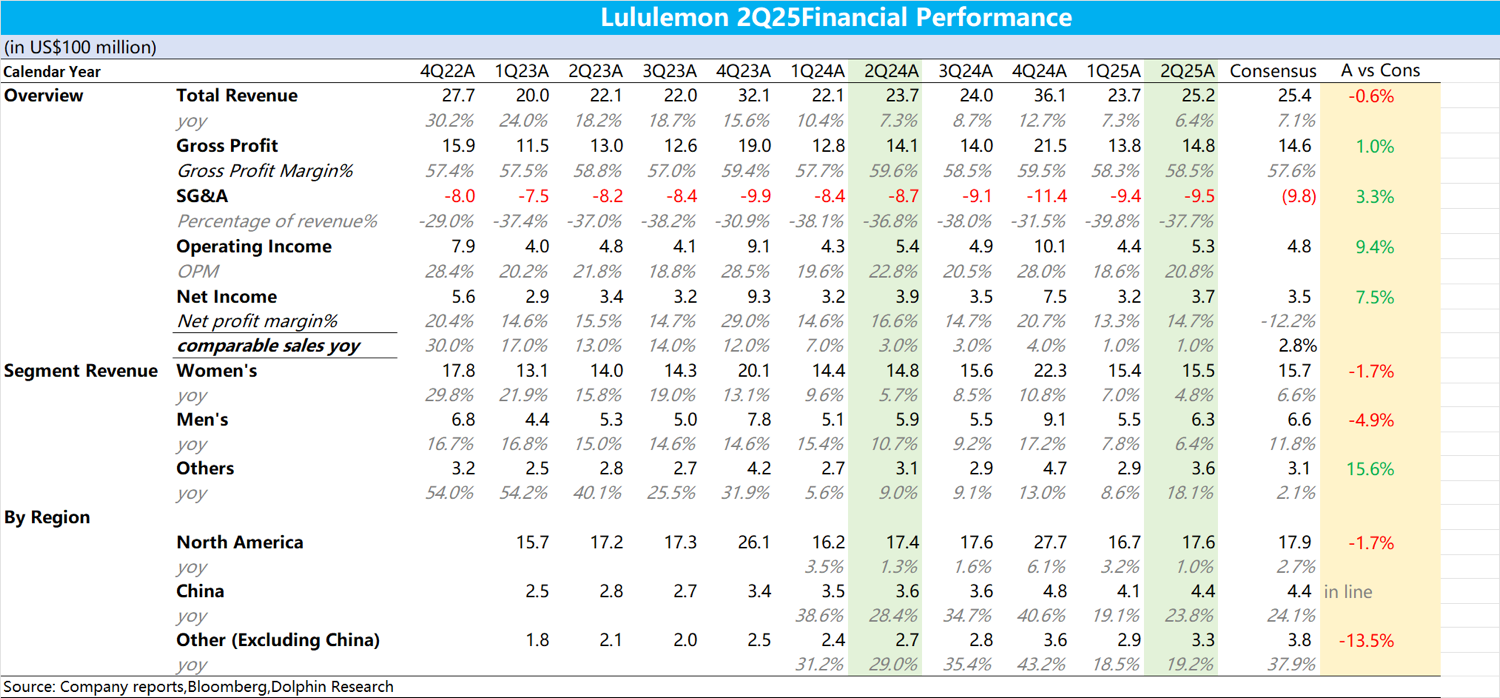

Lululemon 2Q25 Quick Interpretation: Overall, Lululemon's performance this quarter remains disappointing.

Despite having lowered guidance last quarter, this quarter's results still fell short, with revenue reaching $2.52 billion, a year-on-year increase of 6.4% (guidance was between 7%-8%).

What is more concerning to the market is that the company has once again lowered its full-year revenue guidance from 5%-7% to 2%-4%.

1) On the revenue side, by category, the core business of women's wear achieved revenue of $1.55 billion, a year-on-year increase of 4.8%, slightly below market expectations.

The core reason is speculated to be that the core product, the black yoga pants, has already saturated the core consumer base. Coupled with the impact of competitors like AloYoga and Vuori, it has become very difficult for the company to achieve high growth through yoga pants.

Men's wear achieved revenue of $630 million, a year-on-year increase of 6.4%, also showing no significant improvement.

From a regional perspective, the biggest issue remains in Lululemon's home market of North America, which only achieved a 1% growth.

On the other hand, the relatively better performance was seen in the Chinese market, where the growth rate improved quarter-on-quarter, achieving revenue of $440 million, a year-on-year increase of 23.8%. This is speculated to be related to the company's Align 10th Anniversary Global Celebration event held in core cities in China during the second quarter.

2) In terms of gross margin, due to the tariffs imposed by the U.S. starting in April, coupled with the impact of discounts, the company's gross margin slightly declined by 1.1 percentage points to 58.5% year-on-year.

On the expense side, due to the expansion of international business, the company increased recruitment of international personnel and raised related salaries. Additionally, the marketing expenses for the Align 10th Anniversary Global Celebration event held worldwide increased, leading to an overall expense ratio increase of 0.9%.

Ultimately, Dolphin Research calculated the core operating profit margin to be 20.8%, a decrease of 2 percentage points. $Lululemon(LULU.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.