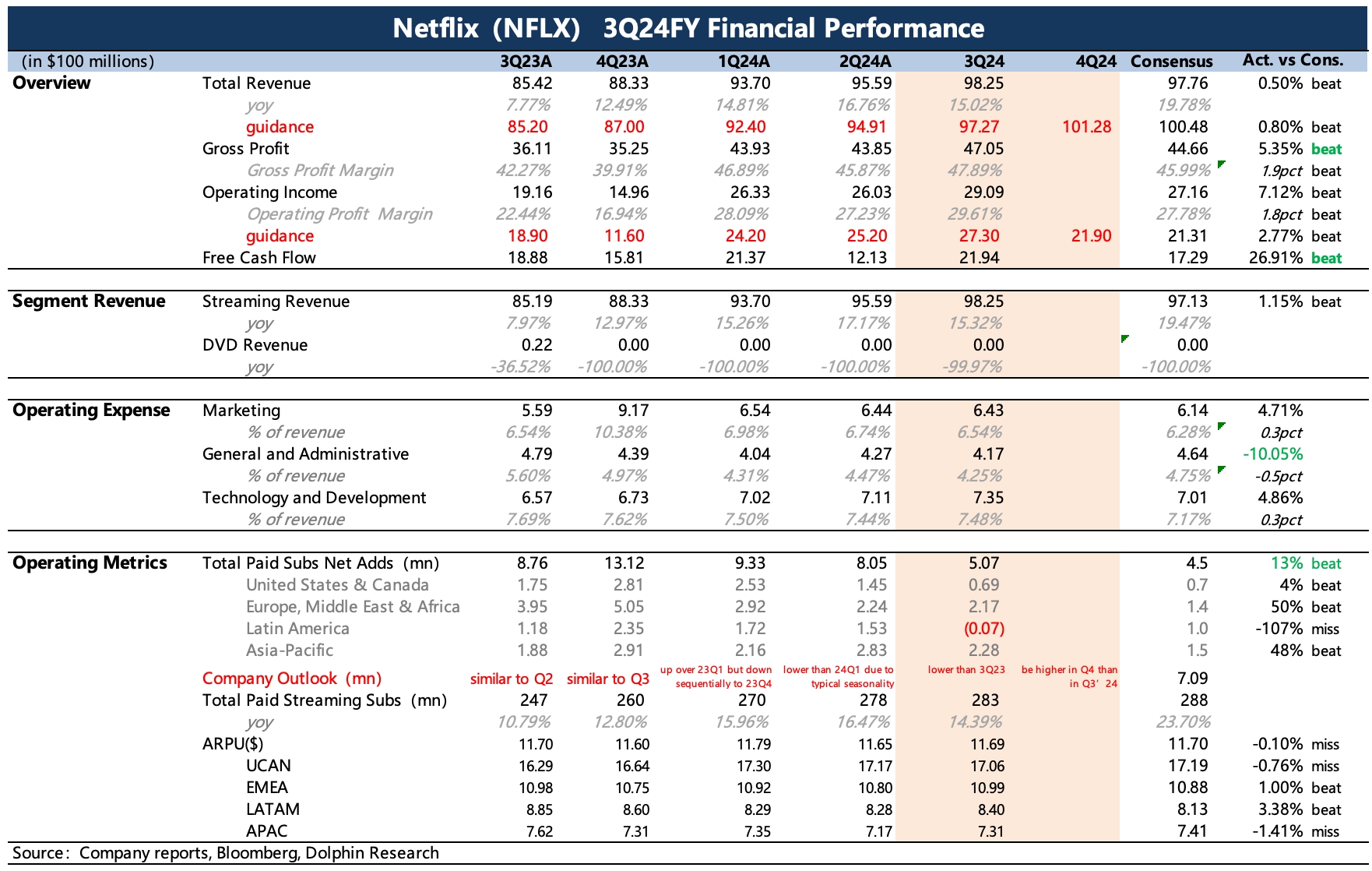

$Netflix(NFLX.US) First take: The Q3 performance was still good, with all key indicators meeting or slightly exceeding market expectations.

The user growth in Q3, which was not expected to be high, actually performed decently, with a net increase of 5.07 million users. This was higher than the consensus expectations and basically met the expectations of major banks.

For the Q4 revenue and profit guidance, Netflix also slightly exceeded expectations. Especially in terms of profitability efficiency, the gross margin and cost optimization were better than market expectations. Short-term user growth was mainly driven by the ad-supported subscription plan, with ad-tier users increasing by 35% quarter-over-quarter in Q3. Additionally, the account-sharing plan is also playing a role. Next quarter, the release of "Squid Game Season 2" at the end of the year, along with two major sports programs and the peak season effect of the Christmas holidays, is expected to further drive user subscriptions.

With the Q4 guidance, the company has also raised its full-year 2024 performance outlook. For 2025, Netflix expects total revenue of $43-44 billion, implying 11-13% growth, which is basically in line with the market consensus of $43.5 billion. As for the market's concern about the potential drag on overall ARM and the slowdown in OPM expansion due to the relatively lower ARM of short-term ad-tier users, the company provided a 2025 OPM guidance of 28%. While this meets expectations, the marginal improvement (from 27% to 28%) is slower than the market anticipated (market expectation was 26%-28%), which precisely confirms the potential impact of short-term ad expansion. However, as the ad monetization model improves with related technologies and partnerships, it will likely have a positive impact on performance in the medium to long term.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.