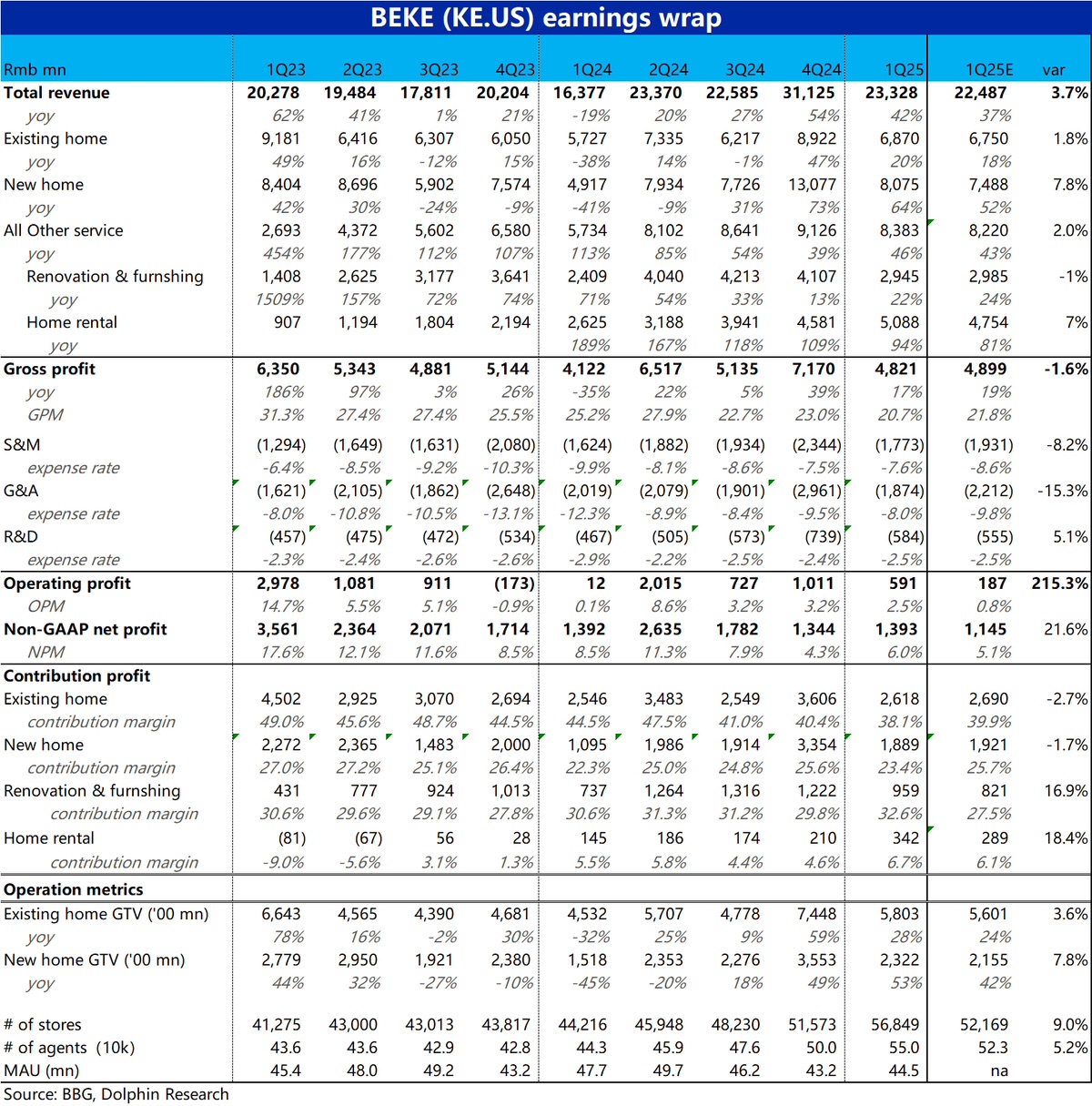

Overall, thanks to property support policies since late last year, the company's key metrics including GTV, revenue, and profit this quarter all exceeded expectations.

However, in terms of stock price reaction, BEKE had already declined significantly before the earnings release, showing profit-taking tendencies. Although the better-than-expected results did cause a short-term rally, the stock eventually fell again. This is mainly because BEKE's performance remains heavily dependent on macro property market uncertainties, while recent high-frequency data shows both YoY and MoM declines in April and early May property transactions. Therefore, the solid Q1 results indeed presented a potential selling opportunity.

From the earnings perspective, the main weakness was the QoQ decline in combined commission rates for both new and existing home transactions. Contributing factors include the growing proportion of non-self-operated business in revenue structure, possibly due to regulatory considerations, but also reflecting the prevailing "volume over price" trend. The company has been promoting transactions through commission discounts.

The result is that while profits were better than more conservative expectations, on an absolute trend basis, adjusted net profit merely stayed flat YoY despite 37% total revenue growth. The problem of revenue growth without corresponding profit growth that emerged last quarter hasn't been reversed.$KE(BEKE.US)$BEKE-W(02423.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.