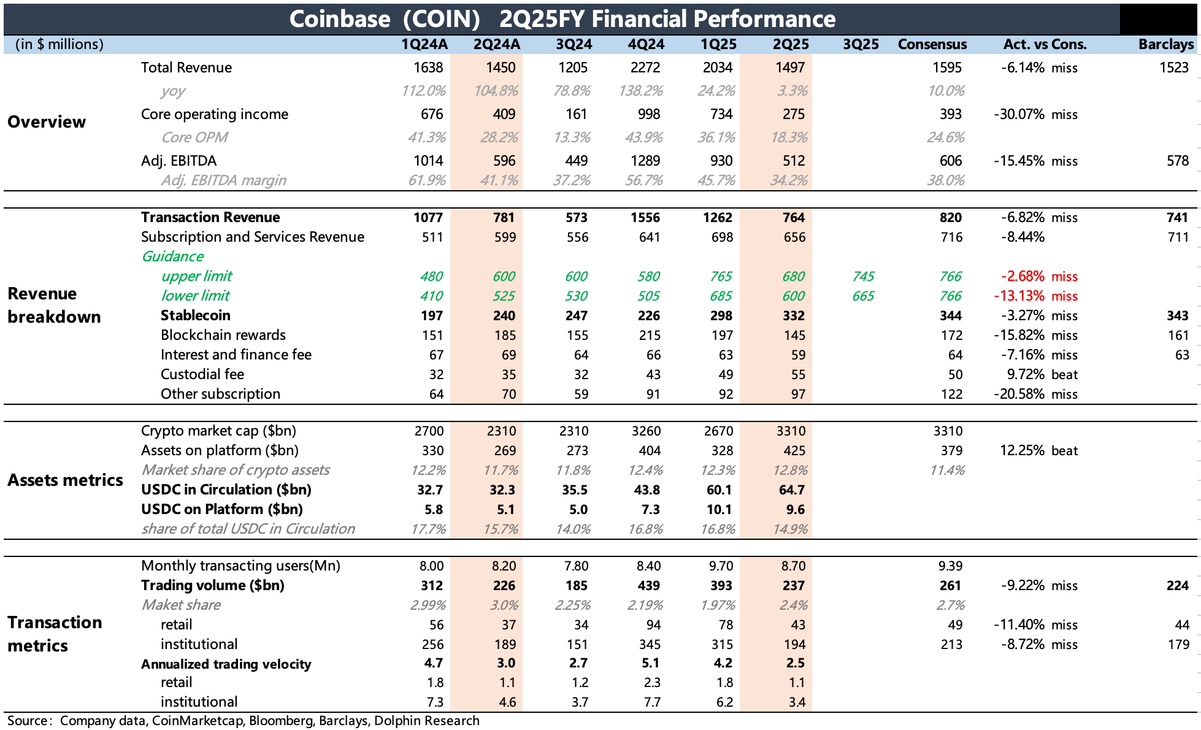

Coinbase 2Q25 Quick Interpretation: Second-quarter results fell short of expectations, but short-term performance fluctuations have limited impact on the long-term valuation support logic. The disappointing earnings report presents an opportunity to focus on potential pullbacks.

1. Trading revenue met expectations: The pressure on second-quarter trading volume was a known fact, and institutions had already lowered expectations before the earnings report (BBG expectations lagged). The actual performance was inline, aside from the industry's own trading activity cooling off quarter-on-quarter. The company mentioned the impact of adjusting stablecoin pricing strategies in the second quarter (intentionally reducing USDT trading pairs to expand the revenue-generating advantage of USDC). However, since USDT is the most widely penetrated stablecoin, it further dragged down the trading volume for the period.

75% of cryptocurrency trading volume occurs in the derivatives market. The acquisition of Deribit at the beginning of the year has not yet been consolidated, and starting in July, Coinbase will launch perpetual futures contracts, which is expected to address Coinbase's market share disadvantage in the derivatives market.

2. Disappointing subscription revenue: Although the asset scale AOP within the platform reached a new high in the second quarter, the actual performance of subscription revenue was mediocre, with both the current period and Q3 guidance somewhat below expectations.

Dolphin Research believes the key reason is that 80% of the AOP increment in the second quarter was mainly due to asset appreciation rather than new capital inflows. Further breakdown shows that Bitcoin contributed the majority, with its share increasing from 66% in the previous quarter to 70%.

In subscription revenue, whether it is stablecoin income or staking income, Bitcoin does not directly create increments. On the contrary, the average asset prices of core staking varieties ETH and SOL declined during the second quarter.

3. Dual pressure on short-term profitability: With high-margin trading revenue under pressure, the second quarter also saw a significant increase in employee costs and a £300 million fine from the UK FCA due to data leakage, which significantly slowed the growth of core operating profit.

However, after excluding these impacts, the adjusted EBITDA margin still fell quarter-on-quarter to 34%. As a trading platform, the main rigid expenses are bandwidth server depreciation and employee costs, making short-term profitability highly sensitive to fluctuations in the revenue side.

Additionally, the originally high-margin stablecoin income has seen Coinbase continuously increase the reserve fund rebate ratio to incentivize users to use USDC since last year. The rebate subsidy ratio in the second quarter decreased compared to the first quarter (mainly reducing USDT subsidies), but it still stands at 40%. $Coinbase(COIN.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.