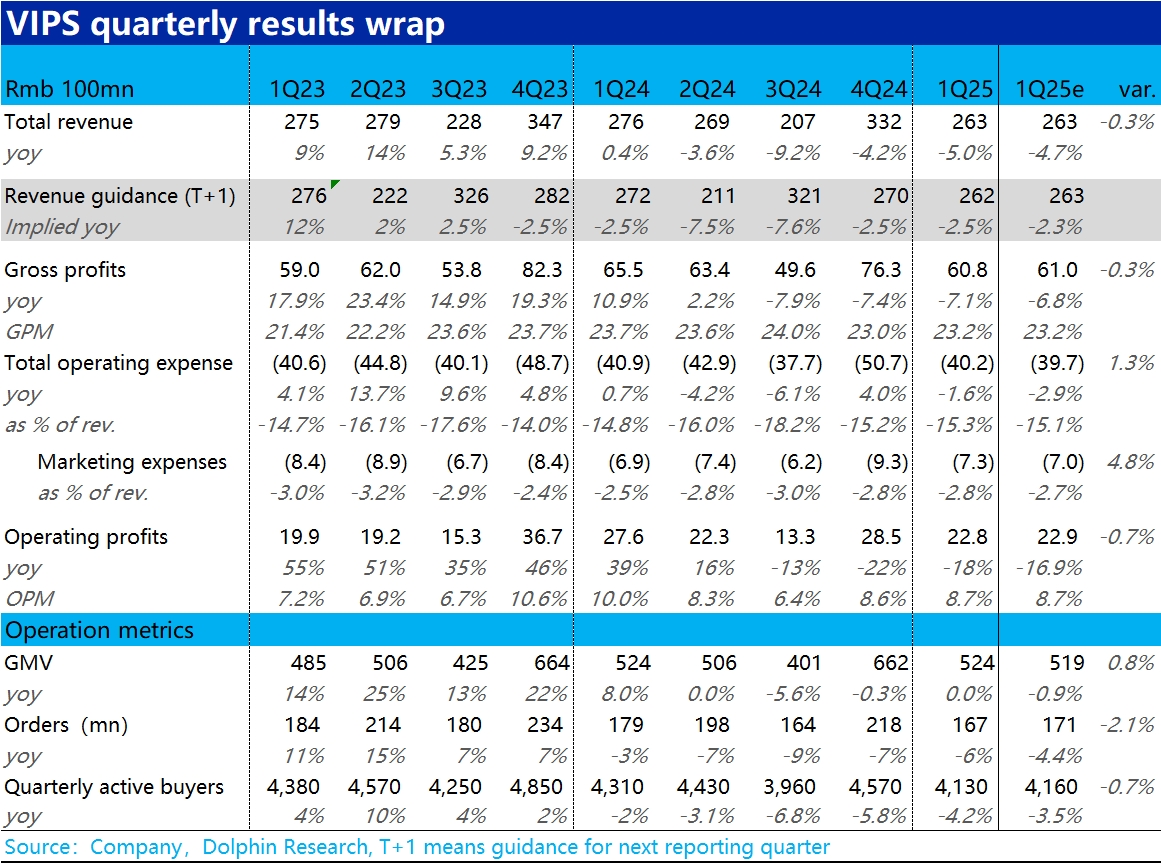

Vipshop 1Q25 Quick Interpretation: In summary, Vipshop's performance this time was as bad as expected. In terms of major figures, revenue saw a year-on-year negative growth of 5%, hitting the lower end of the previous guidance range of -5%~0%. Moreover, due to a significant deterioration in gross margin and expense ratio from a year-on-year perspective, operating profit even dropped by about 18% year-on-year. Both revenue and profit showed negative growth.

In terms of core operating metrics, the nearly flat year-on-year GMV without a significant decline can be considered a 'relief.' However, the user base still lost 1.8 million people year-on-year.

The guidance for the decline remains a year-on-year revenue drop of -5%~0%, with no signs of improvement. But the market had already expected this.

In other words, from an absolute perspective, all indicators performed poorly. From a relative perspective, such poor performance was already within market expectations, and it didn’t get significantly worse compared to the fourth quarter of last year (4Q24 was already very bad).

Logically speaking, the performance wasn’t much worse than expected, so why did the stock plummet by 8% after the announcement? (Pre-market trading volume was very low and may not reflect the reaction of the market's main players). Dolphin Research believes this might be because the company's stock inexplicably surged by nearly 12% last week without any significant positive news. At the time, we speculated that some funds might have been betting early, expecting good performance (possibly due to the decent performance of JD.com and Alibaba). However, there was no surprise performance beyond expectations, so the stock gave back the gains from the early bets.$Vipshops(VIPS.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.