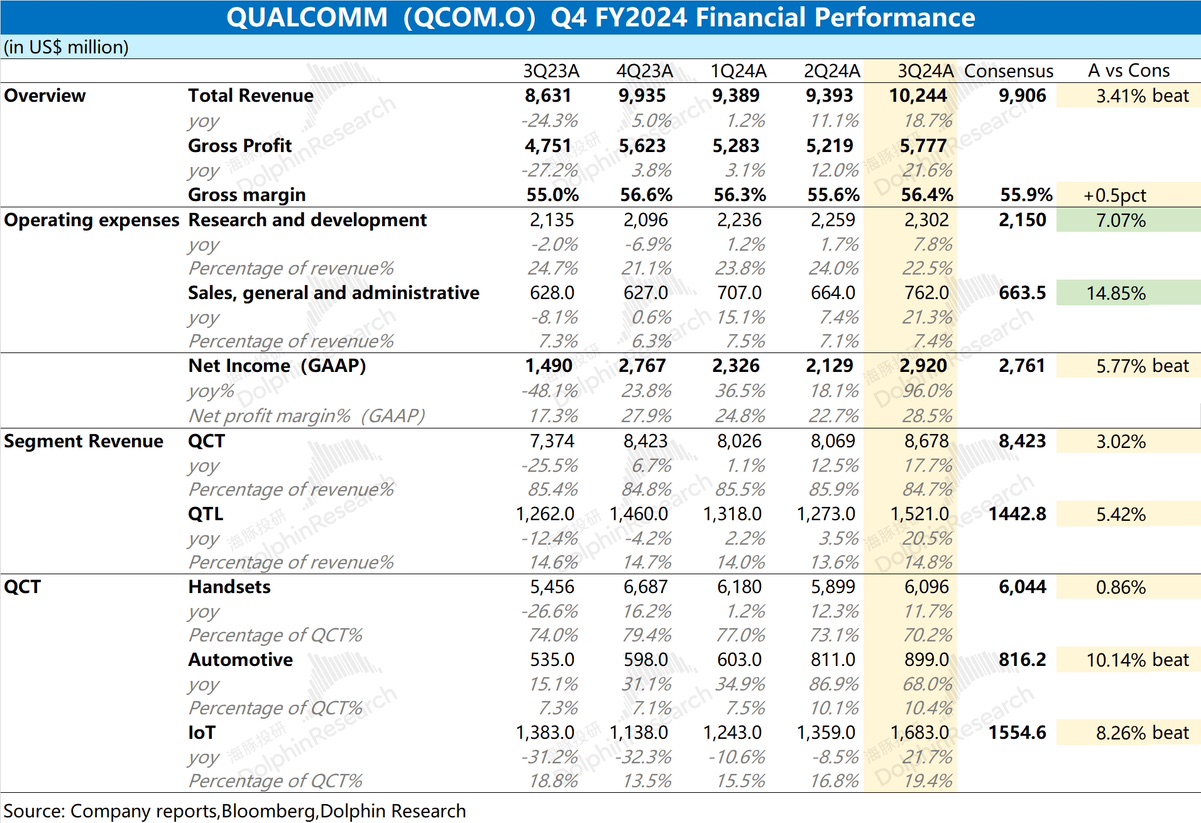

$Qualcomm(QCOM.US)First take: The company's revenue and profit performance this quarter exceeded market expectations. All core businesses showed varying degrees of growth, with the mobile phone business recovering as expected, while the automotive and IoT businesses outperformed expectations. Although R&D expenses and sales & other expenses also increased, driven by revenue and gross margin growth, the company's overall profit continued to rise.

Next quarter, driven by the launch of new products, is typically the company's peak season. According to the company's guidance for the next quarter, it expects revenue of $10.5-11.3 billion (market expectation: $10.55 billion) and adjusted earnings per share of $2.89 to $3.05 (market expectation: $2.81). Both revenue and profit are expected to continue improving, exceeding expectations. As the downstream market gradually recovers, the company's operations have also emerged from the trough.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.