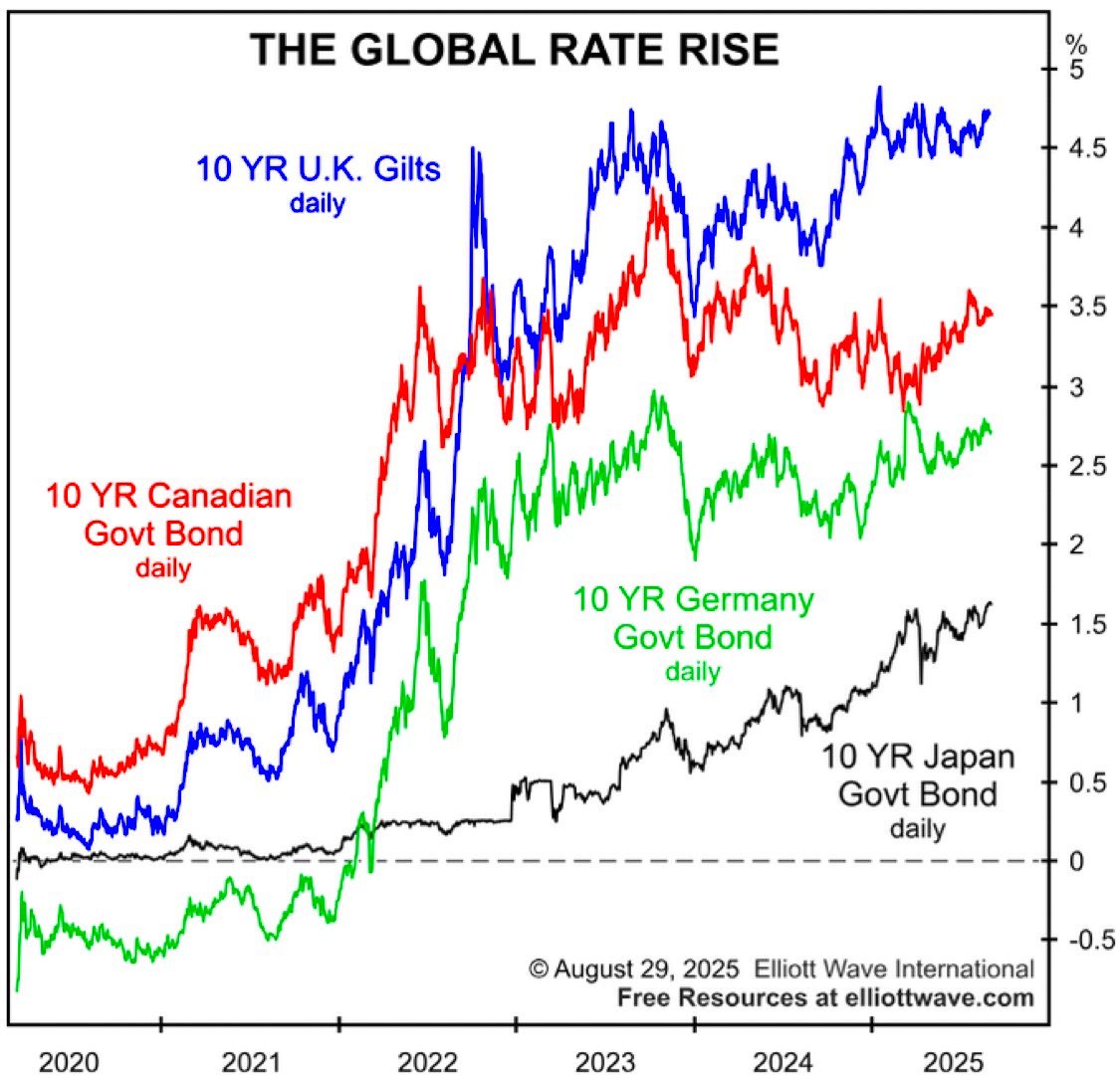

Long-term interest rates are climbing in big economies like the U.K., Canada, Germany, and Japan, even though central banks have been cutting rates or holding them lower. The driver is pretty straightforward: markets are nervous about record government deficits, rising debt loads, and growing political and credit risks. When governments borrow heavily, investors start worrying about whether payments will always be met or if restructuring becomes a possibility. To hold that risk, they want higher yields.

At the same time, some of the traditional buyers of long-term government bonds pension funds and insurance companies are stepping back. Their strategies and demographics are shifting which means less natural demand for this debt. On top of that, central banks are still in quantitative tightening mode. They’re letting bonds they already own roll off without reinvesting, which pulls away a big source of support from the market. That’s showing up in the yield curve. Short-term rates stay lower because of policy cuts, but long-term yields keep pushing higher as investors price in inflation, fiscal stress, and political uncertainty. In the U.S. persistent deficits and heavy Treasury issuance, combined with pressure on the Fed, have made long-term Treasury yields stubbornly high. The shape of the curve is telling us that investors see more inflation and more risk down the road.We’ve been here before. In the 1940s, the U.S. used yield curve control to keep long-term rates artificially low to fund World War II debt. Once that policy ended, yields shot up, bondholders took big losses, and credit conditions tightened fast. That’s a reminder of how dangerous it can be when long-term rates reset higher after being held down. Today’s setup carries the same warning signs. Higher yields mean governments face bigger interest bills at a time when budgets are already stretched. That can squeeze out other spending and make debt sustainability even shakier. In weaker economies, the risk of restructuring or outright default grows if borrowing costs keep climbing. Rising long-term yields aren’t just a market move, they’re a signal that fiscal strains, political risks, and inflation fears are starting to catch up.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.