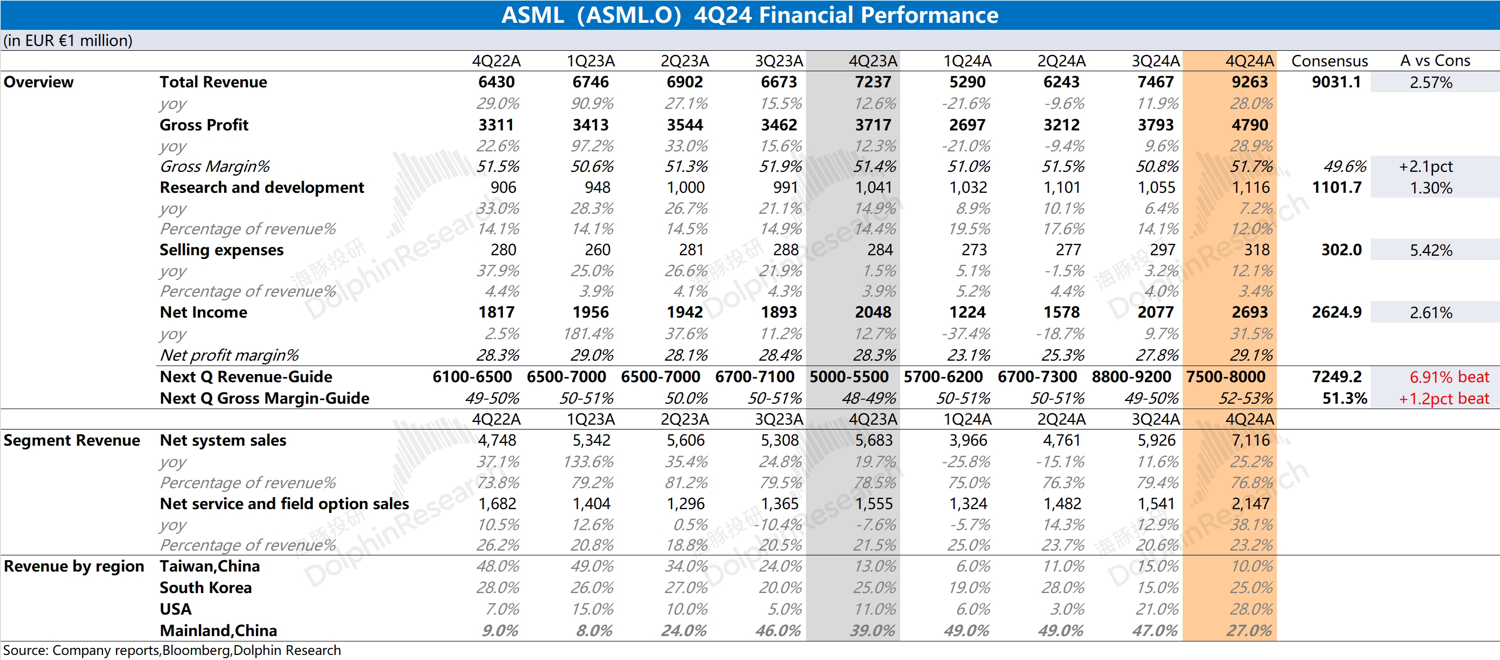

$ASML(ASML.US) 4Q24 Quick Interpretation: The company's financial report performance this quarter was good, with operating revenue and gross margin reaching the upper limit of previous guidance, mainly due to the increase in EUV shipments. The company's EUV revenue reached a new high this quarter, approaching 3 billion euros. In 2024, the company's low-NA product (NXE:3800E) has officially shipped, and high-NA products have also received acceptance from two customers. Although R&D expenses and selling expenses have increased, their proportion is still declining, and the overall operational situation of the company is showing a steady improvement.

In addition, the performance guidance provided by the company has also brought more confidence to the market. The company expects next quarter's revenue to be between 7.5 billion and 8 billion euros, with a gross margin of 52-53%. The first quarter is often a slow season for the company's performance, but both guidance figures are better than market expectations.

Although TSMC recently provided a capital expenditure plan of 38-42 billion USD for 2025, the market remains concerned about the procurement situation of customers such as Intel and Samsung, leading to a relatively cautious outlook on ASML's operational performance. However, the company's guidance of 30-35 billion euros in annual revenue (a year-on-year increase of 6%-24%) and a gross margin expectation of 51-53% undoubtedly provides the market with a "reassurance." For more detailed information, please continue to follow Dolphin Jun's detailed interpretation and the conference call summary.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.