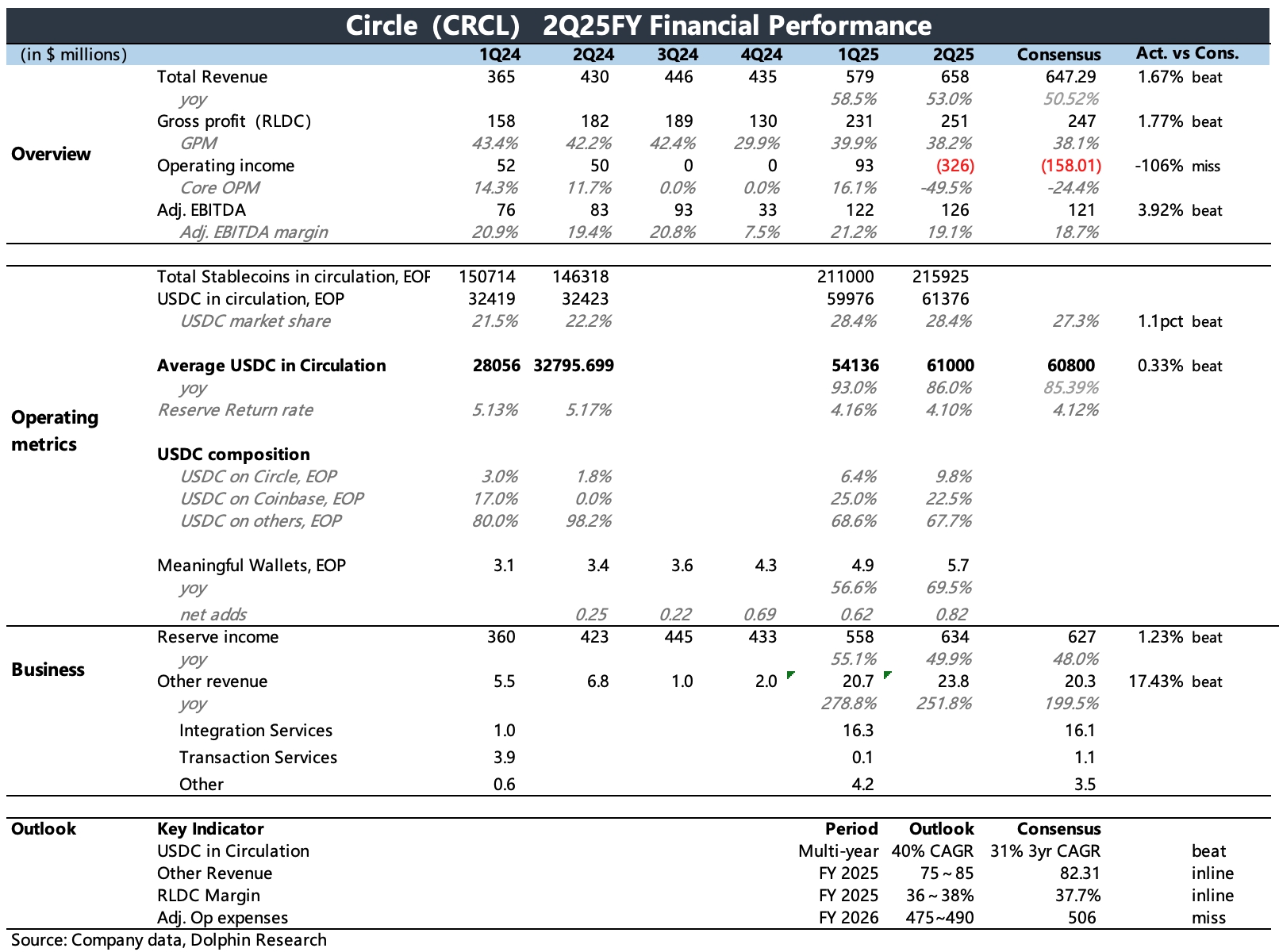

Circle 2Q25 Quick Interpretation: Circle's second-quarter report is decent, with performance slightly exceeding expectations. However, short-term results are not particularly important. The biggest highlight of this financial report is the 'guidance,' which to some extent counters some market doubts.

1. First, regarding the guidance, the management provided an annual outlook based on several core metrics. In Dolphin Research's view, each metric is crucial.

(1) Over the coming years, the circulating USDC volume is expected to maintain a 40% CAGR growth.

This is a rebuttal to concerns about the company's growth potential. The 40% growth rate exceeds the market's consensus expectation of a 30% CAGR over the next three years.

Assuming an average annual growth rate of 40% over five years, the USDC volume will reach $328 billion by the end of 2030. According to the market's expectation of a stablecoin market size of $150 billion, USDC's market share will remain at 22%, only slightly down from 28% at the end of Q2.

(2) This year's gross margin is stable at 36-38%, with adjusted operating expenses of $475-490 million.

This addresses concerns that expanding distribution channels would significantly deteriorate short-term profitability. The gross margins for Q1 and Q2 were 39% and 38%, respectively, implying that the annual gross margin will only slightly weaken.

However, point (1) indicates that Circle will not hesitate to collaborate with multiple channels. Combined, this suggests that Circle's channel partnerships are likely conducted in a non-direct revenue-sharing manner, indirectly demonstrating Circle's relative bargaining power in the industry chain (with channels being more proactive).

The guidance on operating expenses is below expectations, with Circle's expenses mainly consisting of employee salaries. This indicates that while the company is expanding externally, it is also mindful of maintaining efficient internal operations.

(3) Other income is expected to be $75-85 million.

Although this income guidance meets expectations, market skepticism about Circle's business model (unfavorable interest rate cut cycles, high channel revenue sharing) naturally raises expectations for other income (such as payment APIs, USYC tokenized funds).

Therefore, this guidance represents the company's strong willingness to expand non-interest income, which is a strategic direction welcomed by the market.

2. As for the current performance, Q2 revenue and profit slightly exceeded expectations.

Interest income from reserve assets, which accounts for 96%, is essentially public data. Therefore, the main source of expectation variance is other income, which significantly exceeded expectations in the second quarter.

However, since there are not many sell-side analysts covering Circle, and most valuations of Circle are considered from an endgame perspective, there are not many institutions making short-term performance forecasts. Thus, the BBG consensus forecast is not very meaningful. Therefore, Dolphin Research suggests not focusing too much on short-term financial metrics.

3. Finally, a brief overview of the USDC ecosystem:

(1) The average USDC circulation value in the second quarter was $61 billion, reaching $6.14 billion at the end of the quarter, a 2% quarter-on-quarter increase, slowing compared to the beginning of the year. However, according to Coingecko, there has been an acceleration since July.

(2) USDC distribution: Circle's internal share has rapidly increased to 9.8%, much faster than Dolphin Research anticipated. Coinbase accounts for 23%, with the remaining 68% distributed across Binance and other channels.

(3) As of the end of the second quarter, the number of digital wallets (on-chain wallets holding more than $10 in crypto) reached 5.7 million, a net increase of 800,000 quarter-on-quarter, accelerating compared to previous quarters. This is a relatively forward-looking indicator, truly representing USDC's user penetration.

The larger the number of USDC digital wallets, the greater the market share it can capture in the future. $Circle(CRCL.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.