Nio 2Q25 Quick Interpretation: Overall, Nio's second-quarter financial report did not meet expectations.

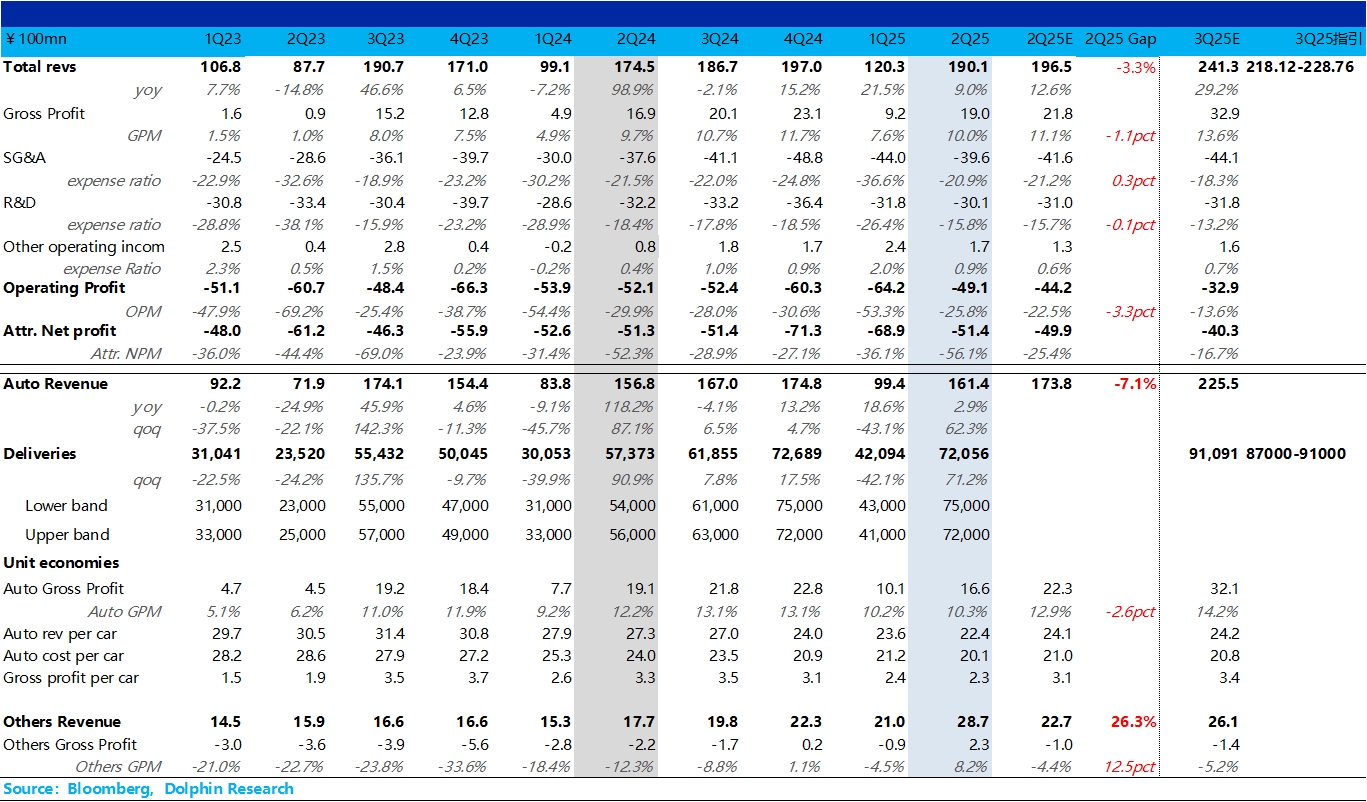

Previously, Nio had provided guidance: with the launch of the revamped 5566 model, the vehicle sales price could recover from the low point of inventory clearance in the first quarter; coupled with the cost reduction from the self-developed chip NX9031, the vehicle gross margin was expected to rebound to around 12%-13% quarter-on-quarter this quarter.

However, the reality is that the second-quarter vehicle sales gross margin was roughly the same as the previous quarter when clearing old inventory, with the core issue being the vehicle sales price.

This quarter, the vehicle sales price actually decreased by 12,000 yuan quarter-on-quarter compared to the previous quarter's clearance of old models, with the price reduction even greater than during the first quarter's inventory clearance!

Behind this is the mediocre demand for the revamped 5566 (using the NT2.0 platform instead of NT3.0), and the declining competitiveness of the Le Tao L60. However, for Nio, which is already in a critical survival period, sales volume remains the top priority.

This has led to a situation where, although the cost per vehicle did decrease by 10,000 yuan this quarter, the sales price dropped even more significantly, resulting in an overall vehicle gross margin decrease of 1,000 yuan to 23,000 yuan compared to the previous quarter's off-season inventory clearance.

From the bottom line net profit perspective, the second-quarter net profit was -5.1 billion yuan, which indeed showed a reduction in losses compared to the first quarter, but still fell short of the market expectation of around -5 billion yuan. The key reason for missing expectations was the vehicle gross margin.

Fortunately, there are signs of improvement in Nio's three expense categories this quarter, with selling and administrative expenses improving by 440 million yuan to 3.96 billion yuan, better than the expected 4.2 billion yuan.

This is mainly due to the merger of Le Tao and Nio's channel operations, and the organizational restructuring in the second quarter, which resulted in approximately 5,000 layoffs, primarily affecting the sales and service teams.

Research and development expenses also improved by 170 million yuan to around 3 billion yuan this quarter, with expectations for further reductions in the second half of the year (Nio previously guided that 4Q25 R&D expenses would fall to 2-2.5 billion yuan).

Regarding the crucial third-quarter guidance, with the delivery of the Le Tao L90 already underway, the sales guidance is 87,000-91,000 units, implying September sales of 35,000-39,000 units, an increase of 4,000-8,000 units from July's 31,000 units. Dolphin Research believes this sales guidance is acceptable, especially since nearly 10,000 units of the Le Tao L90 were delivered in August.

However, the implied vehicle sales price in the revenue guidance is expected to continue to decline by 4,000 yuan quarter-on-quarter to 220,000 yuan, significantly below the market expectation of 242,000 yuan.

In conclusion, the most apparent issue with this financial report is the severe decline in vehicle sales price, leading to a second-quarter vehicle gross margin below company guidance, and the implied price in the third-quarter guidance is also significantly below market expectations. This exacerbates market concerns about Nio's vehicle gross margin and the extent of loss reduction, especially with the L90 still being sold at a low price. Therefore, the most critical aspect is how the company guides the third-quarter vehicle gross margin in the earnings call and whether it still adheres to the fourth-quarter breakeven target. $NIO(NIO.US) $NIO-SW(09866.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.