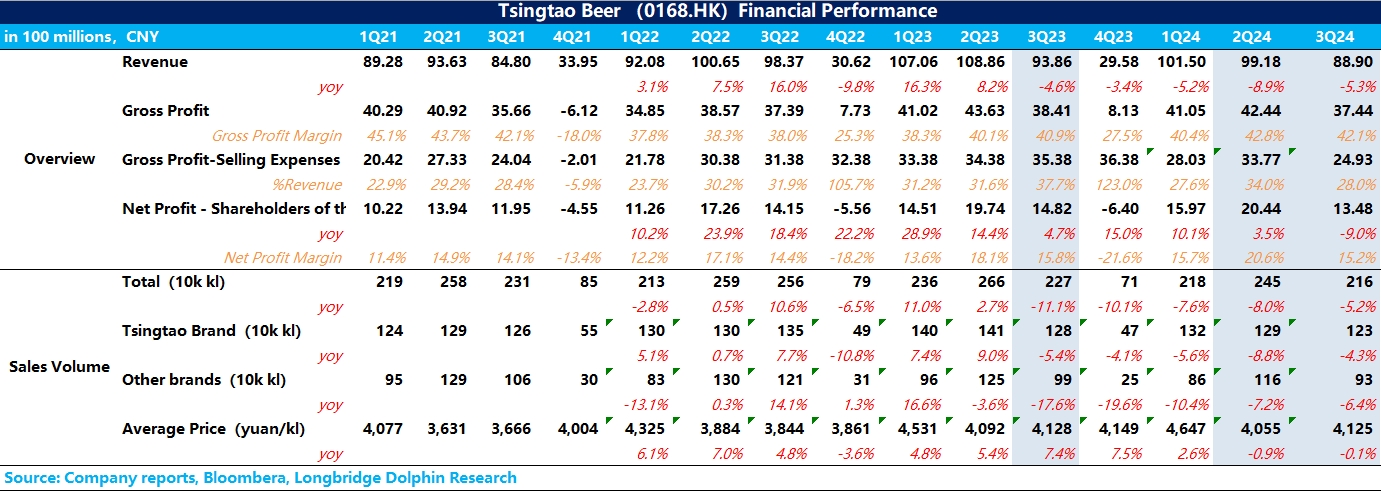

$TSINGTAO BREW(00168.HK) First take: Due to the continued weak macro environment, Tsingtao Brewery's Q3 report still showed declines in both volume and price, but there was some improvement compared to Q2.

1) Revenue was 21.6 billion yuan, down 5.3% year-on-year. Among them, sales volume: In Q3, Tsingtao Brewery achieved a sales volume of 2.16 million tons, down 5.2% year-on-year. The decline narrowed compared to Q2, but considering the peak season in Q3, the company increased marketing expenses, and channel inventory remained at normal levels. Overall, we believe the improvement in sales volume fell short of expectations. Price per ton: Tsingtao Brewery's price per ton was 4,125 yuan/ton, basically flat, indicating limited effects from product mix upgrades.

2) Net profit was 1.35 billion yuan, down 9% year-on-year. Although gross margin remained stable, the company increased marketing expenses in Q3, with the sales expense ratio rising by 1% quarter-on-quarter, further narrowing the gross-to-sales margin.

3) Overall, Tsingtao Brewery currently faces significant pressure in both volume and price. In terms of volume, Dolphin Research learned that since August, the company's core Shandong market has seen a significant decline, with intensified market competition. In terms of price, although the company directly raised prices for products like Tsingtao Pure Draft this year, acceptance has been low. In the future, it may be more reasonable to indirectly increase the price per ton by optimizing the product mix.$Tsingtao Brewery(600600.SH)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.