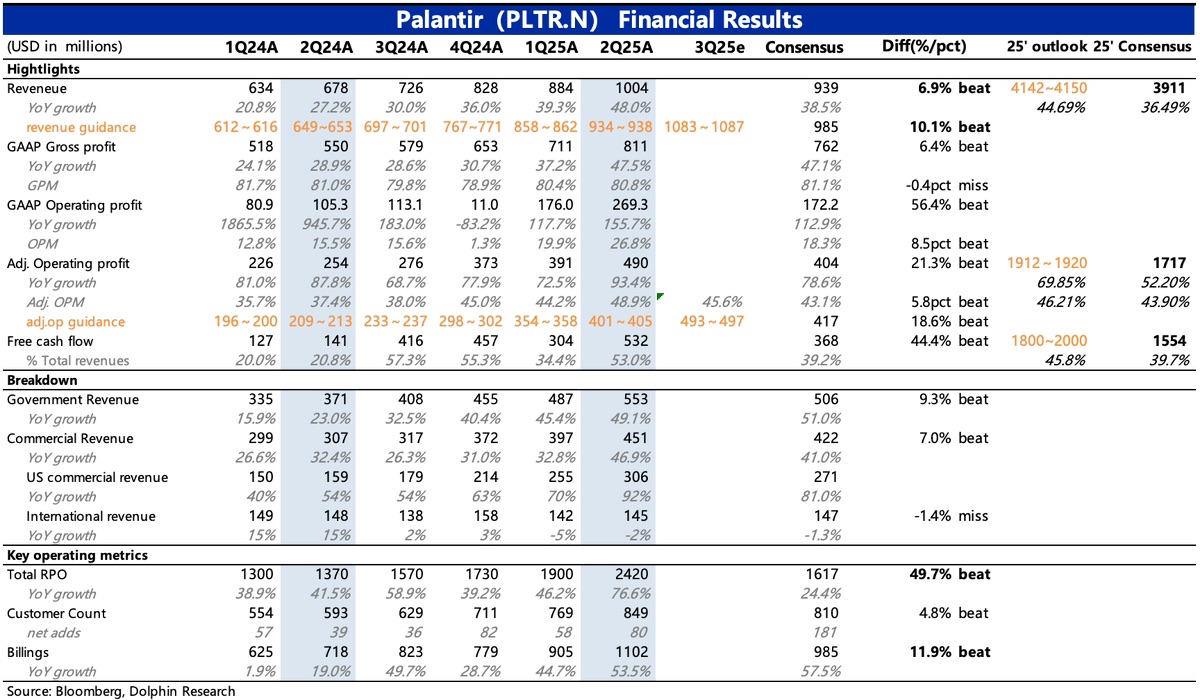

Palantir 2Q25 Earnings Quick Interpretation: The second quarter performance was good, including the current period and the upward revision of guidance for Q3 and the full year 2025.

However, despite the excellent earnings beat, the market reaction this time was relatively subdued compared to usual (only up 4% after hours).

1. Reasons for the "Flat" Market Reaction – Expectations of Approaching Peak Growth + High Expense Increases

While a large market capitalization and high valuation are certainly key reasons for the post-earnings weakness, Dolphin Research believes some "flaws" in the earnings themselves might also be important influencing factors.

(1) Based on the midpoint of the revised guidance, it is expected that after the Q3 growth peak, Q4 growth rate will begin to show signs of deceleration. "When will growth decelerate" is the biggest factor impacting current valuation. After the Q1 earnings report, PLTR rose another 30%, and its current market cap of $380 billion implies a 2026 PS ratio of nearly 67x. Under high valuations, the tolerance for error is lower, so the market will be more focused on and concerned about signs of slowing growth in the short term.

(2) At the same time, the guidance also implied a sequential decrease in Q3 operating profit margin due to personnel additions. However, the guidance also indicated that profit margins would recover somewhat in Q4.

However, Dolphin Research believes that Palantir's management guidance has consistently been conservative, possibly leaving room for upside. Therefore, this slight deceleration signal is not strong enough. The relatively flat market reaction is essentially due to investor apprehension about the high valuation.

2. Nevertheless, Fundamentals Remain Healthy, Reflecting Industry Prosperity and the Company's Product Competitiveness:

(1) From an operational metrics perspective, both customer count and new order value show a very strong accelerating growth, indicating robust current demand.

(2) Growth is primarily driven by commercial revenue, especially US domestic B2B enterprise orders, which surged by 92% year-over-year. The decline in international enterprise demand has narrowed, and combined with new order trends, it is expected to resume growth soon.

(3) Government revenue is also strong, with a 43% growth rate in Q3, though it shows a slight sequential deceleration. However, government revenue does not follow a linear trend, so short-term fluctuations are normal. Given the current government's attitude towards AI and its emphasis on defense spending, future growth has some assurance.

(4) Current period expense growth was restrained, leading to a 5 percentage point sequential increase in operating profit margin, reaching 49%.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.