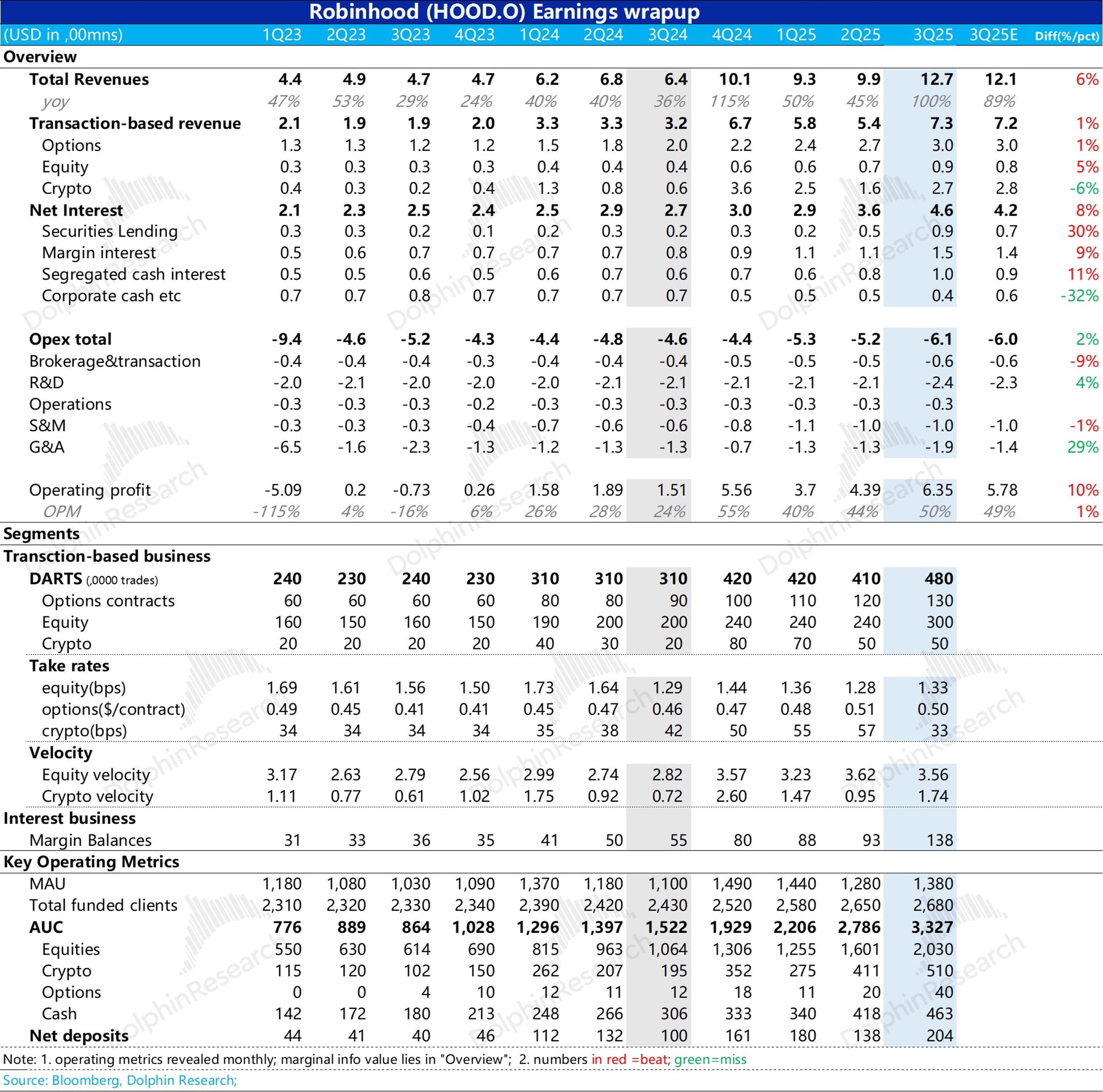

Robinhood 3Q25 Quick Interpretation: Excluding expected discrepancies, the third-quarter performance itself was very impressive—from customer acquisition, fund inflow, trading, revenue, to profit, almost all aspects were commendable.

However, a significant characteristic of this company is that it almost publishes its operating data in real-time on a monthly basis. On September 29, it released the operating data up to the 25th of September. Therefore, customer acquisition, fund inflow, and trading volume were essentially pre-priced by the market, and the market had already set expectations for the company's revenue and profit based on the operating data and the trend of monetization rates.

Since the last earnings report, although there are signs of 'falsification' regarding stock tokens, due to consistently good operating data, the stock price has increased by more than 40%. From the actual situation, the valuation is relatively full, and the most important marginal incremental information on the performance side—possibly due to the acquisition of Bitstamp—has led to a slight market misjudgment of the monetization level of virtual assets.

Due to Bitstamp's huge trading volume, but with basically 90% being institutional trading, the trading monetization rate is only 4 basis points, but the monetization rate of the original virtual asset business of the HOOD APP actually increased to 63 basis points in the third quarter, which is actually very outstanding.

However, since Bitstamp has been fully included in HOOD from the third quarter, the comprehensive monetization rate is only over 30 basis points, which seems much lower. If this gap is not considered, the company's performance from trading-related revenue to interest-bearing income, especially the performance of margin financing, is very impressive.

On the expense side, management expenses were significantly below expectations, mainly because the stock price increased significantly, triggering CEO equity incentives, resulting in relatively high salary payment taxes.

It can actually be seen that the shortcomings of HOOD are not core issues that affect long-term judgment. From the operating results, it is still the retail king favored by young people. $Robinhood(HOOD.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.