Sea 3Q25 Quick Interpretation: Overall, Sea's performance this quarter is somewhat fragmented, with both highlights and shortcomings. The highlight is on the growth side, where the revenue and business metrics of the three major segments exceeded expectations, and the extent of the outperformance was significant.

Before the earnings release, the market's main concern was that the company's increased focus on growth would lead to a slowdown in margin improvement. This quarter indeed validated this concern, as the adjusted EBITDA of the most important e-commerce and financial segments both fell short of expectations, and the segment margins continued to decline sequentially.

Specifically,

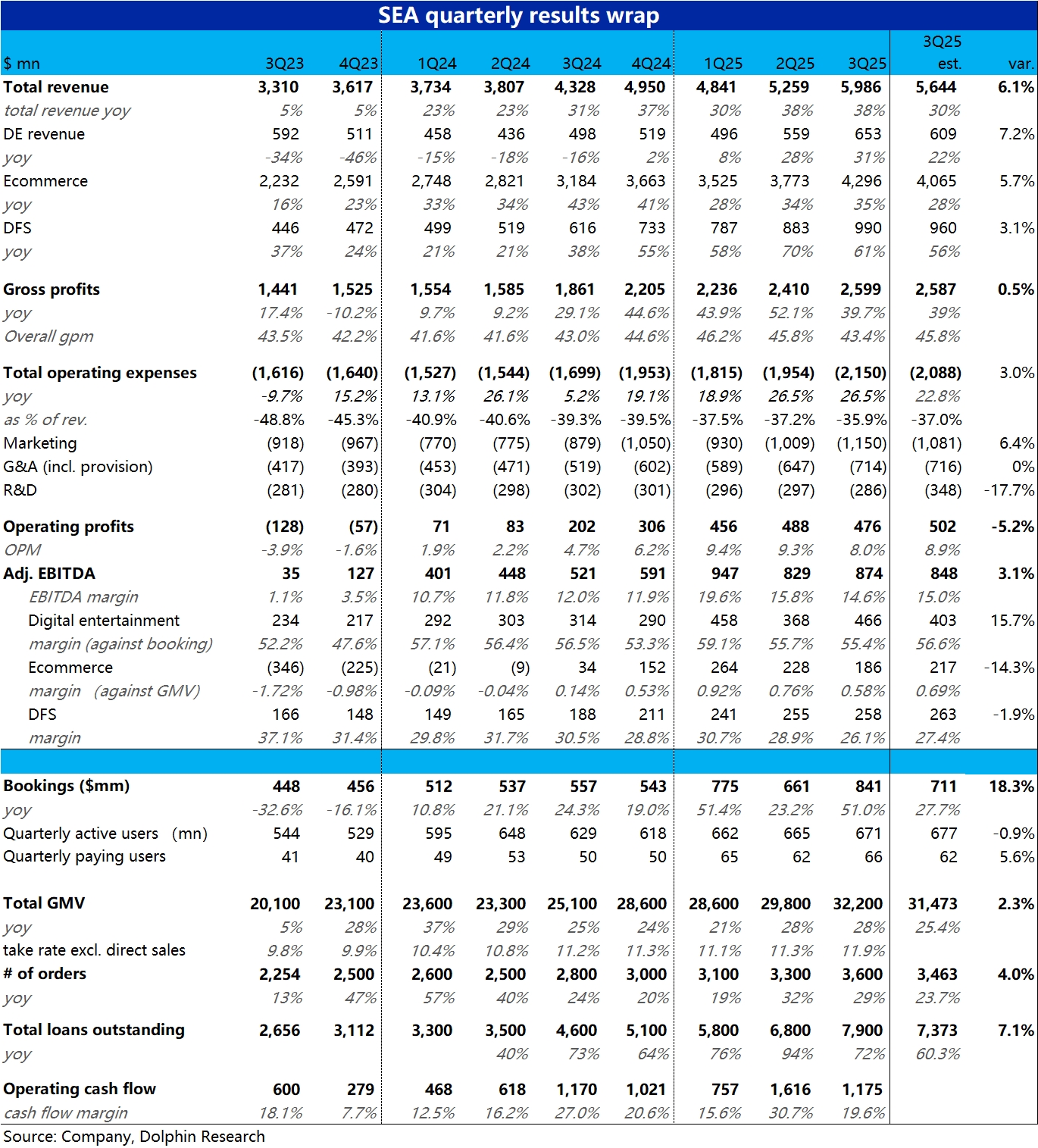

1) Total revenue for the quarter grew by 38% year-on-year, maintaining the high growth rate of the previous quarter and significantly exceeding the market expectation of 30%. The revenue growth of all three business segments surpassed expectations by 3-7 percentage points, with no segment lagging behind.

2) In terms of key operating metrics, the year-on-year growth rate of e-commerce GMV was 28.3%, continuing to accelerate slightly from the previous quarter and significantly better than expected. The traffic volume of the gaming business also grew by an impressive 51%, far exceeding expectations, reportedly stimulated by collaborations with the Naruto anime and Squid Game.

The loan balance of the financial segment reached 7.9 billion this quarter, with a year-on-year growth rate of 72%, also far exceeding the expected 60%. It is evident that the core metrics of the three major segments grew significantly stronger than expected.

3) In terms of profit, the group's overall adjusted EBITDA for the quarter was 870 million, which at first glance is slightly higher than Bloomberg's expectations, but this is mainly due to the unexpectedly strong yet potentially unsustainable performance of the gaming business. (The gaming segment is currently the largest contributor to profits, but it is the least important segment in terms of valuation.)

4) By segment, the gaming business indeed had the best profit performance, with actual profits exceeding expectations by about 60 million, and the adjusted EBITDA margin did not decline significantly sequentially. However, the e-commerce segment's profit was about 30 million less than expected, and the profit margin narrowed from 0.76% to 0.58% (based on adj. EBITDA/GMV), although the market had anticipated a decline in margin, the actual extent was greater.

Adding insult to injury, the profit margin of the financial business, which is the second most important for the company's future growth, also declined more than expected, at 26.1% this quarter, down 2.8 percentage points sequentially.

As a result, despite a 61% increase in revenue for the financial segment, the segment's adjusted EBITDA only grew by 37% year-on-year. Therefore, overall, although the growth of the three major segments was stronger than expected, the sequential contraction in margins across all three segments meant that profit growth was not as robust as revenue growth. $Sea(SE.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.