Posts

Posts Likes Received

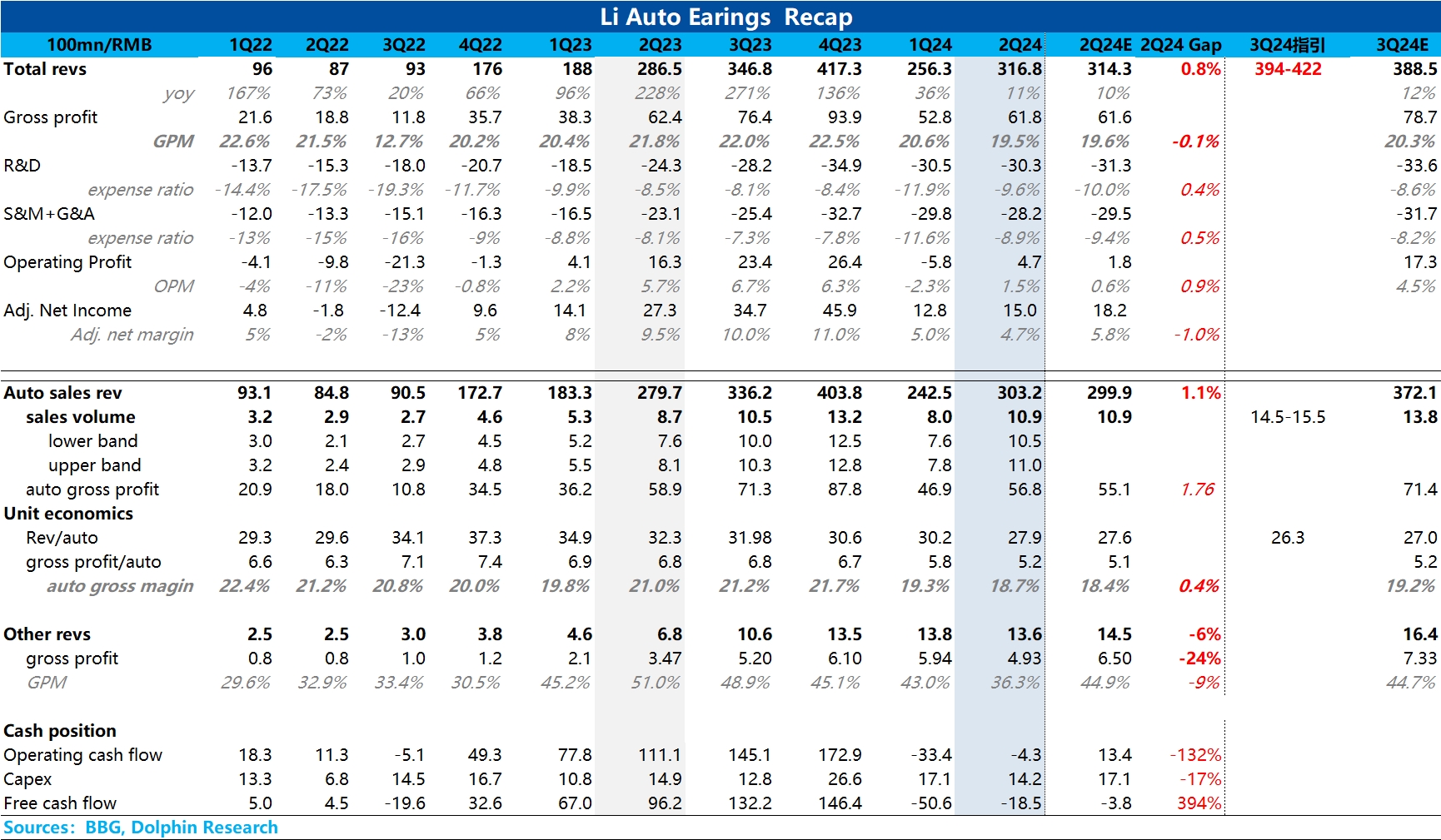

Likes Received$Li Auto(LI.US) first take: Sales figures are clear, unit price estimates are slightly lower than market expectations. With total revenue of 31.6 billion yuan and an 11% year-on-year growth, it can only be said to be within reasonable margin of error. The key automotive gross margin, due to slightly higher-than-expected unit prices, reached 18.7%, a tad above projections. Meanwhile, under cost-cutting and efficiency measures, operating expenses were well-controlled. The profit of less than 500 million yuan was indeed a bit higher than market expectations.

However, from start to finish, Q2's overall performance had no fundamentally surprising or shocking aspects. Thus, Dolphin Research views it as neither outstanding nor disappointing.

As for Q3's sales guidance, the range of 145,000 to 155,000 vehicles, in Dolphin Research's view, reflects a lack of confidence. The key difference this time is that past guidance ranges typically had a narrow spread of just 2,000-3,000 units, whereas this time it's a whopping 10,000 units.

Based on current sales trends, Dolphin Research estimates that even a slight improvement would make 150,000 units an easy threshold to reach but hard to exceed. This widened range inherently signals reduced confidence in the guidance. Another layer is the implied unit price of around 263,000 yuan, lower than market expectations, suggesting continued weak sales of Li Auto's L8/9 models under competition from the M9, with the lower-priced L6 taking a larger share. There's also the possibility of price wars to meet sales targets.

Short-term outlook: Li Auto's sales have indeed recovered from Q1's slump, but competitive pressure from the M9 in the premium hybrid segment, order momentum for the L6/7, and ongoing negative free cash flow due to heavy upfront investments in pure EVs all indicate that Li Auto's turnaround moment has yet to arrive.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.