$Microsoft(MSFT.US) 1Q25 first take: As the first earnings report after the change in accounting standards, it does bring some impact on our understanding of the financial details, but it also gives us an opportunity to focus more on the company's overall and most critical comparable business performance. From Dolphin Research's initial perspective, this quarter's earnings report is a pass, but with both positive and negative aspects.

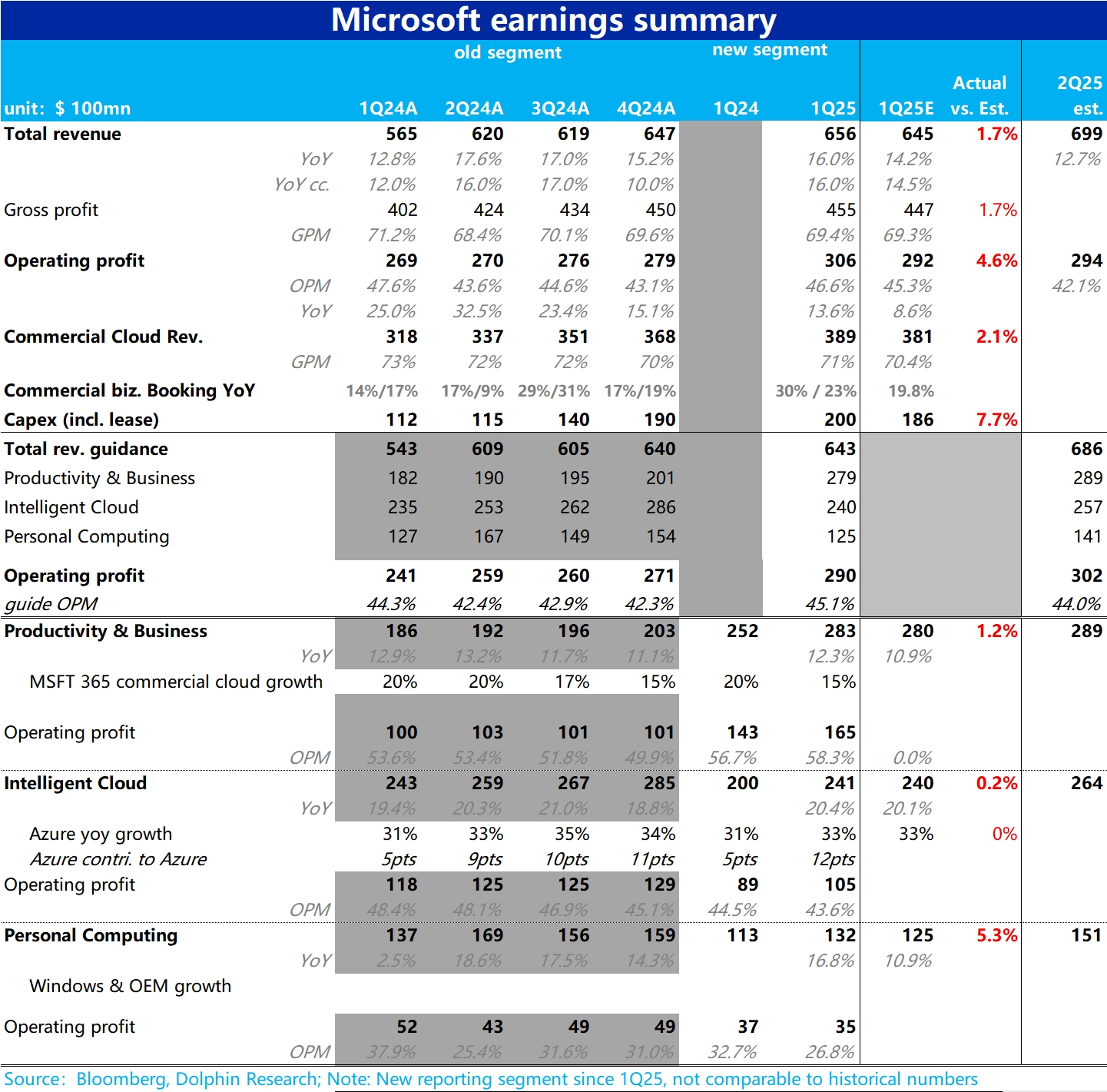

1) First, in terms of overall performance, total revenue increased by 16% year-over-year (including contributions from the acquisition of Activision Blizzard), slightly accelerating from the previous quarter's 15.2% and also slightly exceeding market expectations by 1.7%. However, on the profit side, operating profit of $30.6 billion, while better than market expectations, grew only 13.6% year-over-year, lagging behind revenue growth. The operating profit margin declined both year-over-year and quarter-over-quarter, officially marking the end of Microsoft's profit margin expansion phase, sliding into the contraction phase due to high AI-related Capex.

2) At the same time, this quarter's Capex increased quarter-over-quarter to a full $20 billion, nearly 8% higher than expected. We also noted that this quarter's D&A has doubled compared to the same period last year, increasing by over $3 billion. Free cash flow, dragged down by high Capex, has already declined by 7% year-over-year. The pressure of massive AI infrastructure investments on financial metrics has begun to fully manifest.

3) By segment, the actual revenue growth of Productivity and Business Processes (PBP) and Intelligent Cloud (IC) this quarter was in line with or slightly better than expectations, meeting but not exceeding expectations. On the other hand, the More Personal Computing segment, due to the impact of the Activision Blizzard acquisition and strong advertising business growth (benefiting from Copilot search), exceeded expectations by about 5%.

4) For key core businesses, Azure's growth rate was 33%, down 1 percentage point quarter-over-quarter, basically in line with market expectations—no surprises. The guidance for the next quarter points to a further slowdown of 2-3 percentage points, not indicating a continued strong rise in cloud computing demand due to AI but rather a continued decline. Combined with profits already starting to decline due to Capex investments, it gives the impression of high investment without a real demand explosion. Another core business, 365 Commercial Cloud under PBP, grew 15% this quarter, flat with the previous quarter. Guidance for the next quarter also points to a slowdown of about 2 percentage points, with no signs of demand explosion from AI features like Office Copilot.

5) The only comforting aspect is that the constant currency growth rate of newly signed commercial bookings this quarter reached 23%, up 4 percentage points from the previous quarter, suggesting that incremental demand may indeed exist. However, it is still in the contract stage and has not yet been reflected in financial metrics, leaving room for potential future release.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.