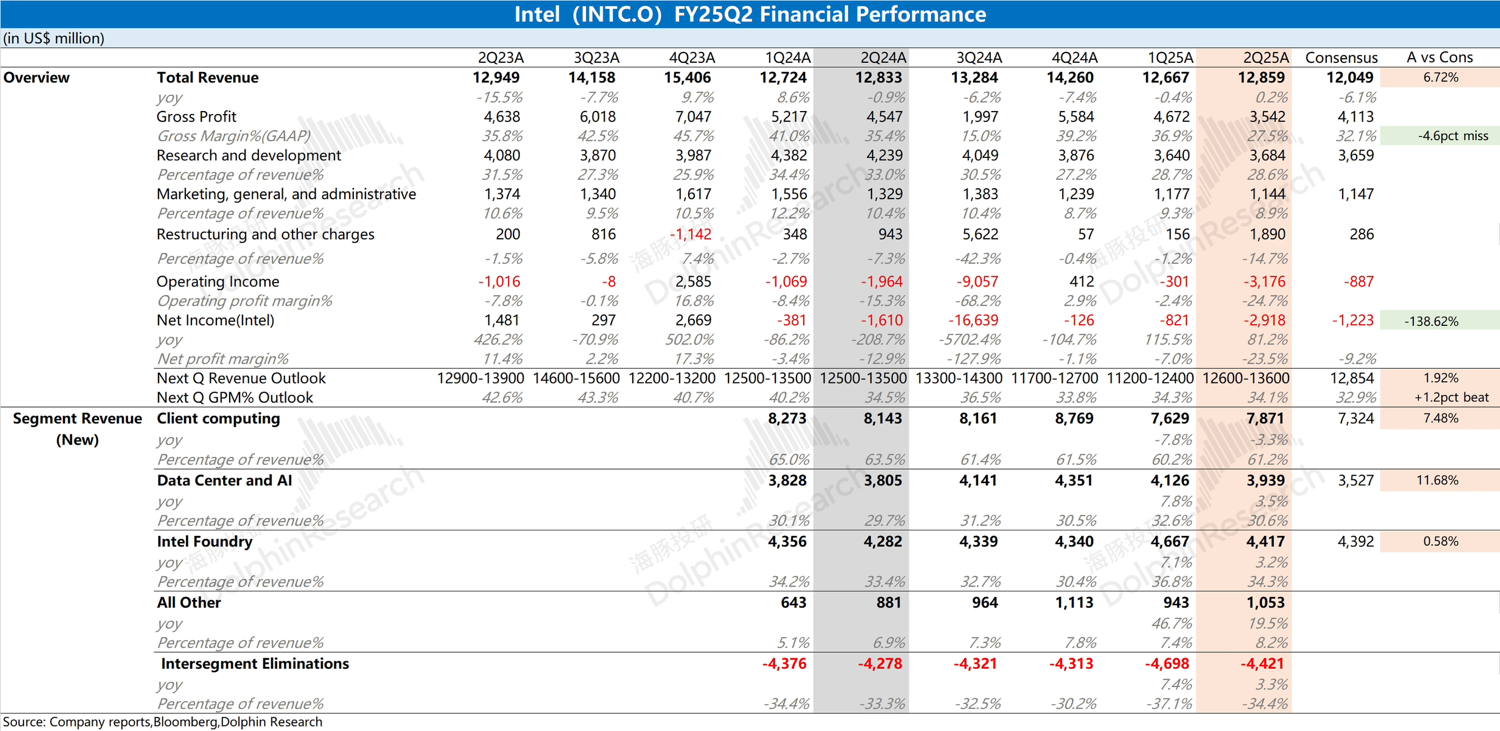

Intel Quick Interpretation: The company's revenue for this quarter exceeded the upper limit of guidance, primarily due to some customers stocking up in advance amid tariff uncertainties, rather than a genuine improvement in operations.

This quarter's gross margin fell to 27.5%, influenced by the recognition of approximately $800 million in non-cash value and accelerated depreciation (related to surplus legacy tools that cannot be repurposed). Excluding this impact, the company's gross margin for the quarter is close to the guidance.

Regarding the company's goal of reducing operating expenses, efforts are still underway this quarter. Although operating expenses remain high, the total headcount has been reduced to around 100,000, with approximately $1.9 billion in restructuring and severance-related expenses incurred this quarter. The company plans to reduce its workforce to around 75,000.

The new CEO, Chen Liwu, is adjusting Intel's strategy to focus on "reducing capital expenditures, divesting non-core businesses, and concentrating on foundry manufacturing." The company is currently in a phase of business adjustment, and the market is more focused on breakthroughs in the foundry manufacturing segment rather than short-term performance, as this is the foundation for the company's future resurgence.

Previously, the company's management announced the 18A and 14A manufacturing node roadmap, and the company's stock price has recovered somewhat from the bottom. However, further increases will require more substantial progress from the company. For more detailed content on the company's current business adjustments and manufacturing progress, you can follow Dolphin Research's subsequent specific analysis and management communication minutes. $Intel(INTC.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.