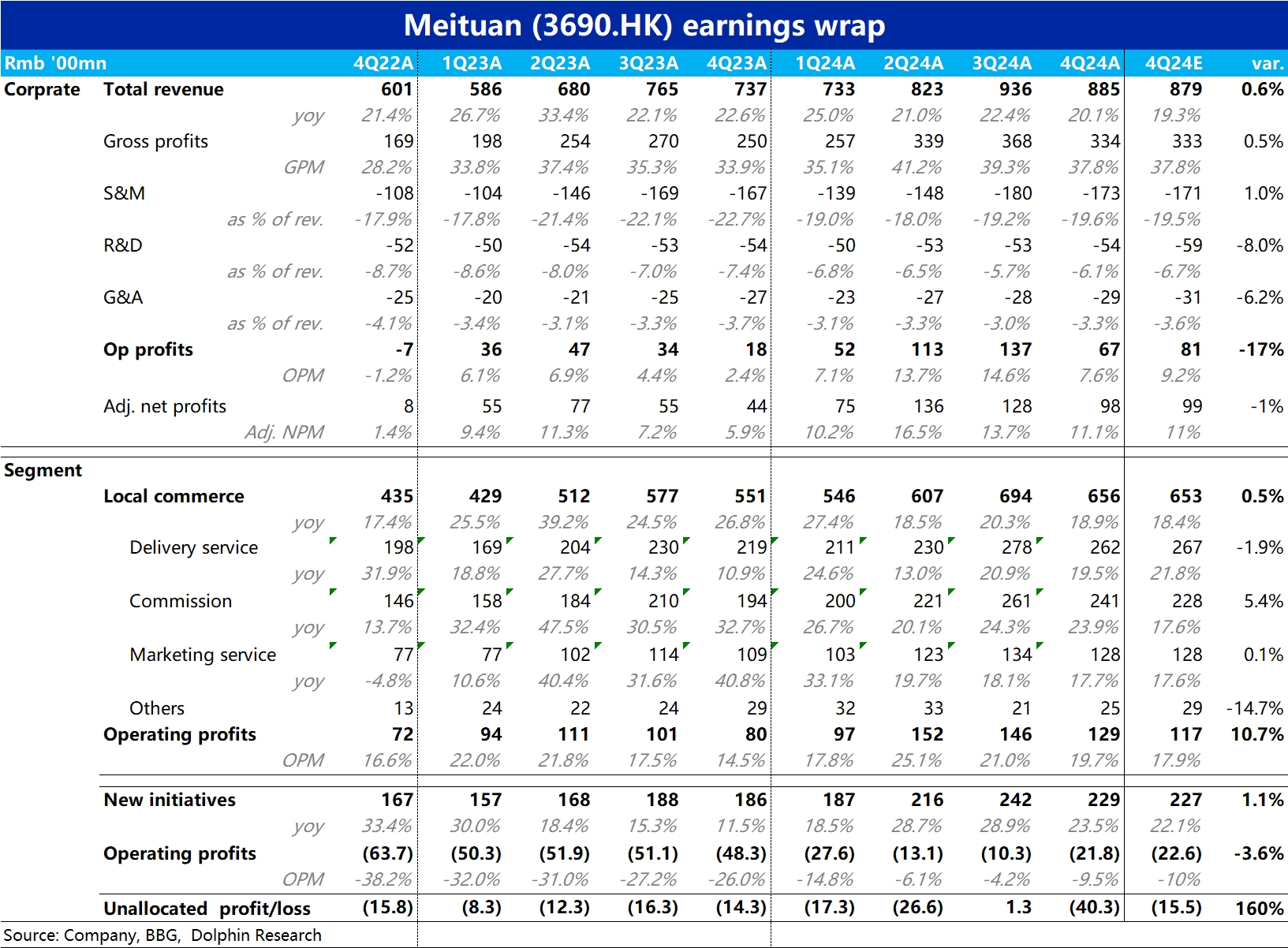

$MEITUAN(03690.HK) 4Q24 Quick Interpretation: This quarter, Meituan's performance was generally in line with expectations, delivering reasonable results from the perspective of expected discrepancies. All major indicators were broadly consistent with market expectations. At first glance, the operating profit was about 1.4 billion lower than expected (17%), but this was mainly due to the recognition of approximately 1.67 billion in foreign exchange losses from overseas assets in this quarter. Excluding this one-time impact, the profit under non-GAAP standards also met expectations.

However, Meituan did not disclose order volume data this quarter, resulting in a lack of publicly disclosed non-financial operational indicators, making it more difficult to analyze the quarterly report. In terms of trends, revenue growth in core local commerce was 18.9%, slightly slowing by 1.4 percentage points compared to the previous quarter, showing stable performance. The operating profit margin reached 19.7%, only slightly down by 1.3 percentage points in the off-season, which is better than Bloomberg's consensus expectation of 17.9%.

Additionally, the new business that the market is concerned about has seen an expansion in losses from overseas operations, with the company's guidance indicating a loss of 2.18 billion this quarter, doubling from the previous quarter, which is indeed a significant increase. However, market expectations were relatively well-anticipated, and the actual loss was slightly lower than Bloomberg's consensus expectation.

Overall, it still reflects Meituan's good execution capability, with all data meeting delivery performance standards.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.