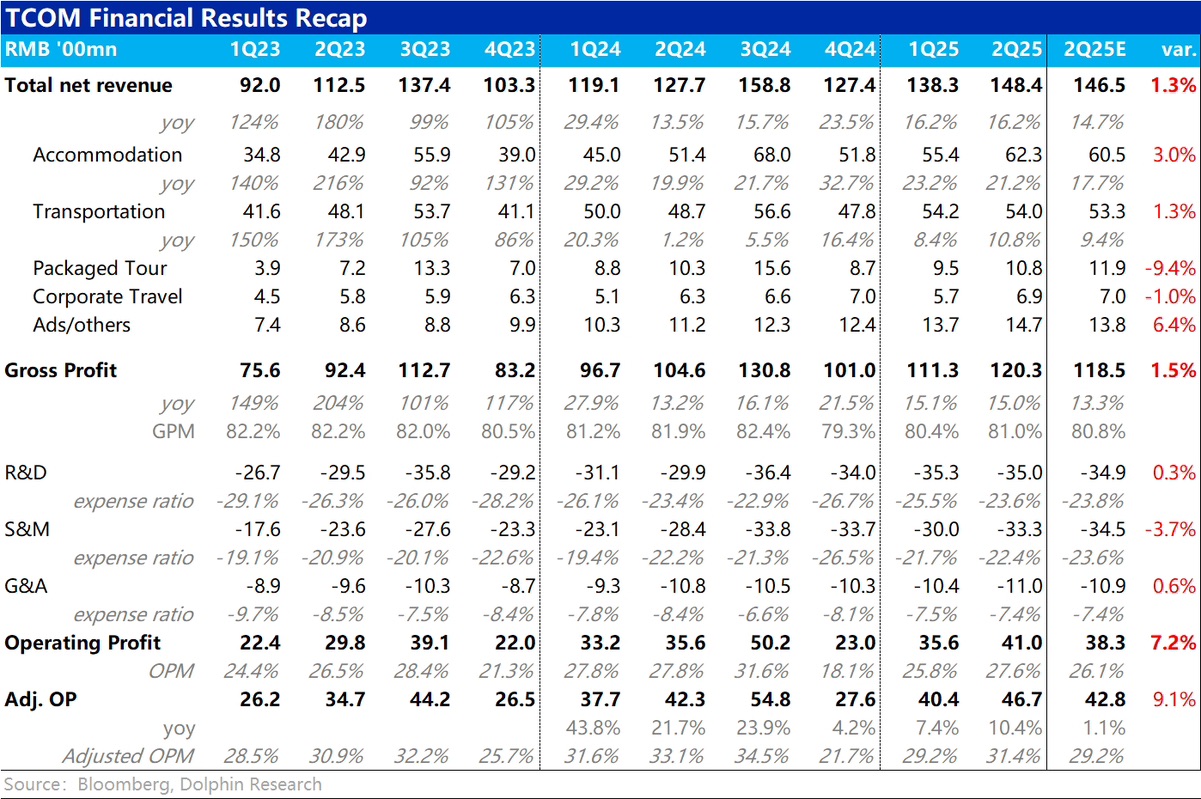

Trip.com 2Q25 Quick Interpretation: Trip.com delivered another solid and stable performance this quarter. Overall revenue maintained a stable high growth rate, slightly exceeding expectations, while actual expenses were lower than expected, resulting in a more impressive profit performance.

1. Total revenue increased by 16.2% year-on-year, consistent with the previous quarter, with no deceleration. Hotel and advertising revenues maintained high growth, and ticketing revenue also rebounded from the bottom.

2. Gross margin met expectations, rebounding to 81% quarter-on-quarter, but still narrowing by 0.9 percentage points year-on-year (due to the structurally higher proportion of lower-margin overseas business). Gross profit increased by 15% year-on-year, also slightly exceeding expectations.

3. While growth performance was slightly better than expected, actual marketing expenses accounted for 22.4% of revenue this quarter, lower than the company's guidance of 24%. Meanwhile, administrative expenses only increased by 1.9% year-on-year (benefiting from a reduction in SBC).

Excellent expense control resulted in adjusted operating profit reaching 4.67 billion, a year-on-year increase of 10%.

The issue of profit growth significantly lagging behind revenue growth due to significant expansion in expenses in the previous two quarters showed a marked improvement this quarter (although it still lagged behind revenue growth). $Trip.com(TCOM.US)$TRIP.COM-S(09961.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.