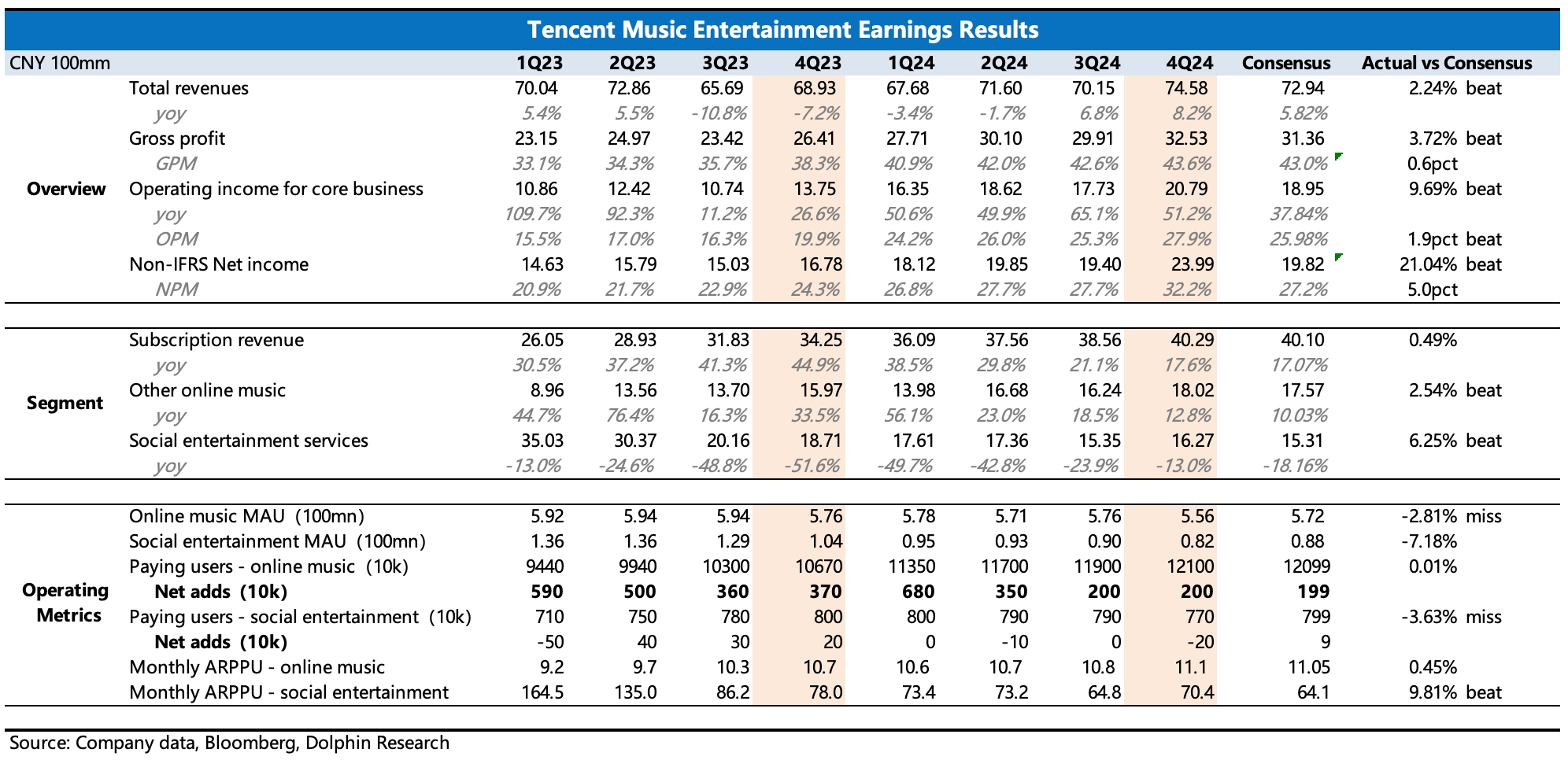

$Tencent Music(TME.US) Q4 2024 Quick Interpretation: Overall, Q4 performance is slightly better, with profits exceeding expectations and new shareholder returns approved, but the weaker part remains user data.

1. Profits exceed expectations: Excluding the impact of interest and investment income, Dolphin Research mainly focuses on the operating profit of the core business (the significant beat under Non-IFRS is mainly due to non-operating items). Q4 exceeded consensus expectations by nearly 200 million, and besides the gross margin continuing to optimize below our expectations, Dolphin Research was surprised that operating expenses could be further compressed (the three expenses in Q4 all accelerated their year-on-year decline), reflecting internal efficiency advantages. As long as competition remains relatively stable, this ability to generate profits is worry-free.

2. New shareholder returns: This quarter, a new repurchase was approved (USD 1 billion over 2 years) and a dividend for 2024 (USD 273 million, with a dividend rate of 26%), resulting in a current shareholder return yield of 3.5%, which is neither high nor low.

3. Weak user data: The number of music subscription users is the same as in the third quarter, with growth under some pressure, but the company has already guided in advance, so it is not surprising. There are currently no signs of a stop in the decline of paid live singing users, but it has further filtered out loyal fans, with per capita payment rebounding.

The overall ecosystem's monthly active users continue to decline, a trend that can also be seen from third-party data platforms. In the second half of last year, the competition from Soda Music intensified. Although there is still a significant gap in user perception compared to Tencent Music, increased competitive pressure may affect Tencent Music's growth expectations, thereby limiting further valuation expansion.

This is also why Dolphin Research emphasizes that Tencent Music's value is being overlooked (short-term fundamentals and valuations are mismatched, and the potential for gross margin improvement is expected to open up industry chain premiums), while also repeatedly reminding in recent weekly reports to start paying attention to Byte's actions in Soda Music.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.