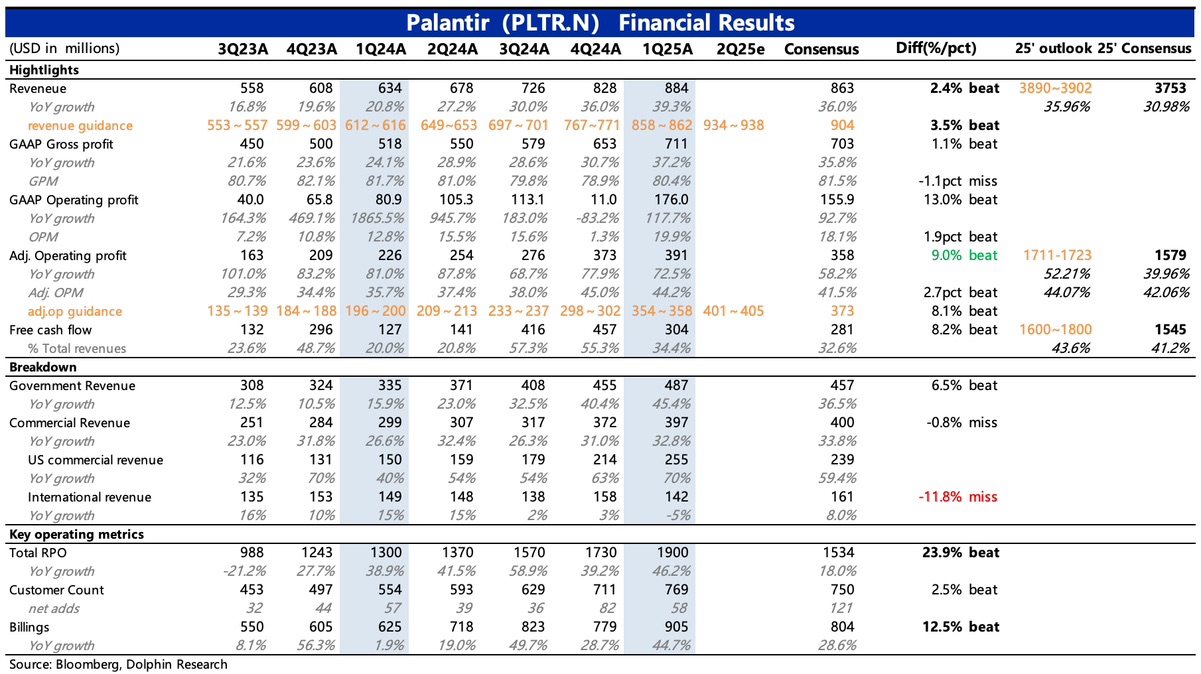

Palantir 1Q25 Quick Interpretation: The overall performance in the first quarter remains strong, exceeding market expectations, mainly driven by robust demand from the U.S. government and enterprises, as well as Palantir's product superiority over its peers. Particularly, the U.S. government revenue slightly alleviated pre-earnings market concerns about the impact of government efficiency targets on first-half revenue.

However, there was unexpected divergence in international markets. Government revenue surged with rebounding growth, but commercial revenue—which was highly anticipated as a mid-to-long-term growth driver—recorded its first year-on-year decline, falling significantly short of expectations. Dolphin Research speculates this might be the main reason for post-earnings market dissatisfaction.

1. Positive guidance, raised annual target: Q2 revenue guidance implies a growth rate maintained at around 39%, showing strong momentum on a higher base compared to Q1. U.S. domestic revenue now accounts for 71%, ensuring Palantir's high growth this year is secure, with management steadily raising the full-year growth target to approximately 36%.

2. Stable profit margins: Possibly due to more AI investments being recognized in the current period, Q1 gross margin declined slightly. R&D and sales expenses continued to grow over 20% YoY, while administrative expenses saw more noticeable cost control. Adjusted operating margin was 44.2%, down 0.8 pct QoQ but still far exceeding market expectations.

3. Solid forward-looking indicators: Contract liabilities (or Billings), TCV, RPO, NDR, and customer count—though less impressive than last quarter—still showed positive trends, indicating strong short-term revenue. $Palantir Tech(PLTR.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.