Li Auto 2Q25 Quick Interpretation: Overall, Li Auto's second-quarter performance was basically in line with expectations, but the guidance for the third quarter is very poor.

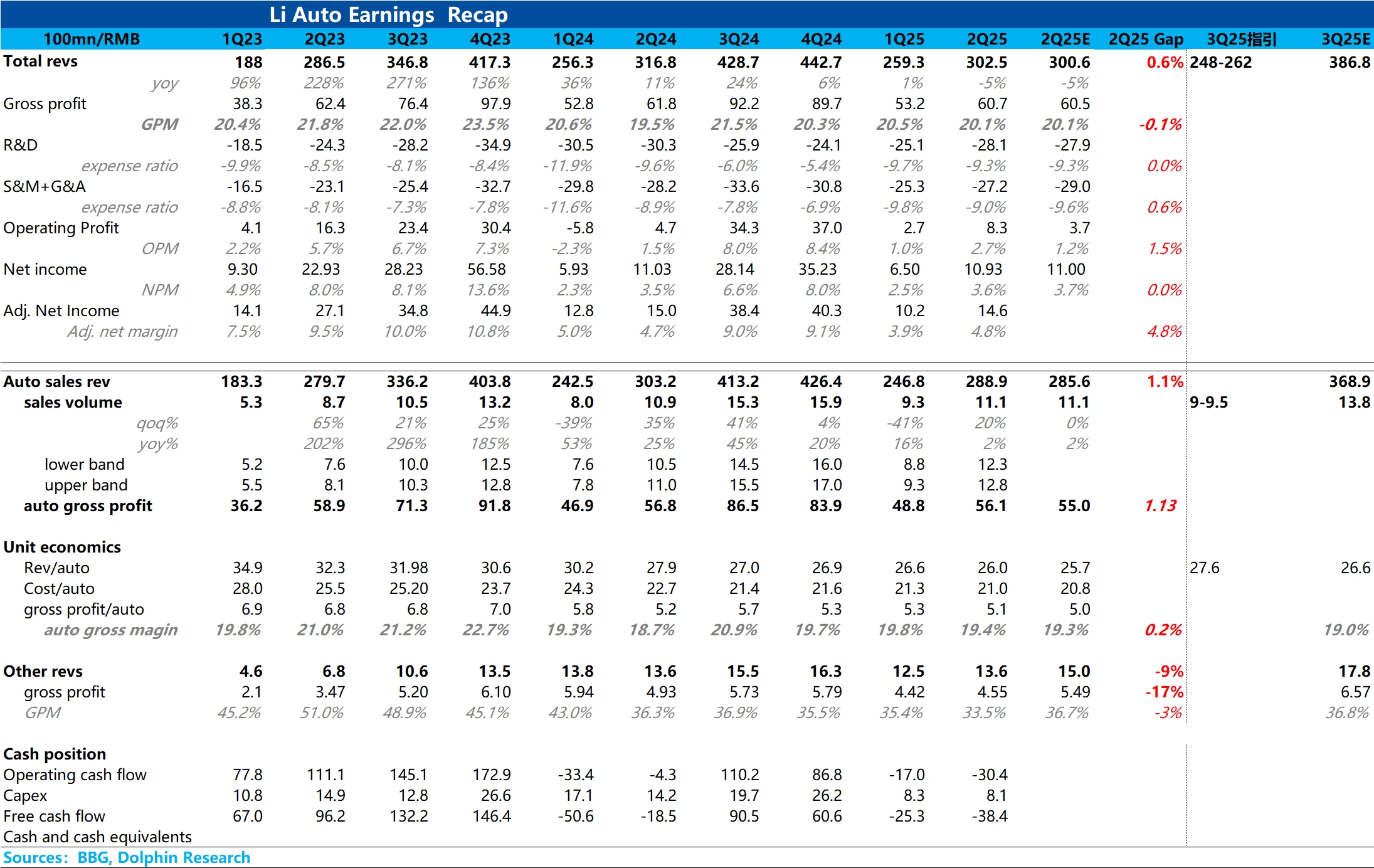

Looking at the second-quarter performance itself, starting with the car sales business that the market is most concerned about, since Li Auto had already provided guidance in advance, the second quarter saw significant promotions for the L series, resulting in a quarter-on-quarter decline in car sales prices. Meanwhile, the revamped Mega is still ramping up, so the company's guidance for the second-quarter gross margin was expected to decline to around 19%, and the actual car sales gross margin was 19.4%, which is basically in line with expectations.

In terms of car sales revenue, the car sales price also declined quarter-on-quarter, still due to the promotions for clearing old models of the L series in the second quarter. However, the overall decline was less than expected, so car sales revenue slightly exceeded expectations.

As for the bottom line net profit, this quarter's net profit was 1.093 billion, in line with the expectation of 1.1 billion. R&D expenses continued to rise quarter-on-quarter due to investments in intelligence, but sales expenses were reasonably controlled.

The real problem lies in the third-quarter guidance, where both sales and revenue guidance are significantly below market expectations, with the core issue being the sales guidance.

The third-quarter sales guidance is only 90,000-95,000 units, compared to 111,000 units in the second quarter, representing a quarter-on-quarter decline of 14%-19%, while the market expectation was still at 138,000 units, which is clearly too high.

Since Li Auto's July sales of 31,000 units have been announced, and August sales are expected to be around 29,000 units based on current weekly sales trends, the third-quarter sales guidance implies September monthly sales of 31,000-36,000 units.

Excluding the sales expectations for the i8 and Mega (Li Auto previously expected to deliver around 8,000 units of the i8 in the third quarter), the third-quarter sales guidance implies that the basic sales volume of the L series in September has already declined to 22,000-27,000 units, while the basic sales volume of the L series in July/August was around 29,000/23,000 units (estimated values), indicating significant pressure on the basic sales volume of the L series.

The core reason for the decline in the basic sales volume of the L series in September is that the direct competitor Aito's new M7 is about to be launched in September, which is expected to continue to impact the basic sales volume of Li Auto's L6+L7. Additionally, before the launch of the i6, Li Auto is expected not to reduce the price of the L series in order to ensure the success of its pure electric strategy.

Looking back at Li Auto's stock price, since the i8's order volume was below expectations after its launch, Li Auto's stock price has retreated from the high of $32 before the i8's release to the current $22.6, a retreat of 30%. After the release of this underwhelming financial report, Dolphin Research expects Li Auto's stock price to continue to retreat to a safer level (around $20), after which funds will re-evaluate the potential success of the i6, as the risk of betting on the i6 is higher and requires a stronger safety margin. $Li Auto(LI.US) $LI AUTO-W(02015.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.