$Meta Platforms(META.US) A brief summary of some key information from the Q2 earnings follow-up call:

Overall, the management's sentiment is neutral, with confidence in certain areas, but also an indication to temper expectations for some business segments in the short term (Meta's management is traditionally somewhat cautious).

1. Regarding the $100 billion Capex: The call mentioned that next year's Capex "similar to this year's growth" refers to the absolute value, which is a $30 billion increase (at the median), rather than the growth rate, thus basically reaching $100 billion, but also indicating that there will be dynamic adjustments.

2. Regarding Opex: The growth rate will accelerate in the second half of the year, mainly due to: (1) an increase in administrative expenses (legal expenses in the second half of 2024, especially in Q4), (2) accelerated growth in infrastructure expenses (increased operations + increased depreciation), and (3) accelerated growth in compensation expenses for AI talent.

Profit margins may be affected, but the company's operational goal is to ensure long-term profit growth, and short-term fluctuations are not the focus during investment opportunity periods. It was also reiterated that capacity supply is limited and cannot currently meet the computing power needs of various teams.

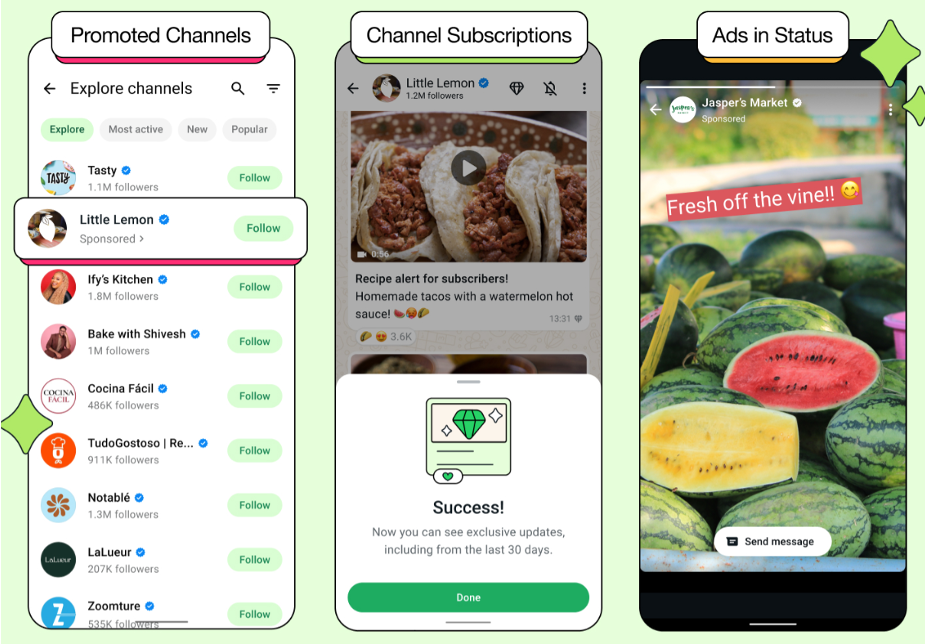

3. Regarding WhatsApp commercialization: In June, it was announced that ads would be introduced in Status, which started in the second quarter, currently targeting a small number of advertisers. The approach will be gradual over the next two years, with a slow pace to ensure it does not affect user experience and with strict control over ad quality. Compared to IG, the focus will be on markets with lower per capita ad spending, such as Southeast Asia and Latin America, and WhatsApp is not linked to Meta's account center, so the precision is weaker, meaning the commercialization potential should be less than IG Stories.

It was emphasized that both WhatsApp and Threads will not make a significant contribution to performance in the short term (2025/2026).

4. Regarding advertising expectations: The growth trend is very healthy, with a full recovery of e-commerce advertising budgets in Asia, increased demand from small and medium advertisers in North America, and increased spending in non-American regions. It was also emphasized that Q3 revenue will have a 1% currency tailwind and a boost from last year's base slowdown.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.