$JD.com(JD.US) 3Q24 first take: Possibly due to the company's prior thorough communication with the market, JD.com's delivered performance this time was largely "within expectations," neither surprising nor disappointing.

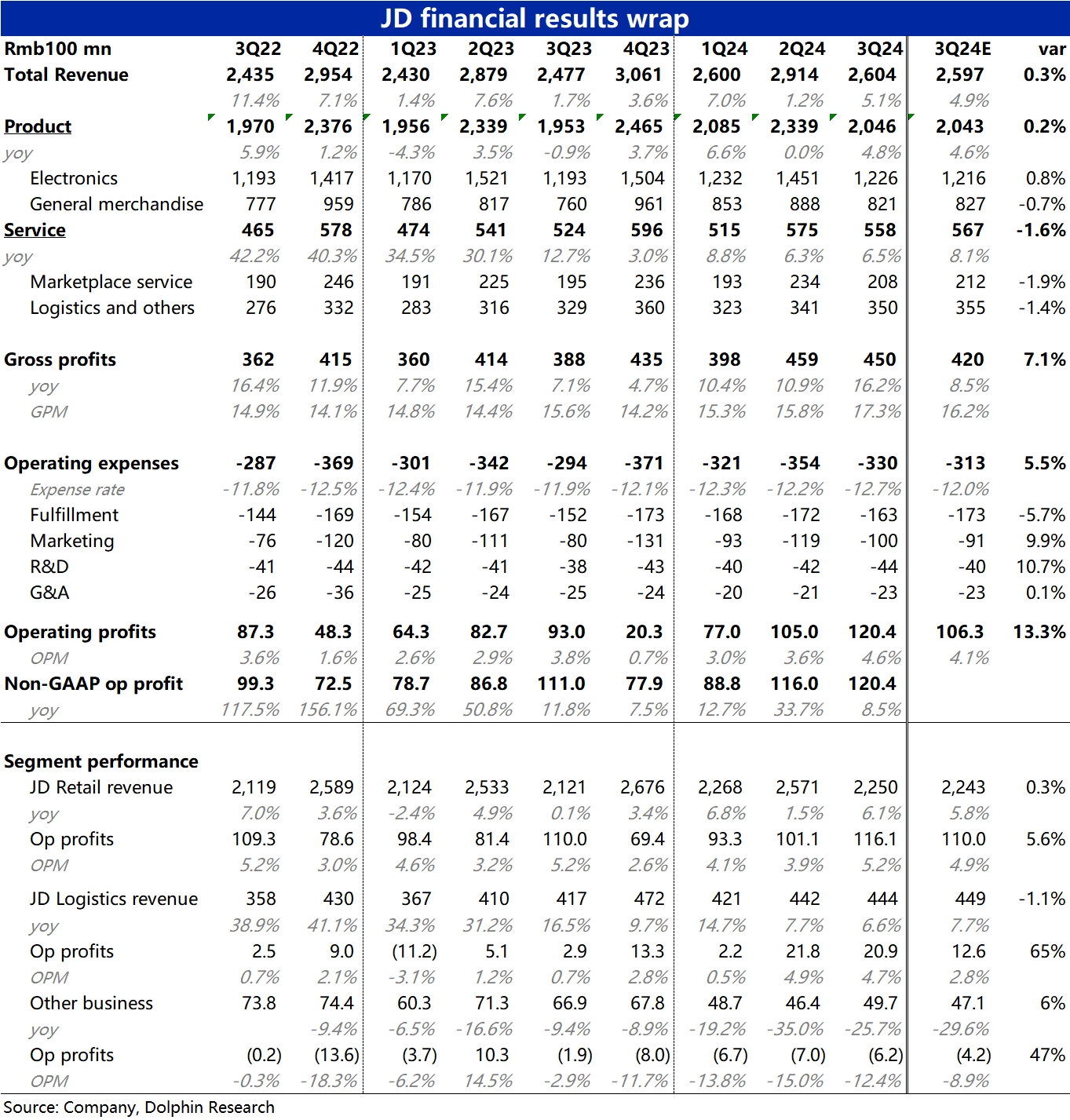

1) On the revenue front, the actual performance was essentially a "copy-paste" of expectations, identical in every way. The trend benefited from national subsidies and the recovery of electronic product growth, helping self-operated retail revenue growth rebound from zero to 4.8%, but the market had already fully priced this in. However, the growth rate of service revenue reflecting 3P business was only 6.5%, slightly below the expected 8.1%. The lead over 1P business growth also narrowed.

2) From a profit perspective, the operating profit that Dolphin Research focused on was about 1.4 billion higher than expected (beating expectations by 13%), which was overall decent. However, structurally, the operating profit margin of the core e-commerce business remained flat year-over-year, leading to a year-over-year profit growth rate of only 5.5% (compared to 24% growth last quarter). This may make the market worry whether JD.com's e-commerce profit expansion momentum is (at least for now) coming to an end, reducing the market's previous relative preference for JD.com within the e-commerce industry. The main source of the profit beat was actually JD Logistics, which saw about 800 million higher profits than expected due to extremely strong cost control.

3) That said, it's also important to emphasize that due to the significant impact of the broader environment, JD.com had previously communicated to lower market expectations for 3Q performance. In other words, it was indeed unnecessary to have overly high expectations for 3Q. From research, JD.com's home appliance sales during Double Eleven should perform well due to national subsidies. Whether the guidance for 4Q performance can bring surprises will be more critical for the subsequent trend.$JD-SW(09618.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.