$Focus Media(002027.SZ) First take: Focus Media's third-quarter report vividly reflects the current challenging macroeconomic environment.

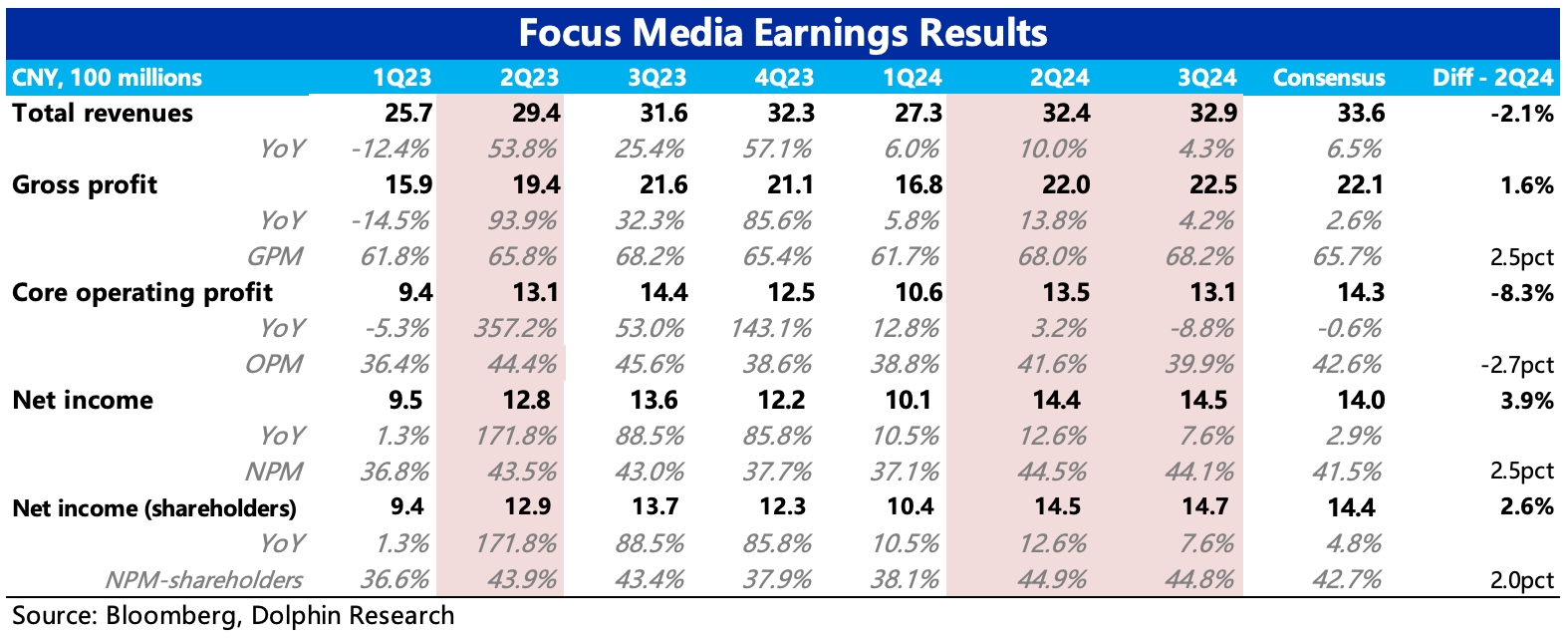

(1) Revenue of 3.3 billion yuan fell within the expected range of several leading institutions (3.2-3.4 billion yuan). The year-on-year revenue growth rate was 4.3%, significantly slower than the previous quarter, reflecting the change in advertising strategy mentioned by Dolphin Research last quarter: "peak season is even busier, off-season is even slower."

(2) Net profit was 1.48 billion yuan, with a year-on-year growth rate of 7.6%, slightly exceeding expectations, but mainly due to investment income and other items unrelated to the core business. Looking solely at the operating profit of the core business, it actually declined by 9% year-on-year, falling short of market expectations. Similarly, comparing the net profit attributable to the parent company after excluding non-recurring gains and losses, the growth rate also slowed to 4.5% (the difference in effective tax rates led to the discrepancy between the growth rate of net profit after excluding non-recurring gains and losses and the growth rate of core operating profit).

The decline in the profitability of the core business was mainly due to rising credit impairment losses, followed by marketing expenses that grew significantly faster than revenue. Combined with a 17% increase in fixed assets compared to the end of the previous quarter and a 10% year-on-year increase in employee expenses, it indicates that Focus Media is actively expanding its media points and sales teams to seek more clients.

(3) Two other indicators reflecting the current environment—credit/asset impairments and accounts receivable turnover days—both showed a quarter-on-quarter increase in Q3, indicating greater short-term pressure on client repayments.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.