Costco F4Q25 Quick Interpretation: Costco's performance for the quarter ending in August remains stable overall, and the company discloses monthly sales and same-store growth, ensuring no unexpected differences in revenue data.

However, this time, only in the quarterly report's disclosed operational and expense indicators, some potential issues have indeed been exposed. Key points are as follows:

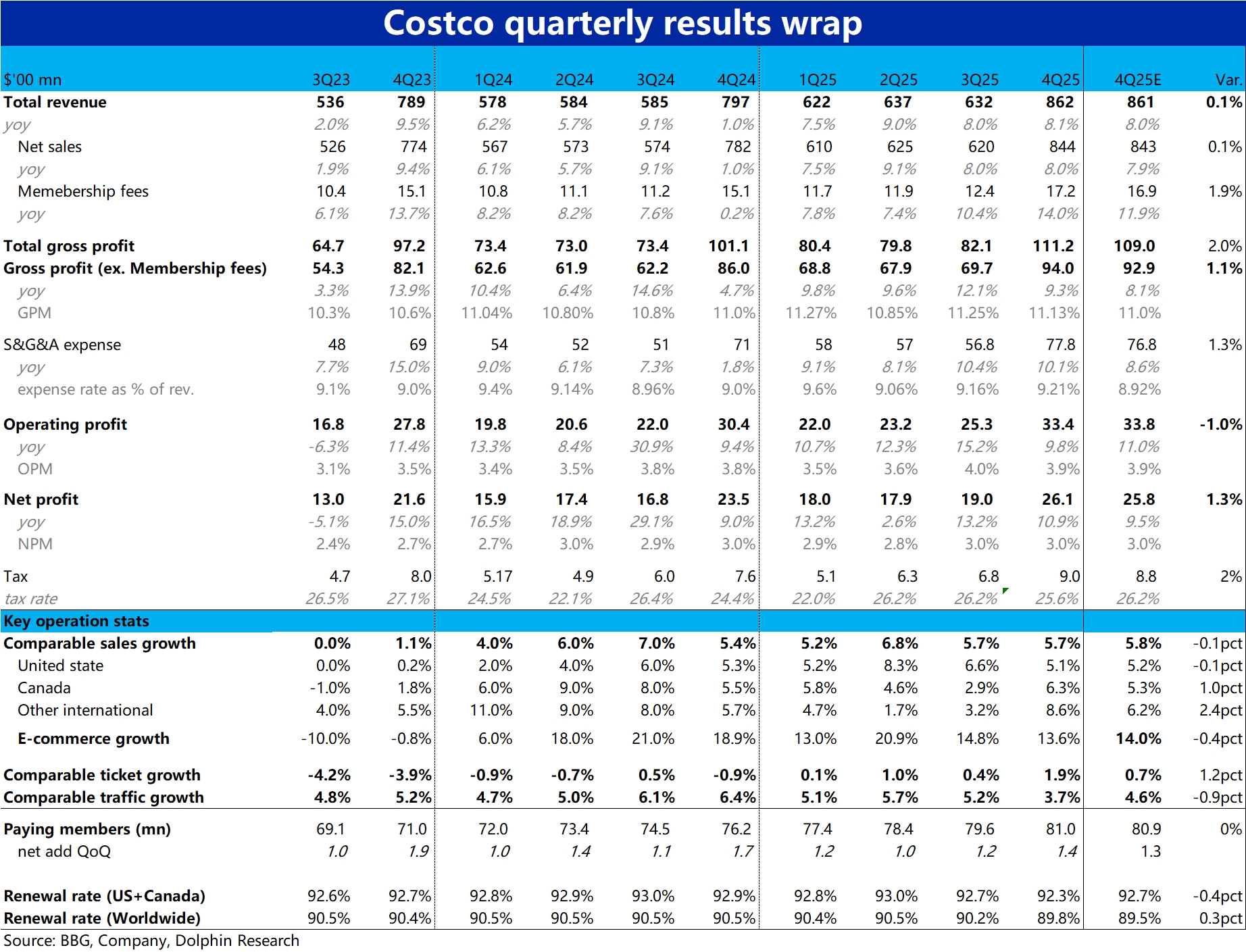

1) In terms of core figures, the company's total revenue for the quarter increased by 8.1% year-on-year, with sales revenue growing by 8% and membership income rising even higher at 14%. Sales revenue had been announced earlier, but the membership fee income slightly exceeded expectations, mainly due to the fee increase starting last September and the continued rise in the proportion of high-level Executive members.

2) Revenue performance was good, as inflation and rising oil and gas prices, although prompting increases in both gross margin and expenses, the latter accelerated faster due to rising labor costs. This led to a significant narrowing of the company's profit margin increase, with operating profit for the quarter growing by 9.8% year-on-year, falling below 10% and the lead over revenue growth being quite limited.

3) In terms of core same-store operating indicators, although the overall same-store sales growth rate remained at 5.7%, consistent with the previous quarter, the growth rate of single-store traffic this quarter significantly declined to 3.7%, the lowest value in the past three years. Stable same-store sales growth has relied more on the increase in average transaction value under inflation. However, price increase and volume decrease is undoubtedly not a very healthy growth model.

It seems to suggest that due to inflation and rising commodity prices, consumers are beginning to reduce the frequency of their purchases. $Costco Wholesale(COST.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.