$XD INC(02400.HK) 2H24 Quick Interpretation: Last year's gaming double stock has released its performance. Since a forecast was issued earlier (earnings greatly exceeded expectations; Dolphin Research's commentary can be found at: https://longportapp.cn/zh-CN/topics/27818057?channel=t27818057&invite-code=032064&app_id=longbridge&utm_source=longbridge_app_share&locale=zh-CN), market expectations have significantly increased in the past month. Referring to the few institutional expectations, it seems that there was high anticipation for TapTap's performance and cost contraction before the financial report.

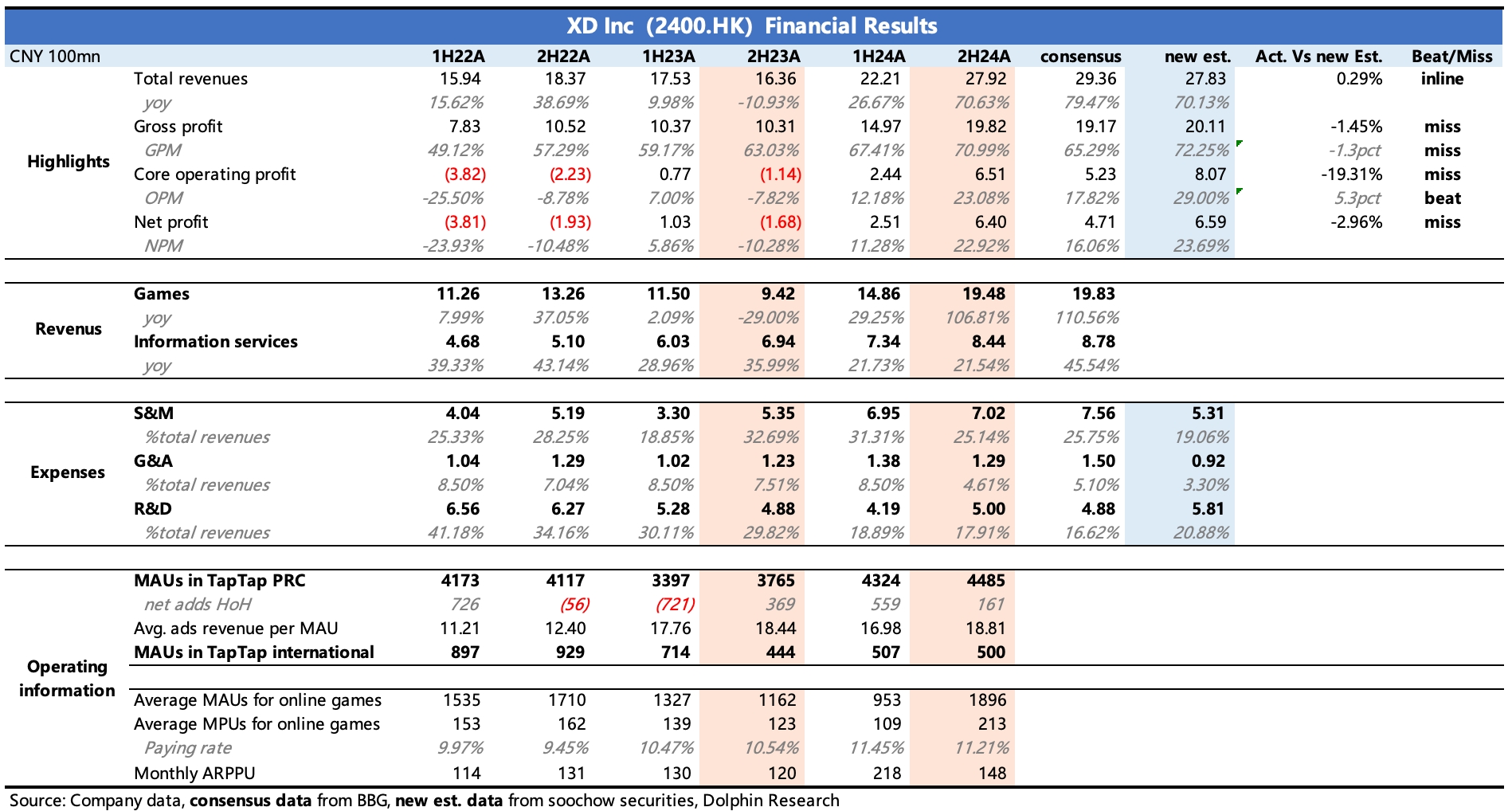

However, compared to the latest institutional expectations (marked in blue in the chart below), Xindong's actual performance showed average revenue (in line with expectations), and although net profit was also within guidance, it had some inflation—boosted by other net gains (rapidly shrinking interest expenses). Looking solely at the operating profit situation of the core main business, it fell short of expectations—mainly due to the discrepancy in cost control.

The significant drop following the performance report was largely based on the high valuation impact brought about by high expectations. According to the optimistic expectations before the institutional financial report (25% revenue growth in 2025, 45% profit growth, which translates to over 1.2 billion in net profit), the forward P/E was also at 15-16x. This is not considered low compared to smaller peers in the Hong Kong stock market and historical valuations.

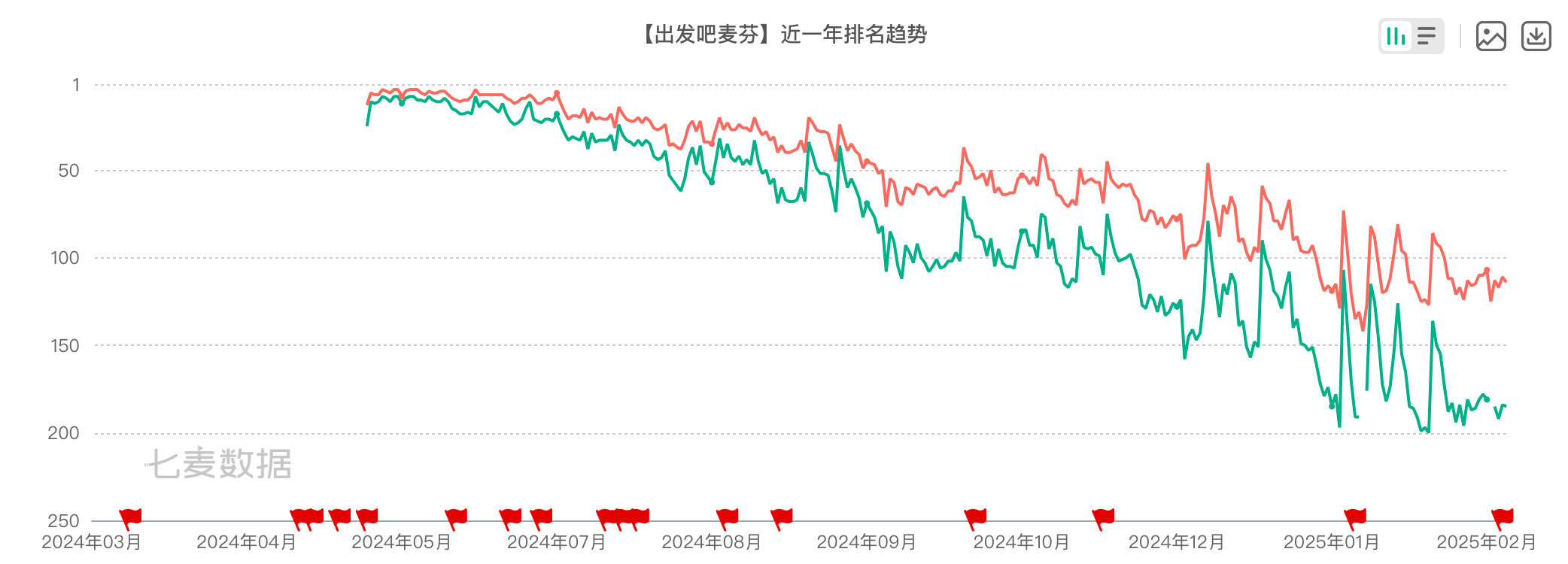

Of course, Dolphin Research also acknowledges that Xindong has TapTap, which deserves a higher valuation than its gaming peers. However, we have consistently emphasized that this year's gaming pipeline is somewhat thin, especially since last year had a high base. Therefore, the institutional expectation of a 25% total revenue growth likely includes a significant contribution from TapTap. The actual performance of TapTap was also quite average, leading to a short-term double whammy under the emotional letdown.

Aside from the performance, Xindong declared its first dividend, paying HKD 0.4 per share, with a dividend yield of 1-2%, and a payout ratio close to 25%, which is considered a normal dividend level.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.