$Marvell Tech(MRVL.US) 4QFY25 Quick Interpretation: The financial report data is acceptable, but the guidance is hard to be satisfactory.

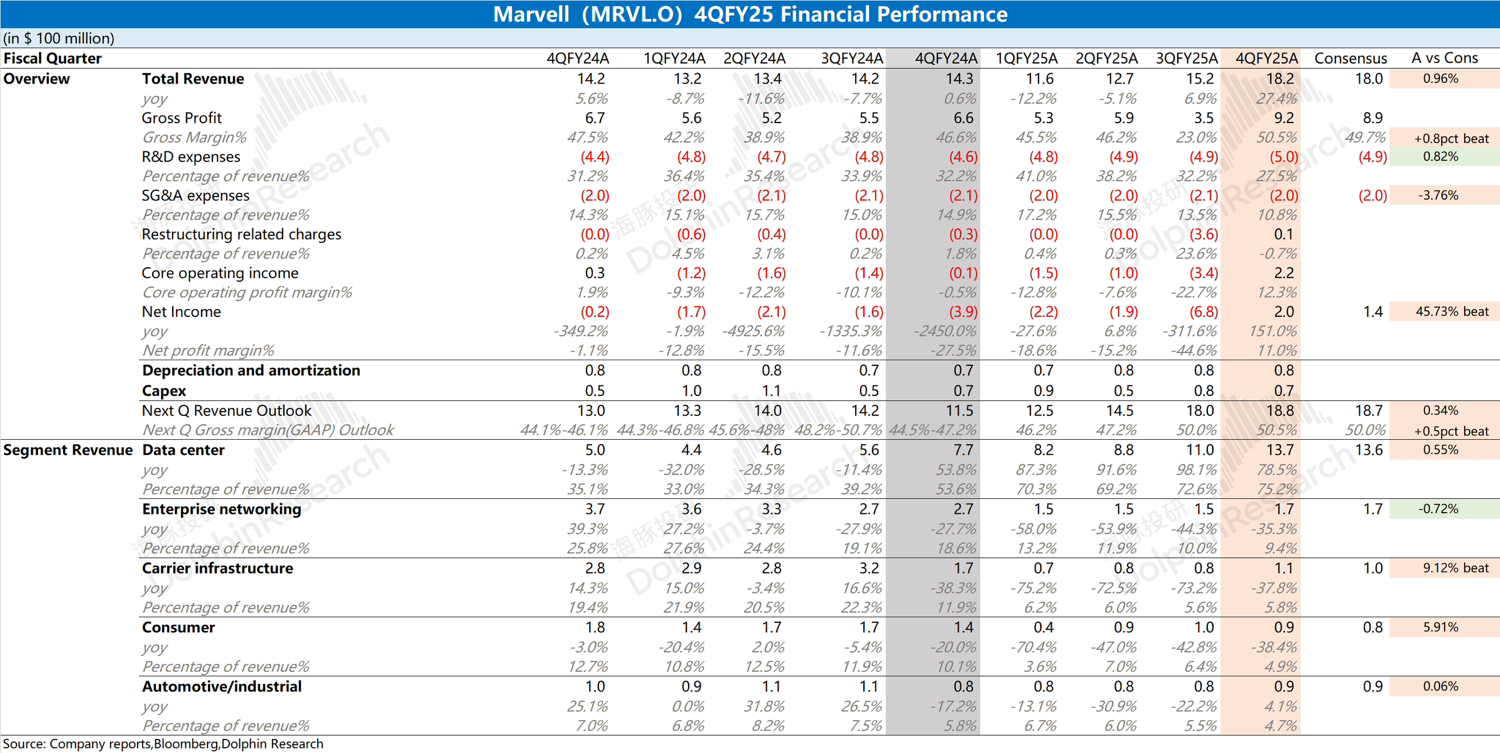

This quarter, the company's revenue achieved double-digit growth, meeting market expectations, mainly driven by the growth in data center and AI demand. Due to the impact of acquisition amortization, restructuring costs, and other factors in the previous quarter, the gross margin saw a significant decline. Excluding this impact, the gross margin for this quarter is also steadily rising.

From a specific business perspective, benefiting from the demand for customized ASICs from companies like Amazon and the boost from optoelectronic products, the company's data center business achieved a year-on-year growth of 78.5% this quarter, making it the main growth point for the company. The enterprise network, carrier infrastructure, and automotive/industrial sectors also showed signs of recovery this quarter.

Compared to the financial report data, the market is actually more concerned about the company's guidance for the next quarter. With signs of recovery in some traditional businesses, the expected increase in revenue for the next quarter is hard to be satisfactory. Coupled with the previous market rumors of CoWos order reductions, such guidance further exacerbates market concerns about the company's future growth in AI business. For more detailed information, please follow Dolphin Research's specific comments and conference call content on the company.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.