An entrepreneur who left Baidu created a ¥19,800 '40 km/h' unmanned vehicle | Jiushi

Produced by Zhineng Technology

In the wave of intelligent driving, urban delivery is quietly becoming a key scenario for the initial implementation of L4 autonomous driving.

Over the past year, most companies in the autonomous driving industry have faced strategic contraction, and capital has become more cautious.

Against this backdrop, Jiushi Intelligence stands out as an exception: in 2025, they completed a nearly $300 million Series B financing round, becoming one of the largest single-round financing companies in the autonomous driving sector in recent years.

Compared to Robotaxi, which has extremely high requirements for safety and user experience, and passenger cars with autonomous driving assistance mainly applied on closed highways, urban delivery is an ideal breakthrough for autonomous driving with "moderate technical difficulty + significant commercial value + controllable operating conditions."

Against this backdrop, we had an in-depth exchange with Jiushi Intelligence at EAC2025—a company founded by teams from Baidu and JD.com's autonomous driving divisions, dedicated to the mass production and implementation of L4 technology for urban delivery.

In the interview, Zhou Qing, Vice President and Head of Ecosystem Partnerships at Jiushi Intelligence, detailed how they use "technology + ecosystem" to bridge the critical gap from road testing to commercialization for unmanned delivery vehicles.

01

An Unmanned Vehicle Priced at 19,800 Yuan

Not long ago (May 27), Jiushi Intelligence just launched the new E-series unmanned logistics vehicle platform and its first model, the E6, with an official price of only 19,800 yuan, selling out six months of production capacity in one hour.

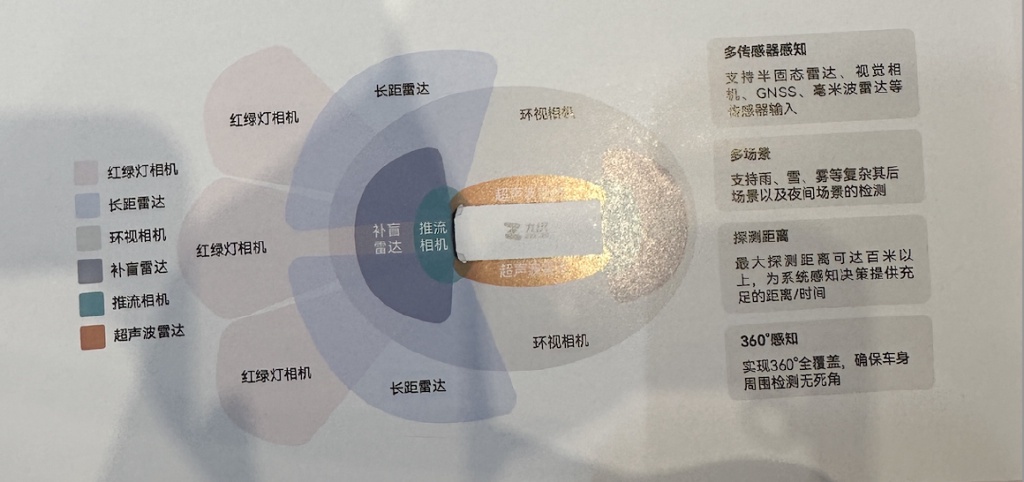

The E6 model is built on Jiushi's self-developed L4 autonomous driving technology platform, equipped with a new-generation perception system (including occupancy network technology stack and bionic sensor layout), capable of centimeter-level recognition accuracy and stable operation in complex weather and urban environments.

Its pillar-free design improves cargo space utilization and features a self-developed NOA navigation system that operates without relying on high-precision maps. The newly added real-time intercom system enhances human-machine collaboration, improving stability and task completion rates in high-density urban delivery scenarios.

The new model targets light and scattered delivery scenarios, emphasizing customization, high efficiency, and scenario adaptability. Unlike the previous Z-series, which emphasized versatility, the E-series focuses on "specialization," adapting to the increasingly segmented logistics demand trends.

Therefore, the E-series offers a flexible business model: the vehicle is priced at 19,800 yuan, with a monthly FSD (Full Self-Driving) subscription fee of 1,800 yuan. Compared to Tesla's $99 (approximately 700 yuan) FSD subscription fee, the E-series seems more expensive, but the logistics vehicle can achieve true "unmanned" operation, saving the equivalent of a driver's cost.

Jiushi Intelligence also offers leasing options, currently covering over 200 cities nationwide.

02

Entrepreneurship is the Romance of Realists:

Why Jiushi Intelligence Focuses on Urban Delivery

"We never intended to do Robotaxi from the start."

Jiushi Intelligence was founded in 2021. That year, the autonomous driving industry experienced an unprecedented financing boom, becoming a focus of the capital market. Many autonomous driving companies received large-scale financing. For example, Momenta completed a C+ round of financing exceeding $500 million, becoming one of the largest financing rounds in China's autonomous driving sector that year.

In addition, companies like Pony.ai and WeRide also received hundreds of millions of dollars in financing that year. According to statistics, there were 129 financing events in China's autonomous driving industry that year, with a total financing amount of approximately 87.2 billion yuan, setting a historical record.

But perhaps because the founding team had experience in developing autonomous logistics products after leaving Baidu, "we focused on urban delivery logistics from the start, as this direction seemed more realistic," Zhou Qing said. "Because it is a low-speed, relatively closed scenario, acceptable to both policymakers and the public."

The so-called "urban delivery logistics" simply refers to short-distance freight within cities, such as supermarket deliveries, campus transportation, or small-batch express transfers. In the past, this work was often done by human-powered tricycles or electric trucks. But now, these routes and tasks have become a new frontier for the "implementation" of autonomous driving.

"The core of 'urban delivery logistics' is not speed but stability—delivering goods on time. And 'even if an accident occurs, it won't be a major one.' Therefore, it is also more relaxed in terms of policy: compared to autonomous driving for passenger vehicles, such 'equipment-type' unmanned freight vehicles face much looser regulations.

"We are not strictly defined as a vehicle; we are considered logistics equipment," Zhou Qing said. "Many cities have speed limits for such equipment below 40 km/h, and we compromised by setting a maximum operating speed of 40 km/h."

As for whether they plan to enter the heavy truck and highway freight sector, Jiushi Intelligence is clear: "We won't do it now because it's not the right time." The regulations for autonomous driving on highways and roads are still in their infancy, "policies are not mature, and we won't rush into it."

Jiushi currently prefers to focus on urban public roads, a more scalable and commercially promising battlefield. However, Jiushi can provide partners with a complete development framework to support secondary development and capability integration.

03

"L4 Cannot Rely Solely on Vision":

The Challenges and Barriers of Unmanned Autonomous Vehicles

What is the biggest challenge now?

"Perception."

Low- to medium-speed urban delivery may seem simple, but it actually involves very complex scenarios.

"On highways, you won't encounter dogs, tricycles, children, or people riding bikes the wrong way. But in urban delivery, we've encountered countless complex situations over the years," Zhou Qing said. "Classifying them correctly is highly challenging. Good prediction is a significant challenge."

To ensure the algorithm can still "see clearly" in these chaotic scenarios, they use "four types of sensors": vision, radar, lidar, and ultrasonic.

"Why not rely solely on vision?"

L4 cannot rely solely on vision. Zhou Qing said, "No matter how strong the vision system is, it cannot solve extreme cases of 'invisibility.' Because cameras are essentially light-sensitive components, they may still have blind spots in complex environments.

For assisted driving, 'invisibility' can be handled by human intervention or safe parking, which is not a big issue. But unmanned autonomous driving cannot do this—the vehicle cannot stop halfway, and goods cannot be left on the road. This requires the introduction of multi-sensor fusion solutions like lidar. Ultimately, each sensor has its technical limitations."

But what is the cost of multi-sensor fusion?

"Computing power."

"We currently use a dual Orin X solution with 500 TOPS of computing power, which is sufficient for our current NOA scenarios. But in the future, we also need to consider domestic alternatives, such as testing Horizon's chips and engaging with domestic chip companies. We even have plans to develop our own chips."

Yes, an autonomous driving startup is discussing "developing its own chips." This might have sounded like capital fantasy three years ago, but now, under the triple pressures of geopolitics, supply chain risks, and cost sensitivity, it has become "common sense."

"We know that relying solely on foreign chips carries risks," Zhou Qing said.

But what level of annual production is needed to balance the cost of chip development?

"Approximately 50,000 vehicles."

We noticed that throughout the interview, this entrepreneurial team hardly talked about financing, valuation, or storytelling. The two words they mentioned most were: data and scenarios.

"Simply put, in this field, the more data you have, the faster you progress," Zhou Qing told us. "Many people think the core is algorithms, but algorithms are for tuning—the core is still data. The more you operate, the more likely you are to develop suitable algorithms."

The core of autonomous driving is not building vehicles but building 'the ability to understand scenarios.'

So, when we asked if they were worried about big companies entering the market, they seemed relaxed: "Big companies will indeed come, but they lack scenarios."

Zhou Qing said, "In the internet era, small companies couldn't survive without traffic because big companies had inherent traffic. But autonomous driving is different—it's not about who has more traffic but who operates more and who gets first-hand data. No matter how big a company is, it can't cover all the routes we've operated in a year overnight."

So he isn't worried, "Unless they buy our data."

Summary

This is Not the 'Future' of Autonomous Driving,

This is Its 'Present'

Jiushi Intelligence's booth is quite modest—so modest that it doesn't even look like an autonomous driving company. Their main exhibits even resemble oversized robotic vacuum cleaners—"vehicles that don't look like vehicles."

But they are solving the most practical problems in the autonomous driving industry—how to truly operate, how to make business sense, how to navigate 'policy gray areas,' and how to build a moat before being surrounded by big companies.

The autonomous driving industry is still far from its true peak, and even the start of real commercial competition is distant. Now, it's more like a warm-up, with policies and standards still being formulated and technology continuously evolving.

But Jiushi Intelligence is not in a hurry. By running ahead in the warm-up phase, they'll be a lap ahead when the race officially starts.

Perhaps when they left Baidu, they already understood: building vehicles is cool, but those who survive (with scenarios implemented) are the truly 'unmanned' ones.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.