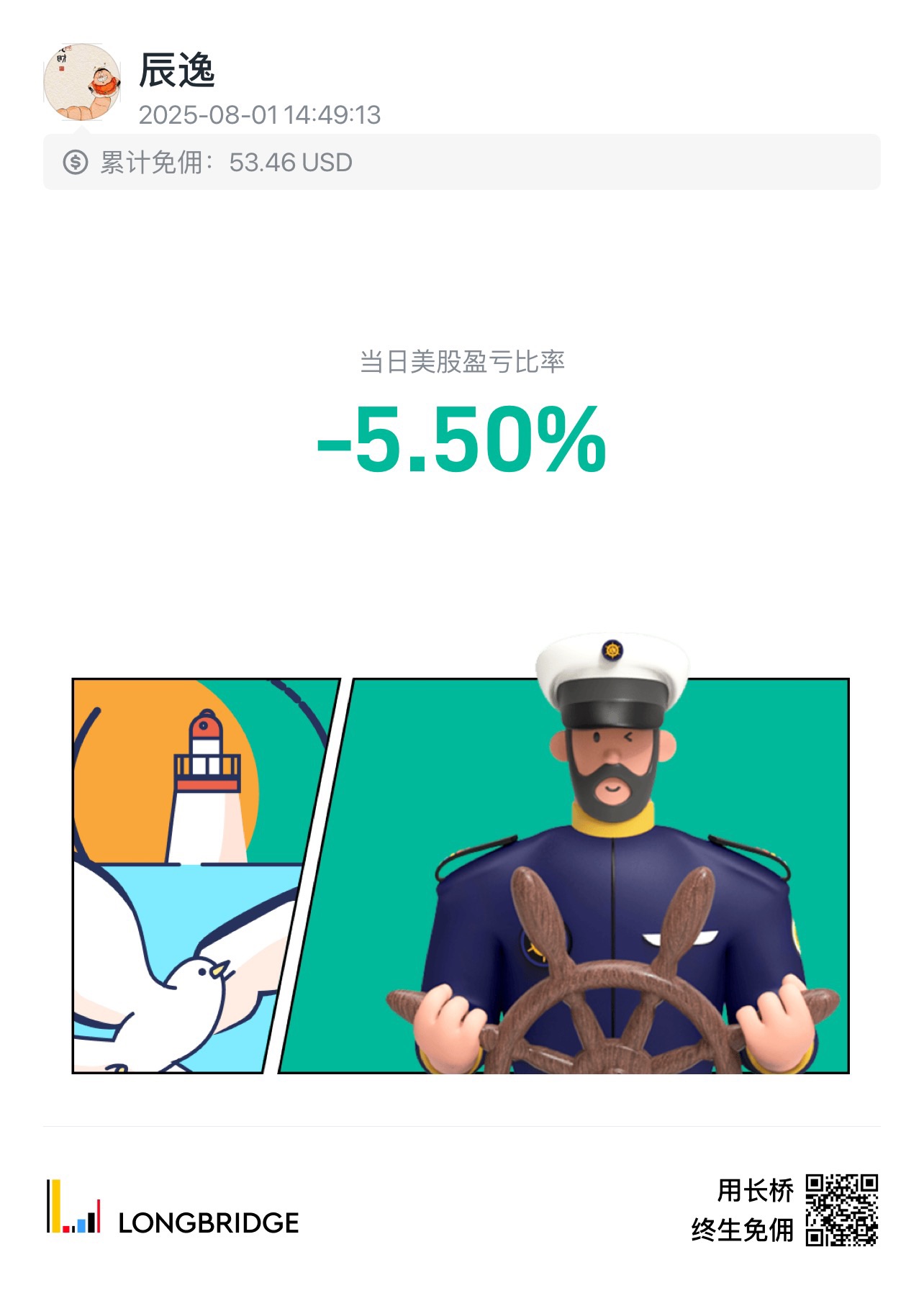

Rate Of Return

Rate Of ReturnAs I said, stay calm!

US stocks closed lower last night, with major indices declining, and Bitcoin dropped to the 115 level. What's happening in the market now?

Reviewing last night's US stock performance, although the decline was small, against the backdrop of strong earnings reports from Microsoft and Meta, the major indices gave up all their opening gains.

What's happening in the market? Is there any negative news? Not really. In my opinion, it's just a phase of profit-taking by funds, coupled with the usual end-of-month selling by hedge funds and pension balance funds. It's understandable—the market has risen too much recently and needs a breather.

On the macroeconomic front, GDP and June PCE data indicate a healthy economy, which has somewhat dampened expectations of rate cuts. After all, the market is currently pricing in rate cuts starting in September, and Bitcoin, which is highly sensitive to liquidity, broke support levels in the short term.

Last night, Apple and Amazon released their earnings reports. Apple's results were decent, slightly exceeding market expectations. However, its much-anticipated AI business remains weak. On the bright side, capital expenditures are increasing, and the core smartphone business is holding up. Apple's stock rose 2% in after-hours trading.

Apple still offers good investment value. With a current market cap of $3.1 trillion, its 2025 fiscal year net profit corresponds to a PE ratio of around 28x, which is in the lower-middle range of its historical valuation band (25-35x PE).

Apple's stock has declined this year, so there is potential for upside in the second half. Maintain confidence in Apple's $240 stock price target.

Amazon's cloud growth fell short of expectations, and its Q3 profit guidance was below estimates, leading to a 6% drop in after-hours trading.

Figama's market cap surged to $50 billion on its IPO day, but its revenue expectations are only around $1 billion, giving it a PS ratio of 50—almost on par with PLTR. This scenario feels all too familiar to CRCL's trapped shareholders.

In summary, no market can keep rising without a pullback. Earnings season is winding down this week, and it's time for profit-taking. Institutional rebalancing typically happens at month-end. Stay calm, stay calm, stay calm.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.