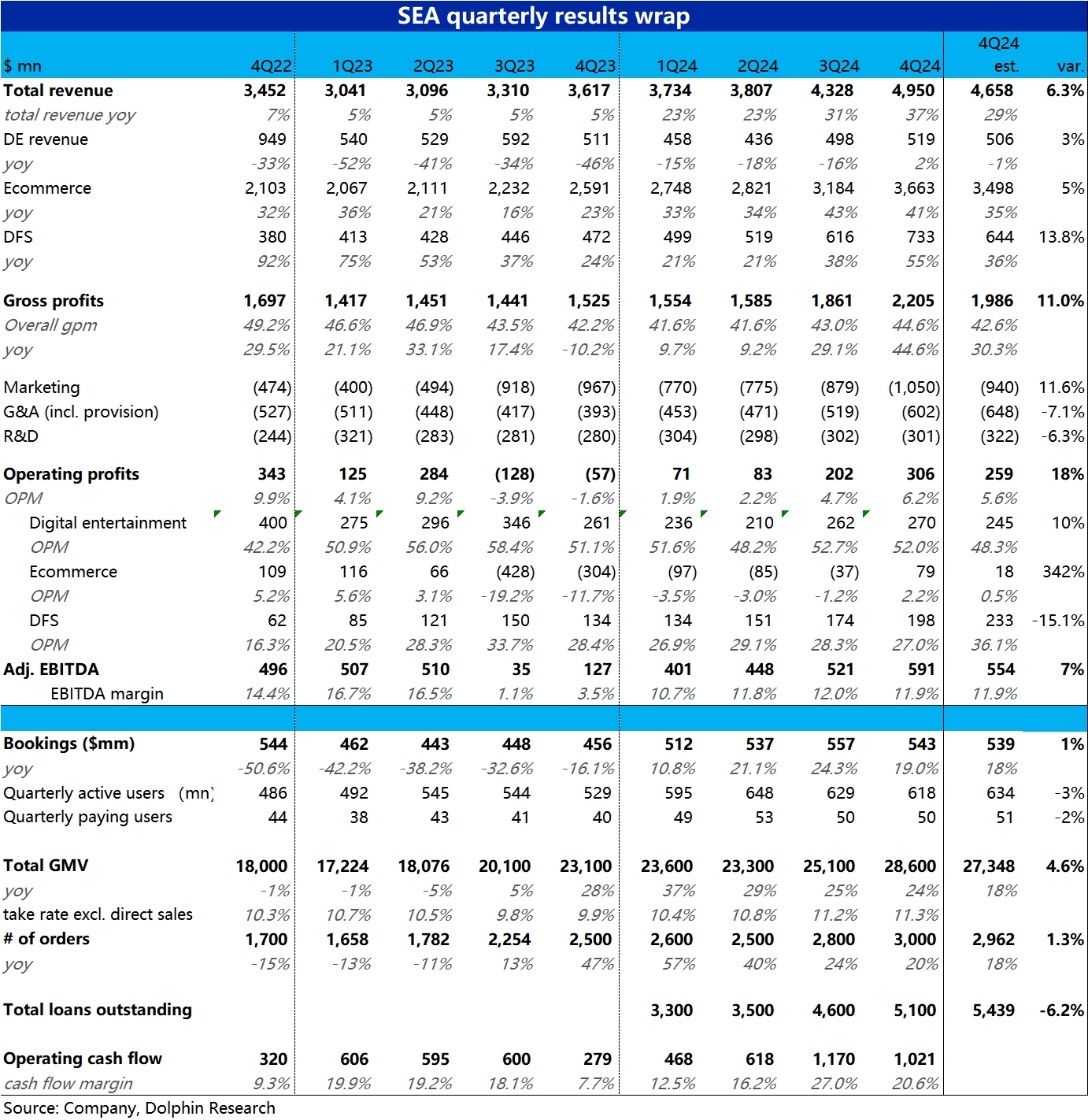

$Sea(SE.US) 4Q24 Quick Interpretation: This quarter, Southeast Asia's small Tencent, Sea, once again delivered impressive performance. Both revenue and profit (adj. EBITDA) exceeded expectations by approximately 6% and 7%, respectively. The highlights are mainly in the growth segment, which performed better than expected, and the profit margin did not lag behind.

1) By segment, the core indicator of the gaming sector, total bookings, grew by 19% year-on-year, slightly better than the expected 18%.

2) The main highlight is that the e-commerce sector's GMV grew by 24% year-on-year, significantly exceeding the market expectation of 18%. On a quarter-on-quarter basis, the growth rate only decreased by 1 percentage point, indicating that the resilience of e-commerce growth is stronger than expected. Meanwhile, the profit release speed of the e-commerce sector also exceeded expectations, turning positive to a profit margin of 2.2% this quarter after six consecutive quarters of operating losses, significantly higher than the consensus expectation of 0.5%. This shows that strong growth is not at the expense of profit.

3) The performance of the emerging sector - SeaMoney financial services is mixed; its current core indicator - total loan balance of 5.1 billion, falls short of the market expectation of 5.4 billion. Additionally, due to a significant increase in marketing expenses (doubling from 6.6 million last quarter to 12 million this quarter), the operating profit of the financial sector also fell below expectations.

Overall, due to the strong performance of the e-commerce sector, which has the greatest impact on performance and valuation, the market's feedback on this performance is clearly positive.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.