With the promotion of this round of AI computing power transformation, customized ASIC chips have gradually attracted market attention. Dolphin Research has also put $Marvell Tech(MRVL.US) on its agenda.

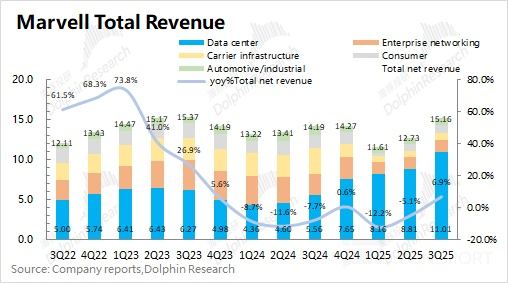

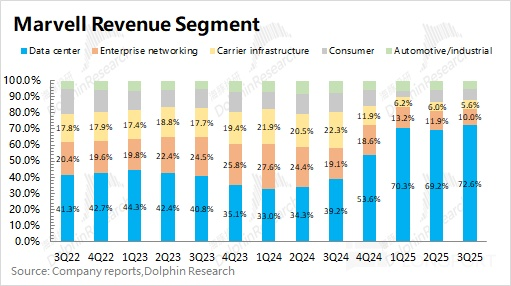

Despite the poor performance of the company's traditional business, its stock price has continued to rise, mainly because the market's focus on the company lies in the growth of its data center business (year-on-year growth has remained above 80% in the past three quarters). The data center business can be divided into two parts: ASIC and other businesses:

1. ASIC business: Benefiting from the mass production and shipment of ASIC products for Amazon and Google, the company has joined the first tier of ASIC design, with a current single-digit market share. However, with the growing demand from major cloud service providers, the company is expected to further expand its customer base and scale. The company expects the overall ASIC market to achieve a compound growth rate of 45% between 2023 and 2028, and it anticipates its market share to exceed 20% in the medium to long term. Therefore, the company's ASIC revenue compound growth rate in the next five years will exceed the industry average of 45%.

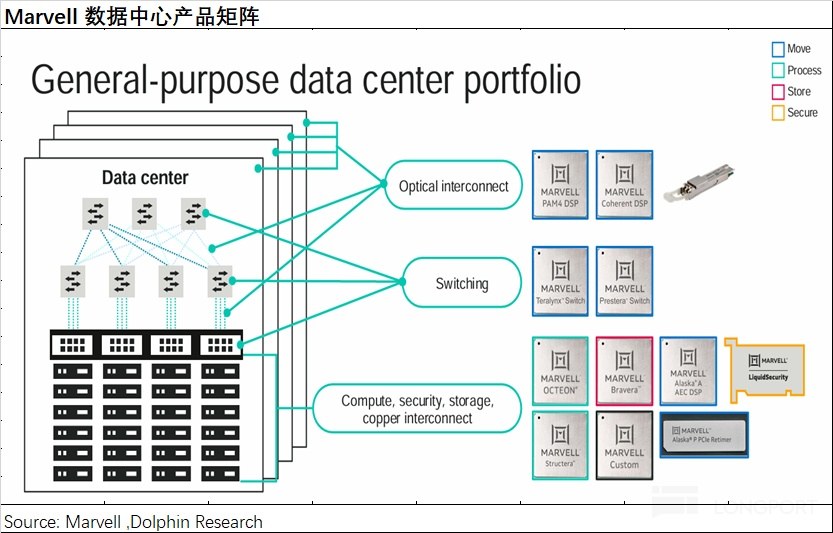

2. Other businesses: Before the mass production of ASICs, the company's data center business mainly consisted of optoelectronic products and switch chips. Currently, the company holds the top position in the market for optical module DSP chips; its switch chips are also in the first tier, slightly behind Broadcom, lagging by about one year. Although storage products were Marvell's founding business, with the decline of hard disks, the proportion of its storage business has dropped to around 10%.

The company began its strategic adjustment in 2016, and by 2024, 70% of its total revenue will come from the data center business, marking the completion of its business adjustment. With the growth of AI demand and deep partnerships with major clients, the company's performance will continue to benefit from the growth of ASIC and data center businesses in the future.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.