Google remains optimistic, on the way

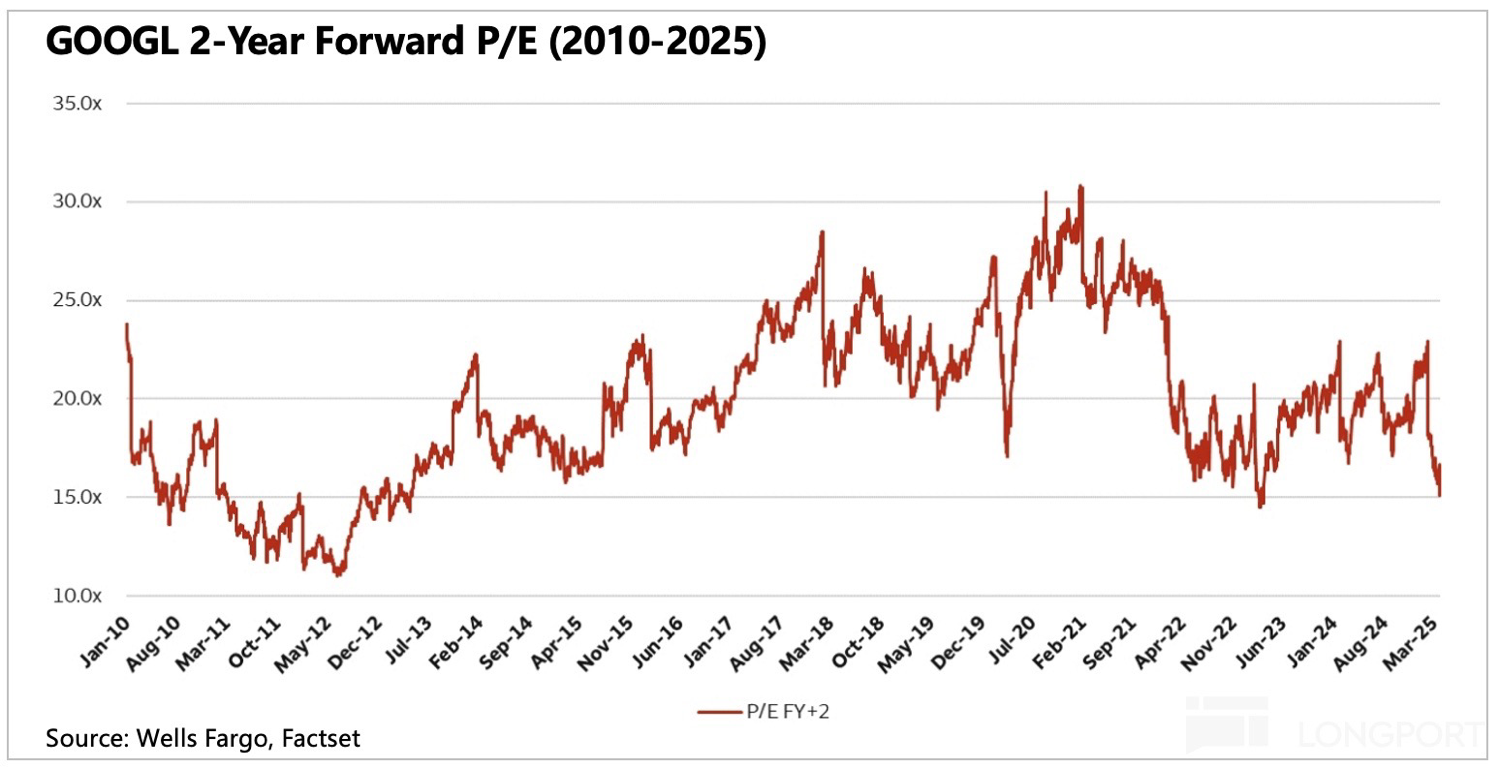

Regarding Google's narrative and valuation, you can refer to two charts. Figure 1 shows Google's current PE trend, which is at a 10-year historical low of 15x, with the previous peak being 30x in 2021. The valuation has been suppressed due to the disruptive expectations of new players like ChatGPT on the ad business model, a topic that has been discussed repeatedly and won't be elaborated further.

Figure 2 shows Meta's historical stock price and PE trend over the past 10 years. In 2022, due to the collapse of the metaverse narrative, Meta's stock price dropped to 90, and its PE fell to 9.3x. As Meta re-engaged in AI and caught the wave of AI applications and the boom in Instagram's ad model, it reshaped the capital market narrative, leading to a 3x increase in valuation to 30x and an 8x surge in stock price to 700+.

Through these two comparisons, what I want to convey is that 'stock price increases are accompanied by a shift in the capital market narrative, and changes in valuation have a significant impact on stock prices.' For example, Meta, through excellent management, reversed the narrative, tripling its valuation, and with the growth in revenue and profits, this was reflected in an almost 8x increase in stock price.

As for Google, the shift in the capital market narrative will take time, just as its establishment took 2 to 3 years—a process of building consensus among various parties. I don’t expect a single earnings beat to reverse the narrative, but I believe Google is on the right path.

$Alphabet(GOOGL.US)$Meta Platforms(META.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.