$Kanzhun(BZ.US) Quick Interpretation: The long-delayed Q3 earnings report of the "recruitment small-cap leader" has finally been released. Since the company's official preview had just been communicated at the beginning of the month, the market has largely digested the pressure on the revenue side of the Q3 report.

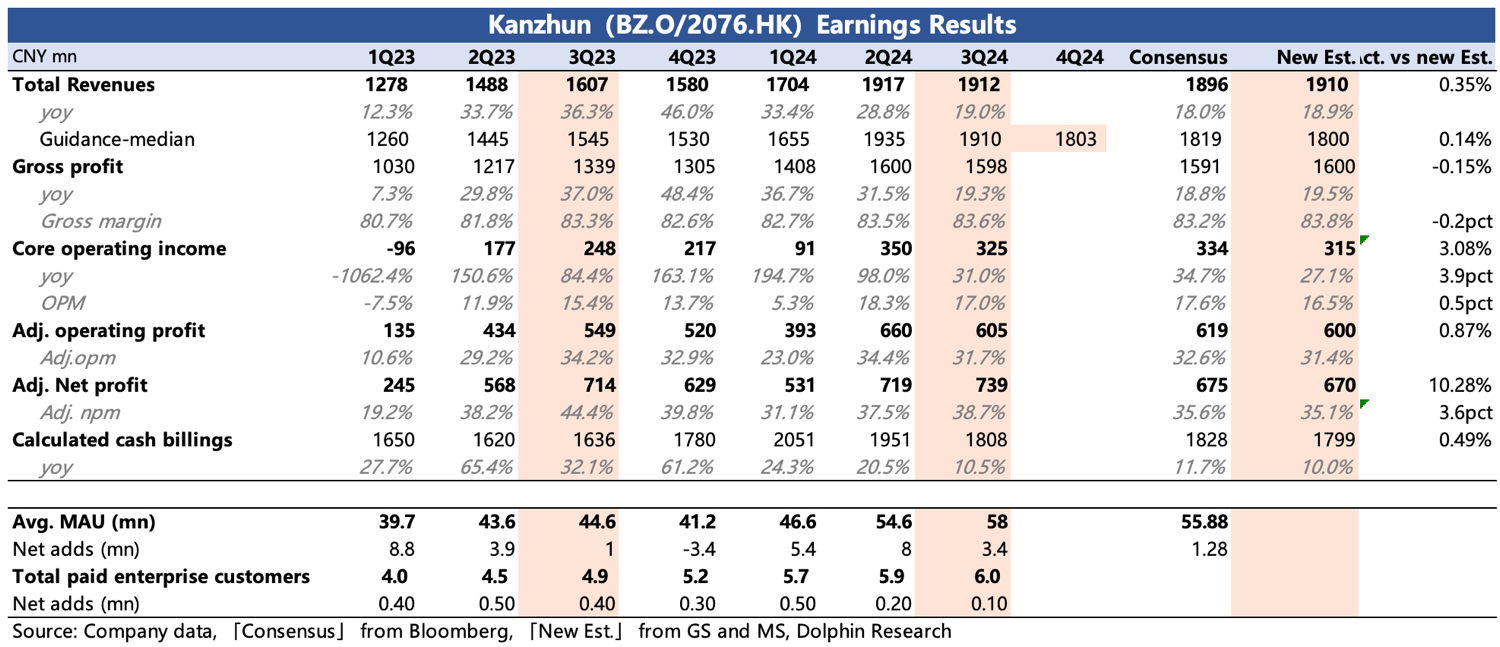

(1) Compared with the latest market expectations, the performance of the core business is basically within the expected range. The better-than-expected adjusted net profit mainly comes from other income such as interest income, investment income, and exchange gains, which are not closely related to the performance of the core business and cannot be considered as a truly sustainable beat. It is recommended to focus on the operating profit of the core business.

(2) Although the market's key concern, "calculated cash billings," is no longer disclosed, Dolphin Research calculated that the current revenue reached 1.81 billion yuan based on deferred revenue, which is in line with the company's guidance and market expectations at the beginning of the month.

Due to short-term environmental impacts, revenue growth will inevitably continue to face pressure, but the company also expects revenue to achieve 10%+ growth next year. Generally, December is the period when most clients discuss and sign contracts for the next year, so it is worth paying attention to whether the management provides any updates on next year's outlook during the earnings call based on December's performance.

(3) In terms of operational metrics, the number of users continues to hit new highs, but most of the new active users are likely still job seekers. However, during the preview, the management disclosed that the user structure of C-end and B-end had improved in late November, though this may not yet have translated into paid conversions.

(4) Recruitment revenue grew by 20%, mainly driven by the increase in paid enterprise users, which rose by 22% from 4.9 million to 6 million. However, Dolphin Research calculated that the average payment per enterprise over the past 12 months has also increased sequentially, indicating that the recruitment demand of small and medium-sized enterprises weakened faster in the challenging Q3.$BOSS ZHIPIN-W(02076.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.