Weiluo Group 4000-word in-depth research report

$REALORD GROUP(01196.HK)$REALORD GROUP(01196.HK) $FIRST PACIFIC(00142.HK) Research on Weilu Group reveals the most shocking cliff-like deterioration in its financial data, with high debt and continuous losses forming a deadly risk loop.

🎯 Core logic: Main businesses in environmental protection (e-waste treatment) + property investment and development. The environmental protection industry is policy-driven but fragmented (CR5<30%), with limited entry barriers leading to weak pricing power; property business is significantly affected by the real estate cycle. Synergies between the two main businesses have yet to materialize, scale effects are hard to achieve, and core competitive advantages need strengthening.

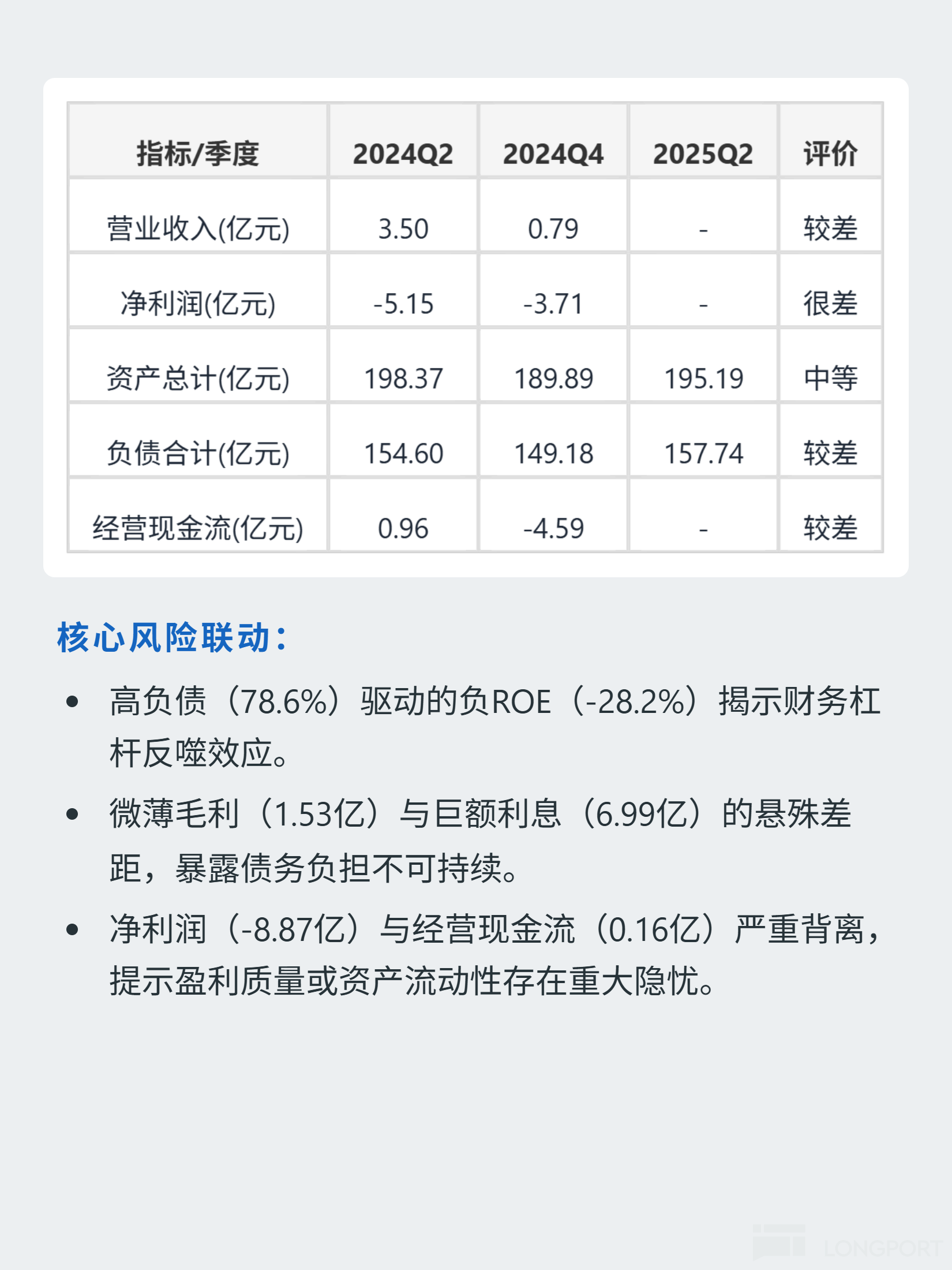

📈 Key financial issues: ROE plummeted from 30.3% in 2020 to -28.2% in 2024; net profit margin was -207% in 2024 (Q4 alone -471.5%), losing over 2 yuan for every 1 yuan earned; debt-to-asset ratio 78.6%, current ratio 1.00 (quick ratio 0.40), interest expense of 699 million yuan uncovered by EBIT; only 2024 saw slightly positive free cash flow (13 million yuan) in the past five years, with 2024Q4 operating cash flow at -459 million yuan, showing severe divergence between net profit (-887 million yuan) and operating cash flow (16 million yuan).

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.