$JD.com(JD.US) 4Q24 Quick Interpretation: Following the better-than-expected trend of e-commerce peers this quarter, JD.com's performance once again beat the pre-year and upwardly revised guidance.

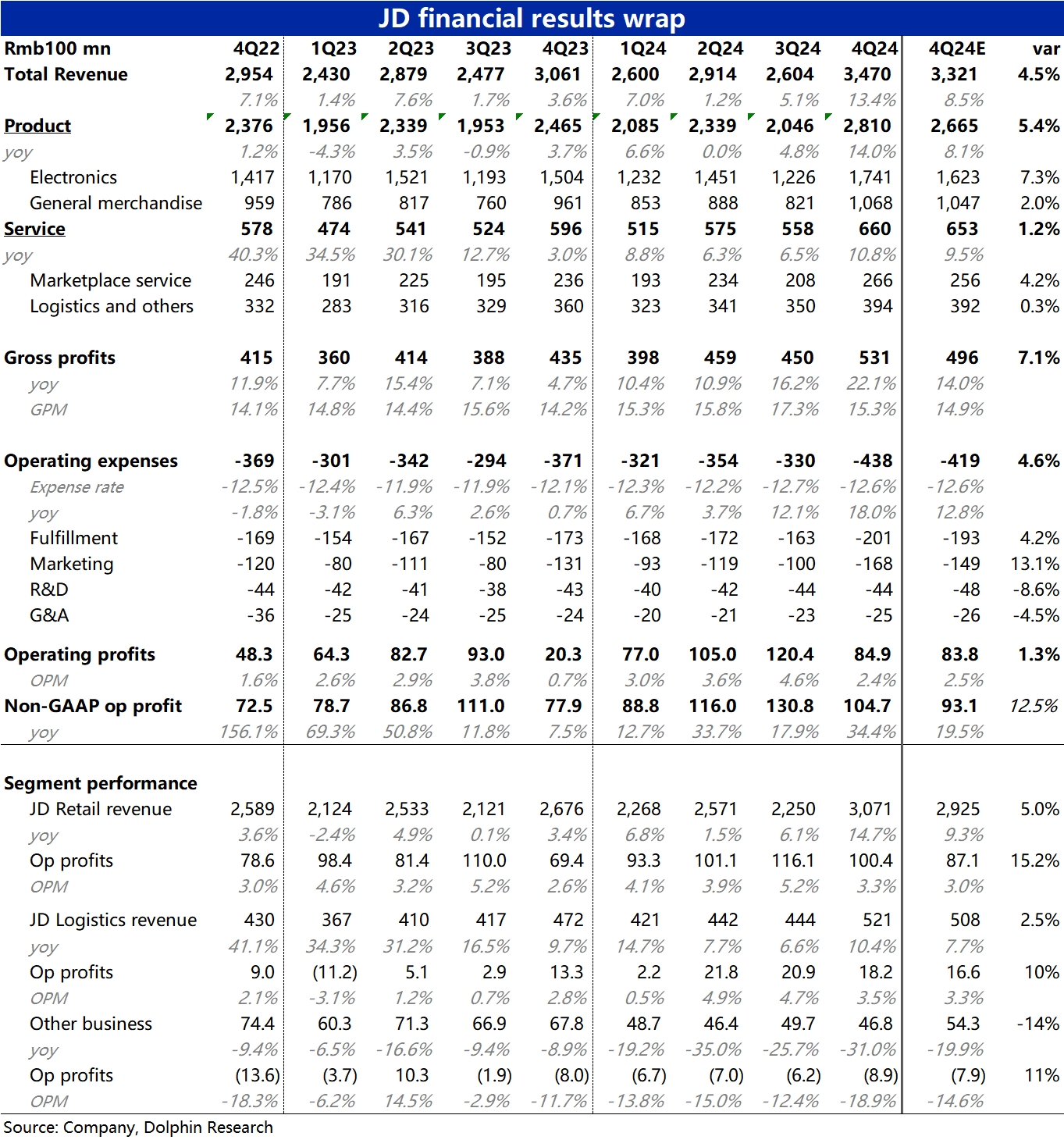

First, total revenue increased by 13.4% year-on-year, higher than the already not low market expectation of 9%~10%. This marks JD.com's return to double-digit revenue growth for the first time since 2022. It is mainly attributed to the boost from national subsidy policies, with JD.com being the biggest beneficiary. The growth rates of electronic products and general merchandise reached 16% and 11%, respectively. Electronic products performed particularly strongly, exceeding market expectations by 7%.

Driven by strong growth, the gross margin was also about 0.4pct higher than expected, driving gross profit to increase by 22% year-on-year, about 3.5 billion more than expected.

However, along with the stronger-than-expected growth, the company's expense investment was also higher than expected, especially marketing expenses, which were nearly 2 billion higher. This reflects the continued competition in the e-commerce industry, or the situation of "spending money for growth." Therefore, under the non-GAAP standard, this quarter's operating profit was about 1.1 billion higher than expected, which is a relatively good performance. But obviously, a significant portion of the excess (vs. expectations) gross profit was eroded by expenses. Personally, I think the surprise on the profit side is not as big as on the growth side.

In addition, JD.com announced a total of $1.5 billion in dividends and a $5 billion buyback quota over the next approximately two and a half years. Assuming the buyback quota is evenly distributed, the total annual buyback + dividends would be about $3.5 billion, corresponding to a return rate of about 5.5% on the pre-market market cap. As the market cap rises, the return rate is no longer so exaggerated, but it should still be above average among Chinese concept assets.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.