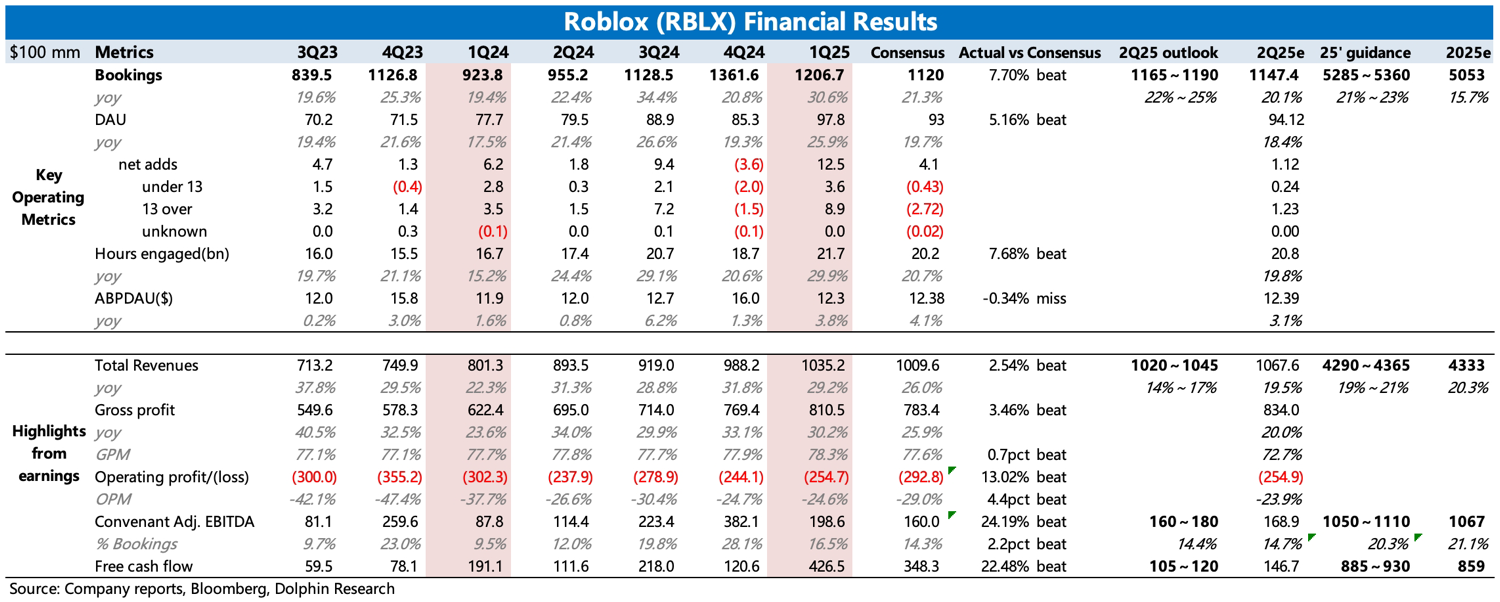

Roblox Quick Interpretation: Q1 performance was good, with both key growth metrics and profitability indicators exceeding expectations, reflecting the company's healthy trend of stable improvement in internal operational efficiency while maintaining ecosystem activity.

1. DAU growth has resumed accelerated expansion. The slowdown in user growth in Q4 last year raised market concerns and was the main reason for the post-earnings plunge. During the earnings call, the company explained—the high base effect from the PlayStation version launch the previous year and temporary bans on Roblox in regions like Turkey were contributing factors. Additionally, the introduction of enhanced parental controls also impacted the activity of users under 13.

The company hinted at improved data in January, and third-party data platforms have shown accelerated user penetration since March. Coupled with the catalyst of the Google ad partnership, the adjusted stock price has quickly recovered. Q1 results indeed stood out, with the most significant growth seen among users aged 13+ and in regions like Asia-Pacific.

2. Revenue growth rebounded to 30%. Currently, average spending per user remains stable, so revenue changes primarily follow DAU trends.

3. Gross margin improved by 1 pct sequentially. Roblox's main costs are channel fees, such as Apple and Google's app store taxes. Since last quarter, the company has actively guided users to top up directly on its official website (with extra Robux incentives), and positive effects are already visible within just one quarter.

4. Developer payout ratio increased by 3 pct. Roblox's standard 20% revenue share isn't competitive in the gaming industry, passively filtering out many high-quality developers. Although management has long discussed raising payouts, this quarter finally showed tangible changes. Developer fees now account for 23% of revenue. While this may slow short-term loss reduction, it’s a critical step for long-term ecosystem health.

5. Q2 guidance slightly exceeded expectations, and full-year guidance was raised following Q1's outperformance, aligning with management's long-term target of maintaining over 20% revenue growth.$Roblox(RBLX.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.