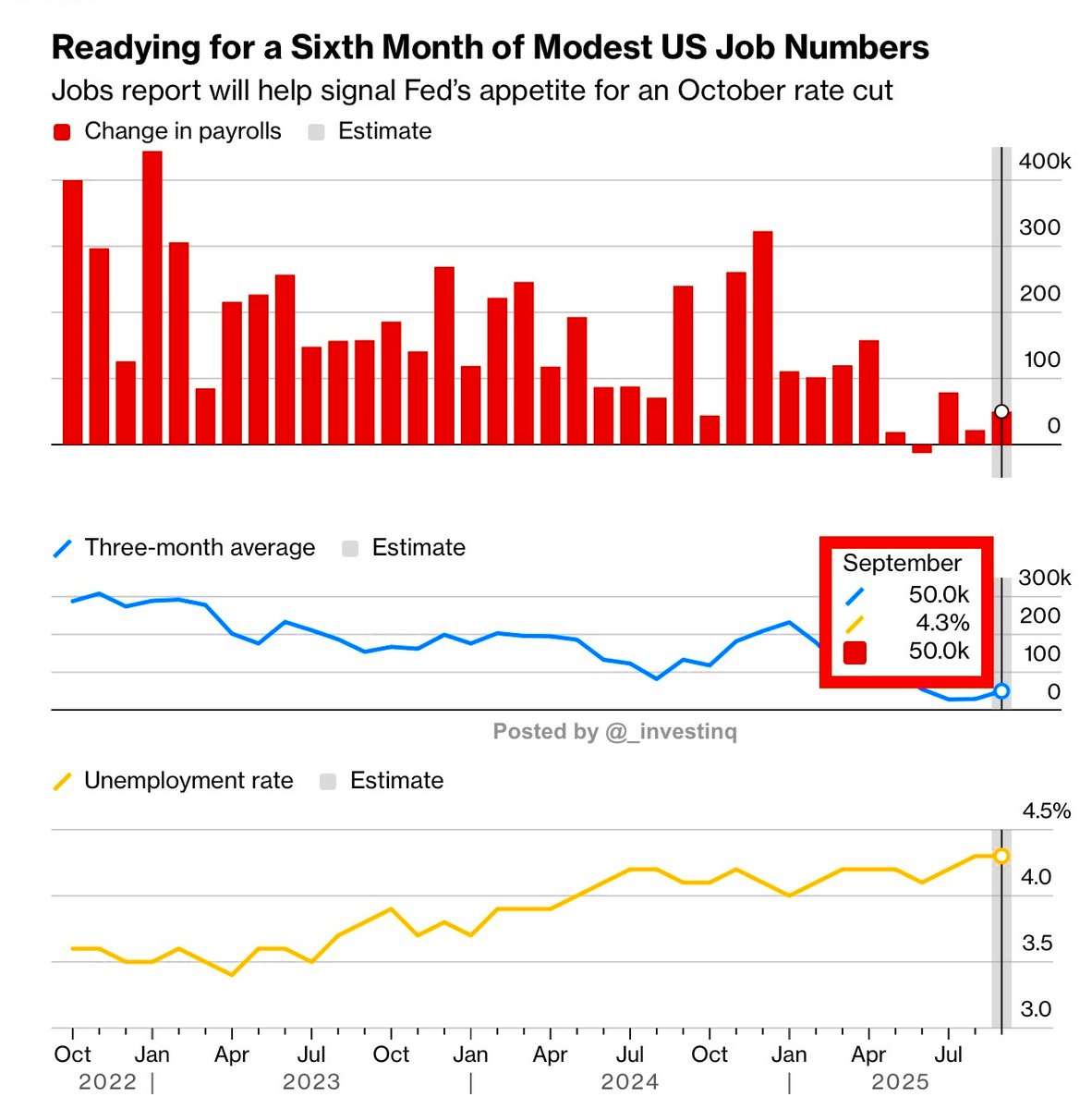

2025 年 9 月正成为美国劳动力市场和美联储的重大考验。就业增长放缓,失业率上升,而华盛顿还面临政府停摆的风险。9 月的就业报告可能决定美联储是否会在 10 月会议上再次降息。

经济学家预计 9 月新增就业约 5 万个,与过去三个月的疲软趋势一致。薪资增长已连续半年低于 10 万,6 月数据更是修正至 2020 年以来最低水平。多数预测在 4.5 万至 5.4 万之间,任何增长可能仅来自酒店业等狭窄领域,而非全行业广泛招聘。

失业率预计维持在 4.3%,为四年来最高。自 2024 年初以来的持续攀升表明,招聘放缓与劳动力增加正推高失业率。同时,职位空缺数在 7 月降至 718 万后,已跌至 2021 年以来最低。随着成本上升和收入疲软,企业明显减少了用工需求。

可能的政府停摆增加了另一层不确定性。若国会未能通过支出法案,官方就业数据等关键报告将冻结,使市场和政策制定者在关键时刻失去指引。这将使美联储在权衡 10 月 29 日是否再次降息时更加复杂。

美联储今年已降息一次,随着劳动力市场走弱,再次行动的可能性正在上升。投资者正密切关注就业数据的修正,此前该数据多次低于预期。个别行业的微弱增长无法掩盖整体放缓。

本周将密集发布劳动力市场数据:周二的 JOLTS 职位空缺和消费者信心指数、周三的 ADP 就业和制造业 PMI、周四的初请失业金人数,以及——如果政府未停摆——周五的 9 月就业报告。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。