$Meta Platforms(META.US) first take: The Q3 performance was actually quite strong, but as advertising experts almost unanimously gave highly positive feedback on Meta's Q3 performance, market expectations were also raised all the way up. Compared to the latest expectations from investment banks, Meta's results were only inline, and some metrics even slightly missed expectations. At high valuations, even the smallest flaws can be singled out and magnified for discussion.

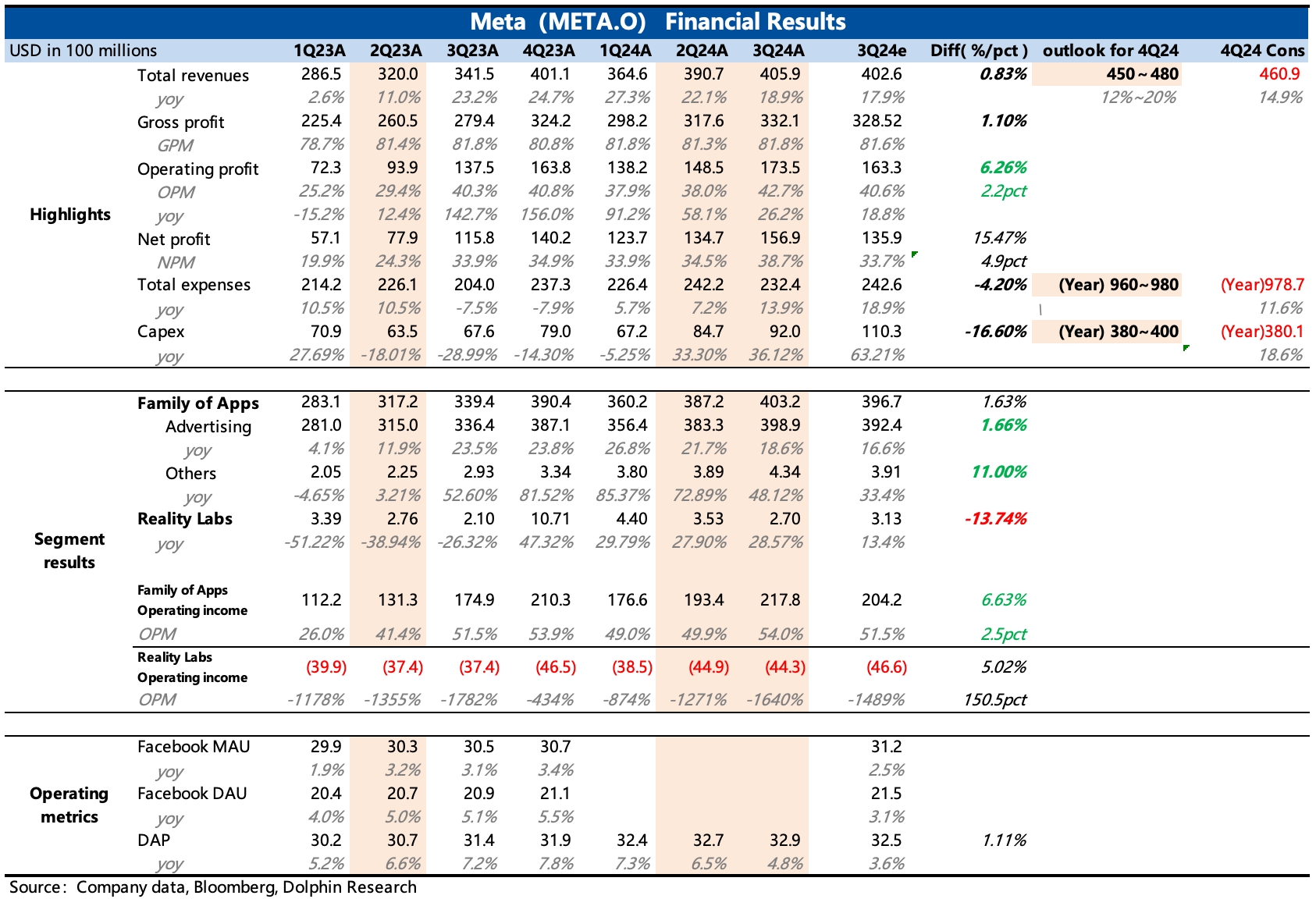

Specifically: (1) Total revenue grew by 19%, which is already quite impressive given the high base (only a 3 pct slowdown quarter-over-quarter), but some market expectations had already priced in 20% YoY growth. For Q4 guidance, current market expectations, including relatively optimistic ones, are hovering around the midpoint of the guidance range. While the growth trend alone looks very strong, it can only be said to be largely in line with expectations, whereas in the past, Meta has often significantly exceeded expectations on this metric.

(2) On profitability, total operating expenses accelerated as expected, growing by 12%. R&D expenses rose 21% YoY, further reflecting the investment cycle driven by high Capex and higher compensation for AI team expansion. However, in terms of margins, similar to Google yesterday, Meta was unaffected, with Q3 operating margins rising QoQ to 42.7%, the highest since the business headwinds of 2022. Despite heavy investments, Meta has offset profit pressures through stronger commercialization on the business side. In other words, these investments are not like the blind spending on the RL department three years ago but rather efficient investments in AI advertising that can quickly generate returns.

(3) However, the market may be starting to worry about the pressure on profits from the 2025 investment scale. Q3 Capex was $9.2 billion, lower than expected, but the full-year Capex guidance raised the lower bound, with the new range at $38-40 billion, implying a sharp spike in Q4 capital expenditures (+72%~98%). Currently, market expectations for 2025 Capex are around $45 billion, with more aggressive estimates reaching $50 billion, representing growth of about 15%~28%. But if the short-term trends from Q3 and Q4 continue, the market's expected growth rate might not hold when Meta provides full-year 2025 guidance during the Q4 earnings report.

Looking at depreciation and amortization expenses, since Q2 last year, the impact of earlier Capex increases on expenses has become apparent, with Q3 depreciation expenses accelerating to 40% growth. As the larger wave of Capex increases starting in Q2 2024 gradually flows into expenses, depreciation expenses are expected to accelerate further unless Meta extends the depreciation cycle. At the same time, Q3 also saw a return to positive growth in employee headcount. If revenue growth cannot maintain its high pace, profit growth pressures may start to emerge next year.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.