SMIC's performance this quarter was mixed, coupled with "bleak" guidance.

Although the gross margin this quarter still performed well, the revenue was significantly lower than previous guidance expectations.

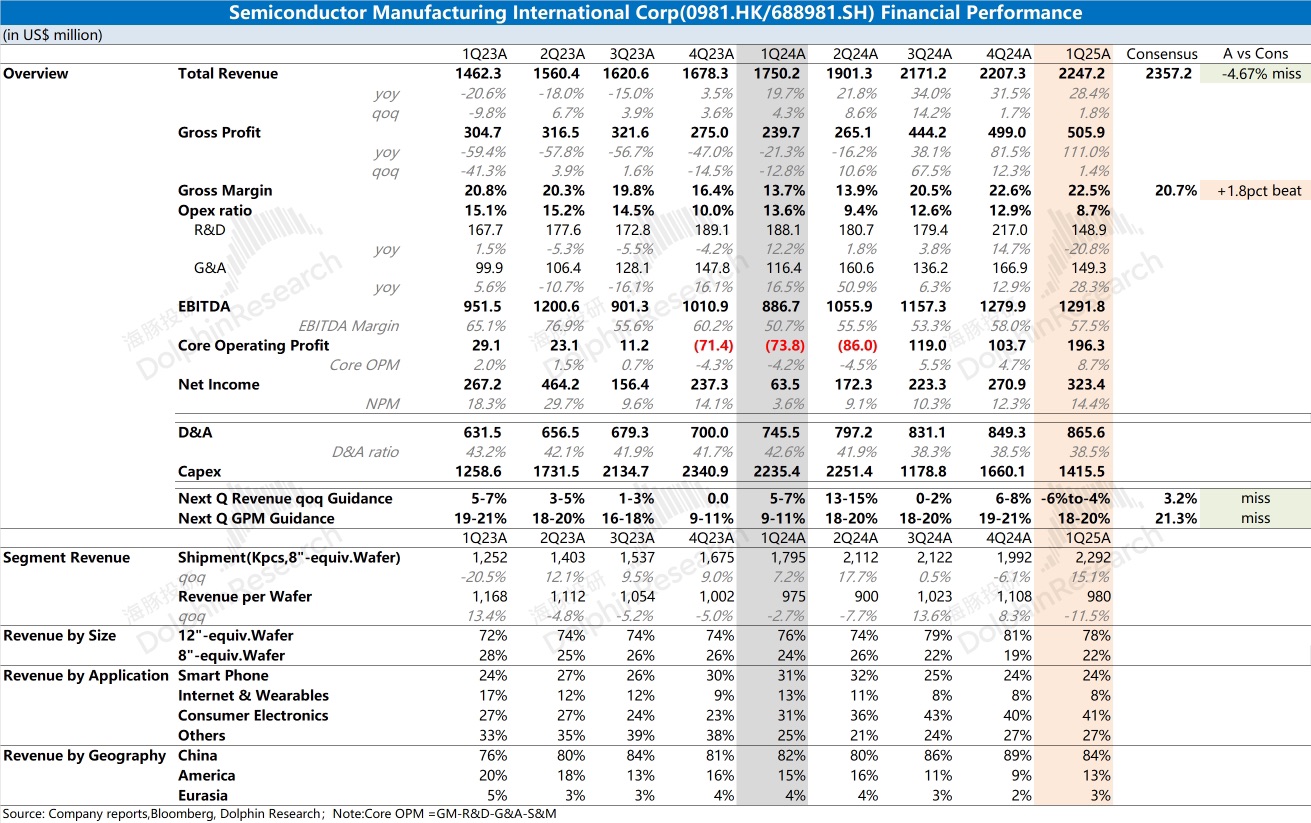

Specifically, the company's wafer shipments increased by 15.1% quarter-on-quarter, while the average product price saw a double-digit decline. This was mainly due to the increase in 8-inch wafer shipments this quarter, which structurally drove down the average product price.

Despite the decline in average product price, the gross margin was still maintained at 22.5%, primarily due to the economies of scale brought by the increase in shipments. The company's fixed cost per unit (depreciation and amortization/shipments) and variable cost per unit (other manufacturing expenses/shipments) both saw significant declines this quarter, ultimately leading to a better gross margin performance.

Compared to this quarter's data, the company's guidance for the next quarter is even "bleaker." The company expects revenue to decline by 4% to 6% quarter-on-quarter, and the gross margin guidance has been further lowered to 18-20%. Combining the data from both quarters, Dolphin Research speculates that the growth in 8-inch wafer shipments this quarter mainly came from customers stockpiling in advance due to factors like tariffs. However, due to weak downstream demand, the company's performance will face pressure again.

For more details, please stay tuned for Dolphin Research's full review.$SMIC(00981.HK)$SMIC(688981.SH)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.