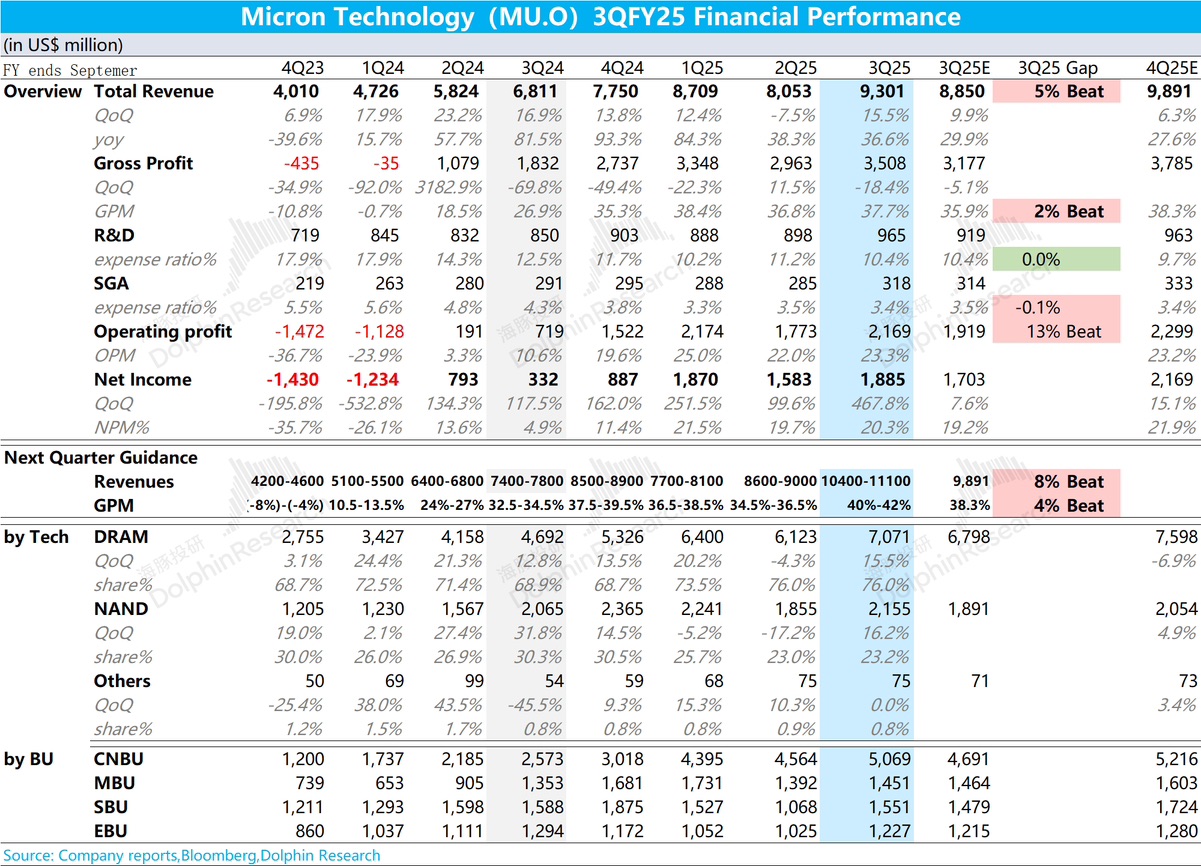

Micron 3QFY25 Quick Interpretation: The company's financial report data and guidance were positive, with the stock rising by 8% in after-hours trading. However, during the subsequent management discussion, the company did not provide additional incremental confidence, causing the after-hours gains to retreat.

Specifically, the company's revenue and gross margin both improved quarter-over-quarter, primarily driven by growth in DRAM and NAND products. The market's focus on HBM products led Dolphin Research to estimate that the company's HBM revenue for this quarter was approximately $1.5 billion, a $500 million increase quarter-over-quarter. Currently, the HBM3E 12-high has been integrated into NVIDIA's GB300, and with mass production ramping up, the company's HBM business is expected to achieve greater growth in the second half of the year. The company's R&D expense ratio and selling and administrative expense ratio remained relatively stable. With the support of revenue and gross margin, the company's profitability is expected to gradually recover.

Additionally, the company's guidance for the next quarter is also positive, with revenue expected to grow by 15% quarter-over-quarter and gross margin to increase by 3.3 percentage points, mainly driven by HBM and DRAM businesses. After providing better-than-expected guidance for the next quarter, the market anticipated that the management would offer more confidence during the conference call. However, the company maintained its previous expectations for the HBM market size and its market share (Dolphin Research speculates that the company's HBM revenue in 2025 will be between $7-8 billion). The better-than-expected part of the next quarter's guidance is more attributed to traditional areas like DDR, where recent capacity constraints have led to price increases for DDR4. Since the current market's focus and stock price elasticity mainly stem from incremental changes brought by HBM and AI demand, merely temporary changes in traditional areas are unlikely to provide the market with more confidence. $Micron Tech(MU.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.