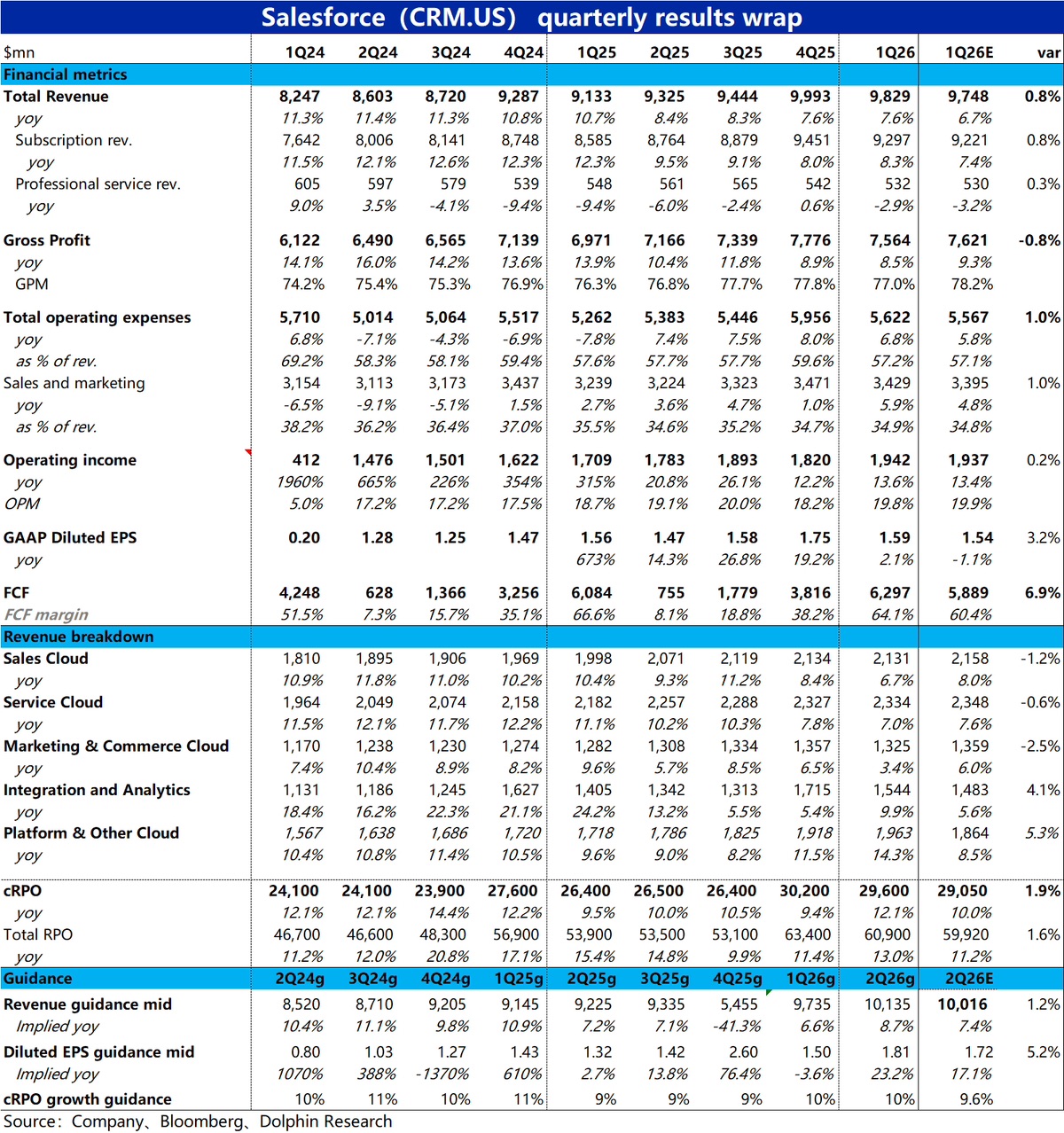

Salesforce 1QF26 Quick Interpretation: Overall, the company's performance this quarter was steadily good, with all major indicators slightly better than expected. Among them, the profit side (with free cash flow as the main indicator) exceeded expectations more significantly than the growth side.

Further analysis shows that among the five major segments, the revenue growth of the three traditional clouds—Sales, Service, and Marketing—was lower than expected. This reflects the sluggish IT spending by European and American companies on traditional IT, consistent with market research findings.

The main drivers were the two relatively newer segments, Platform Cloud and Data Analytics, which are more closely related to AI and Agentforce, showing strong growth. This indicates that, despite no clear increase in overall IT budgets, companies are prioritizing AI-related spending over non-AI expenditures, also suggesting a potential increase in Agentforce penetration.

In terms of profits, the GAAP/Non-GAAP operating profit and net profit for this quarter were not significantly different from expectations. Therefore, the better-than-expected cash flow may be primarily due to favorable changes in operating assets like receivables/payables.

The guidance for the next quarter was also slightly better than expected, implying a growth rate (excluding currency effects) roughly flat compared to this quarter, while the market had anticipated a slight slowdown. Consequently, the full-year revenue growth expectation for 2026 was slightly raised, but the operating margin and cash flow guidance remained unchanged, suggesting the company will be relatively more aggressive in spending this year.$Salesforce(CRM.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.