Top 10 Influencers in 2025

Top 10 Influencers in 2025The core issue is that when the market believes the original valuation model has failed, any short-to-medium-term performance you present will be useless.

You are forced to prove that AI is a driver rather than a stumbling block for your development. This self-verification is extremely difficult—it either distorts the normal growth of your business or requires time to realign with the valuation model originally granted by the market.

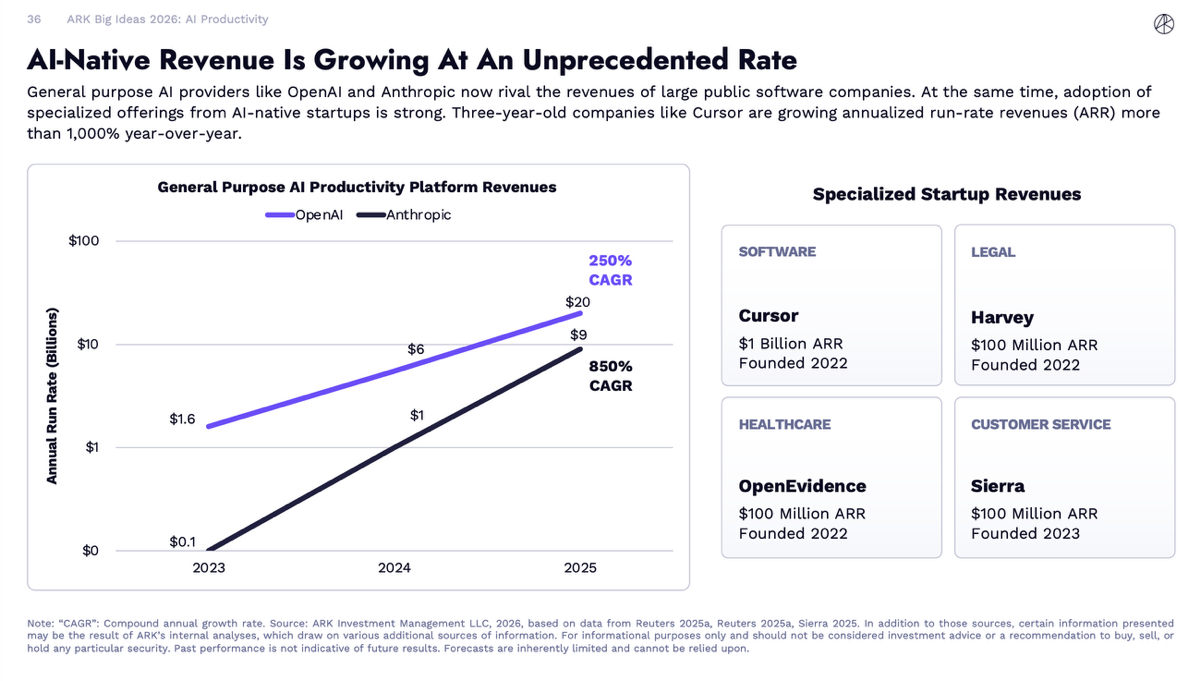

Seeing ARK's data is quite shocking. AI startups in the primary market that have not yet gone public show astonishing growth potential, with annual recurring revenue (ARR) reaching $100 million in just 1-2 years. Traditional SaaS vendors take 3-5 years to achieve such growth through seat-based pricing models. The duration for AI Agents to reliably complete tasks has increased 5-fold within a year (from 6 minutes to 31 minutes). Work that originally required 100 Seats may now only need 10 people plus a group of Agents, rendering the seat-based valuation model for SaaS companies obsolete.

Startups in the primary market are grabbing market share from mature companies in the secondary market through productivity leaps, which is the core reason for the widespread decline of software stocks.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.