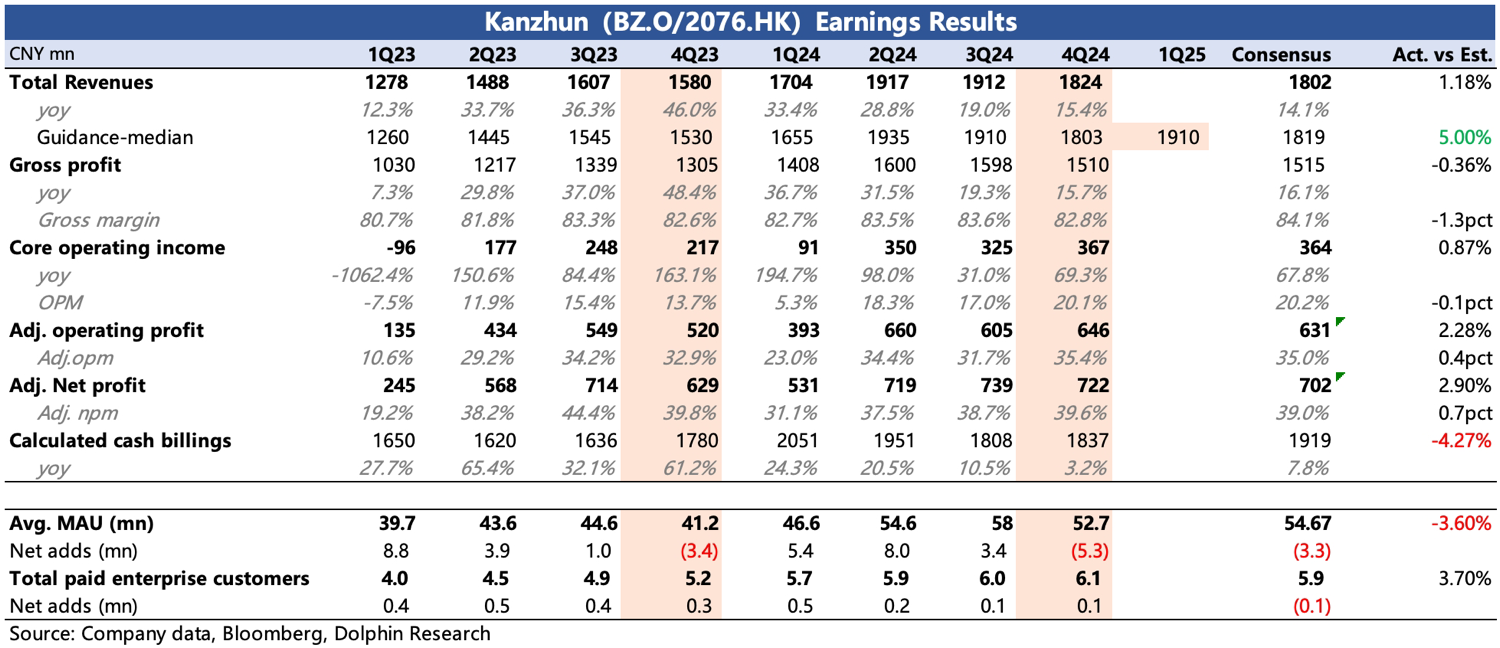

$Kanzhun(BZ.US) Q4 Quick Interpretation: Q4 performance is average. Although overall it is similar to the preview numbers, it is slightly below expectations mainly in terms of Q4 revenue and user MAU, which are the focus of the market. However, the current valuation impact on BOSS ZhiPin is still largely due to guidance and outlook. The management's revenue guidance for Q1 2025 is about a 12% year-on-year increase, which is slightly better than expected. Given the significant changes in some policies and industries at the macro level, we need to see the company's cautious/optimistic attitude towards this guidance during the conference call, as well as some expectations regarding subsequent macro trends.

This quarter, the company will no longer disclose revenue guidance. According to third-party data, the online revenue growth in February was quite good, but there was a disturbance due to the Spring Festival (this year's Spring Festival is earlier than last year's). If we exclude the Spring Festival disturbance, growth may still face some pressure. The management needs to provide some short- to medium-term outlook descriptions based on the platform situation since March.

In terms of profitability, the expenditure on costs and expenses was slightly higher than the market expected. The net profit beat was more due to contributions from other operating profits, unrelated to the main business. However, this is not a big issue. It was emphasized during the preview that marketing expenses would be lower this year, and SBC would decrease to below 1 billion, with a long-term profit margin target still being a Non-GAAP OPM of 40%.

One good point about BOSS ZhiPin is its solid business model and healthy cash flow. The Q4 revenue of 1.8 billion generated a net operating cash inflow of 900 million, and the net cash on the balance sheet at the end of the year was 14.7 billion (2 billion USD). The current repurchase plan is for March and August 2024, with a total approved repurchase amount of 350 million. The Q4 repurchase of 90 million USD significantly increased, accounting for 40% of the total annual repurchase amount of 230 million USD. If this repurchase amount is maintained this year (which means a new repurchase plan needs to be approved), it corresponds to a current return rate of 3%, which is not high. However, the ample cash reserves also provide room for increasing repurchases, so we can pay attention to how the management plans to arrange shareholder returns during the conference call.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.