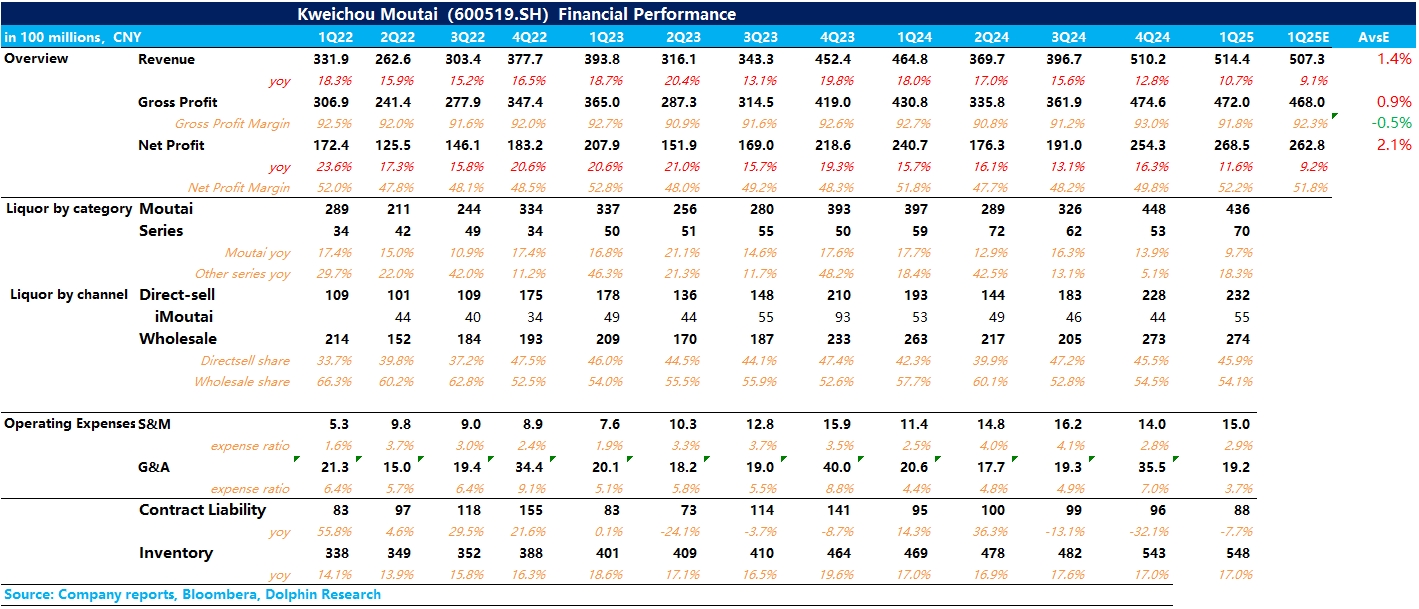

$Moutai(600519.SH) 1Q25 Earnings Quick Interpretation: Moutai's Q1 earnings slowed as expected, but the overall growth rate was still higher than the company's full-year guidance of 9%.

Moutai liquor achieved revenue of 43.6 billion yuan, a year-on-year increase of 9.7%. Although Moutai does not disclose production and sales data in its quarterly report, considering the control of Feitian supply to support prices, Dolphin Research speculates that the growth of Moutai liquor is more attributable to the increased contribution from non-standard products. Series liquor achieved revenue of 7.02 billion yuan, a year-on-year increase of 18.3%, accelerating again after two consecutive quarters of slowdown in Q3 and Q4 of last year. Combined with channel research information, Moutai 1935 sales during the 2025 Spring Festival period showed significant acceleration, and channel inventory has been digested to a relatively low level, basically entering a healthy growth phase.

By channel, the direct sales ratio of Moutai in 1Q25 was 45.9%, still maintaining a high level. Dolphin Research speculates that to alleviate the supply pressure of 500ml Feitian, Moutai continued the Q4 strategy by increasing the supply of non-standard products (such as kilogram packs, 100ml small gift boxes, etc.), which are often distributed through direct sales channels.

In terms of gross margin, although Moutai increased the supply of non-standard products in Q1, the volume growth of series liquor caused the gross margin to slightly decline from 92.7% in the same period last year to 91.8%. However, the highlight of this quarter was that Moutai further strengthened cost control across all business segments, improved dealer sales, and reduced the management expense ratio to 3.7%, the lowest level in nearly three years, ultimately achieving a net profit margin of 52.2%.

For more details, please refer to Dolphin Research's subsequent earnings commentary.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.