$Costco Wholesale(COST.US)1QF25 Quick Interpretation: This morning, the warehouse retail leader Costco announced its Q1 FY25 results, which were generally good and stable.

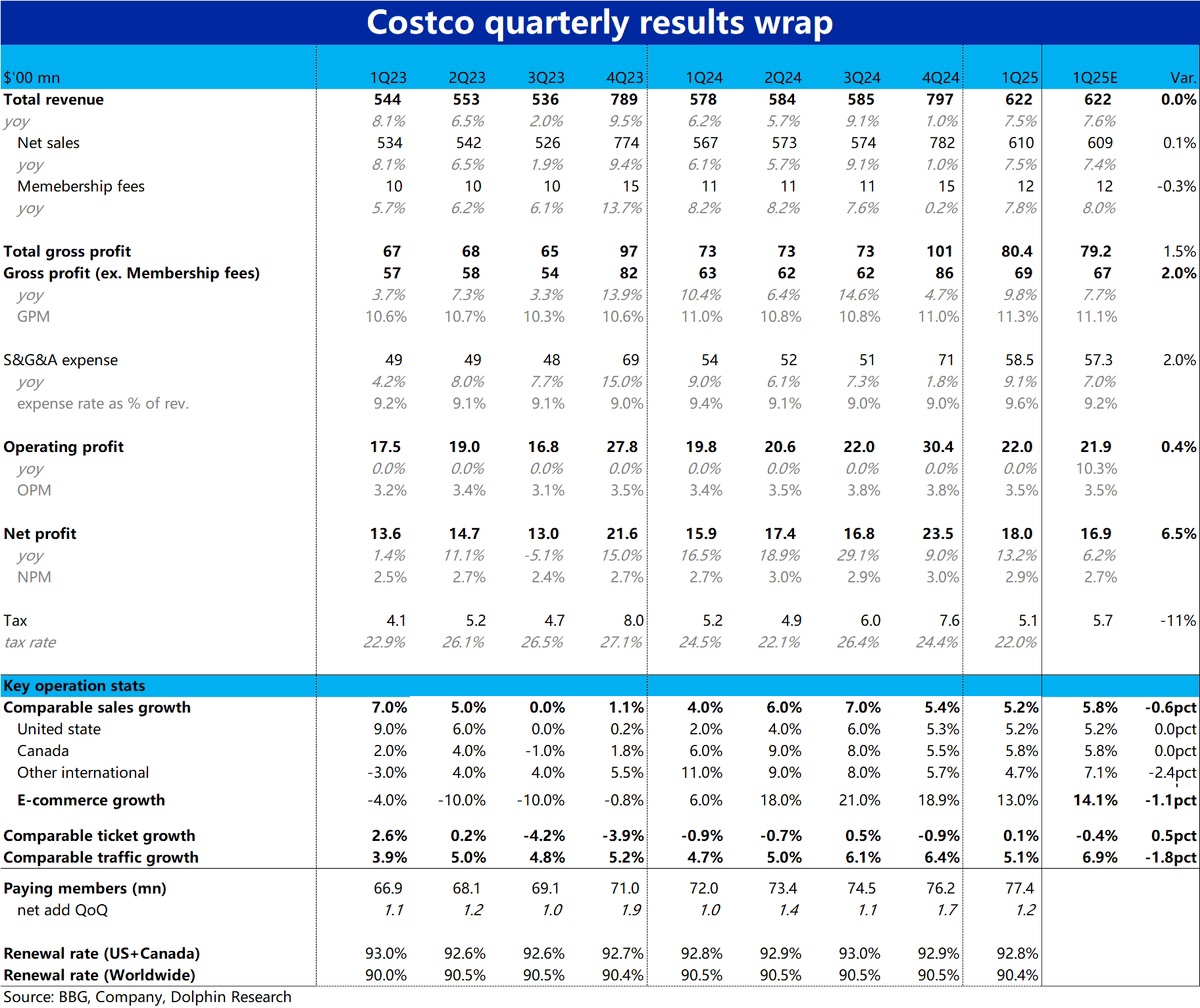

1) Core metrics - Comparable store sales grew 5.2% this quarter, slightly slower than last quarter's 5.4%. By region, North America and Canada's comparable store growth was completely in line with market expectations, while other international regions grew 4.7%, seemingly significantly slower (5.7% last quarter) and below market expectations, but this was mainly due to currency exchange factors. Excluding currency exchange and oil price fluctuations, international comparable growth was 7.1%, slightly faster than last quarter and largely in line with expectations. Reflected in financial metrics, this quarter's sales revenue was $61 billion, up 7.5% YoY, basically in line with expectations.

2) Membership fee revenue this quarter was $1.2 billion, up 7.8% YoY, slightly below the market's expected 8% growth. This was mainly due to a net increase of 1.2 million paid members this quarter to 77.4 million (+7.5 YoY). However, possibly affected by recent membership fee increases and stricter membership checks, global and North American membership renewal rates both decreased by 0.1 percentage points sequentially.

3) While the revenue side was basically in line with expectations, Costco's profit side slightly exceeded expectations this quarter. First, the gross margin on merchandise sales was 11.3%, higher than the expected 11.1%, resulting in gross profit being about 2% higher than expected. Additionally, due to the recognition of approximately $100 million in tax savings this quarter ($44 million in the same period last year), actual taxes recognized this quarter were $510 million, significantly lower than the expected $570 million. This was the main reason net profit was 6.5% higher than market expectations.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.