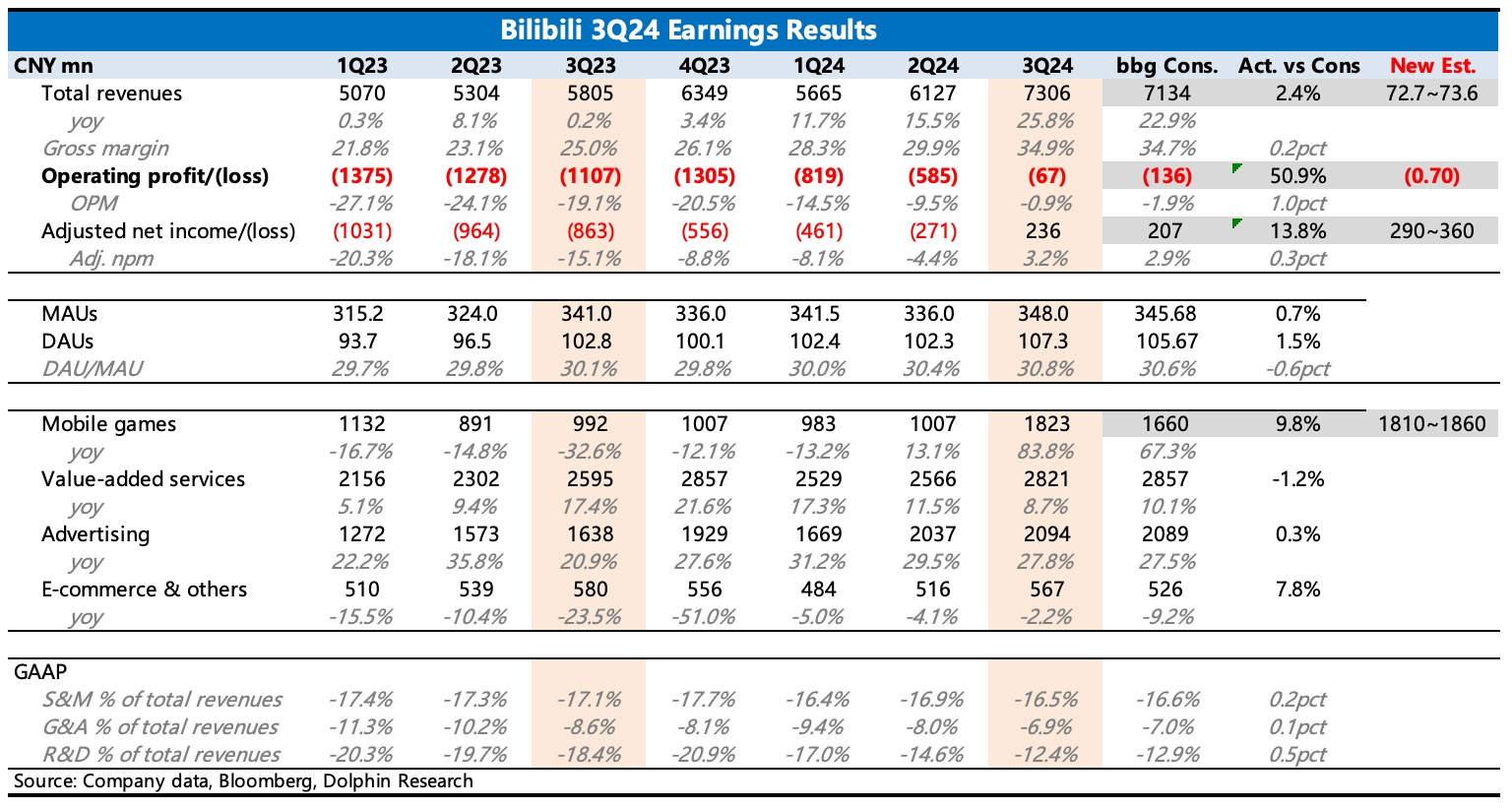

$Bilibili(BILI.US)first take:In the third quarter, thanks to the explosive popularity of "Three Kingdoms: Strategic Edition" and the platform's continuous commercialization efforts, Bilibili achieved profitability on a Non-GAAP basis (mainly excluding the impact of SBC).

However, compared to market expectations, it may be inline or slightly below expectations. The Bloomberg consensus expectations in the chart below are relatively lagging, and there has been a significant upward revision in expectations from top institutions over the past month, especially in terms of gaming revenue. Therefore, compared to the latest expectations, gaming revenue did not beat (actual 1.82 billion vs. expected 1.81-1.86 billion), leading to inline or missed targets for revenue and profit-related metrics.

In terms of user metrics, the growth rate of monthly active users continues to slow. According to third-party app data, Xiaohongshu is rapidly catching up. However, for existing users, engagement with Bilibili continues to improve. On one hand, DAU/MAU has increased, and on the other hand, average daily usage time and monthly interactions per user have further improved. From the perspective of average user monetization and retention costs, the third quarter also showed a healthier trend. While average retention costs declined sequentially, monetization value increased.

For the next quarter, Dolphin Research believes that due to the Double 11 peak season, advertising is expected to maintain high growth. Therefore, gaming performance will be the key to whether the company can continue to perform well. From deferred revenue, the third quarter saw a 10% sequential growth, with continued high year-over-year growth, implying that Q4 gaming performance is expected to remain strong.

Overall, Bilibili's performance is decent, but the high market expectations need some adjustment. In the short term, the sustainability of "Three Kingdoms: Strategic Edition" can still support high growth expectations, but in the medium to long term, there remains a question to be answered—whether the current game pipeline is rich enough to support growth beyond the second half of next year.$BILIBILI-W(09626.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.