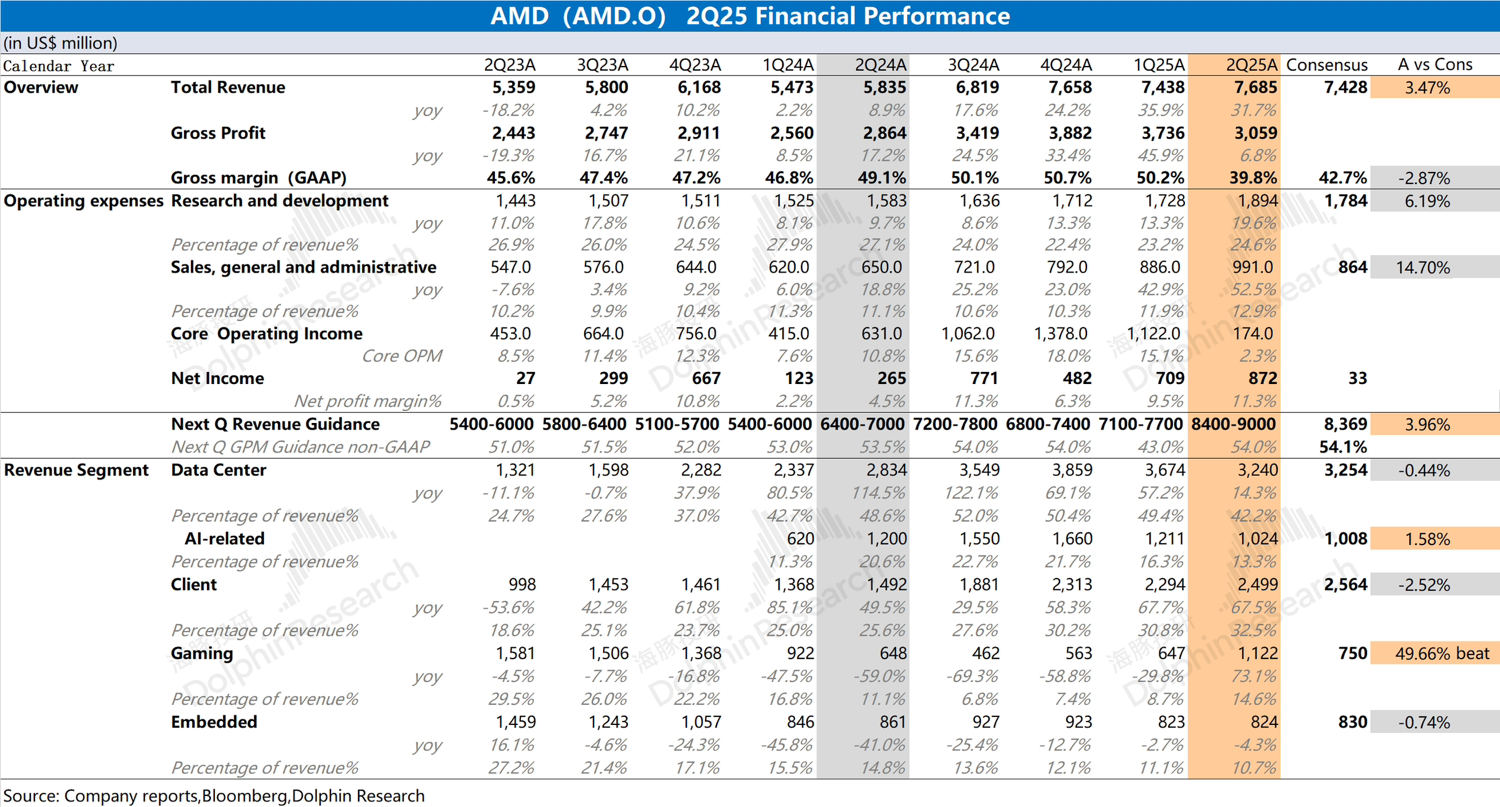

AMD 2Q25 Quick Interpretation: The company's revenue and gross margin for this quarter both met the previous guidance expectations.

The revenue growth for this quarter was primarily driven by the client, gaming, and data center businesses; however, the decline in gross margin was mainly due to an impairment charge of approximately $800 million in the Chinese market. Excluding this impact, the company's non-GAAP gross margin for the quarter would still be around 54%.

Although AMD maintained a good growth momentum in revenue, there was also a trend of increasing operating expenses.

The company's R&D expenses and selling, general and administrative expenses both increased to varying degrees this quarter, with total expenditures reaching $2.89 billion, a year-on-year increase of 29.5%. The increase in operating expenses somewhat suppressed the release of profits.

By business segment, the client and gaming businesses grew by 69% year-on-year this quarter, contributing the main increment, benefiting from the company's continued market share gains in the PC market; the data center business grew by 14% year-on-year this quarter, with strong demand for AMD server CPUs offsetting the adverse factors affecting MI308 shipments to China.

Compared to this quarter's data, the market is more focused on the company's guidance for the next quarter and the AI GPU business situation:

1) Guidance: The company expects next quarter's revenue to be $8.4-9.0 billion, with market expectations at $8.37 billion; non-GAAP gross margin at 54%, basically in line with market expectations of 54.1%.

2) AI GPU: Based on industry and company conditions, Dolphin Research estimates the company's AI GPU revenue for this quarter to be around $1 billion, still relatively low due to the product transition phase in the second quarter; however, next quarter's AI GPU revenue is expected to rise to over $1.7 billion, mainly driven by MI350 series shipments.

Overall, the company's outperformance this quarter and guidance mainly stem from the client and gaming businesses. For the data center and AI GPU businesses, the performance is basically in line with market expectations.

While the increase in CPU market share can also enhance the company's performance, AI GPUs will provide a greater scope for imagination. For more specific information, please follow Dolphin Research's subsequent detailed commentary and conference call minutes. $AMD(AMD.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.