SanDisk QJun25

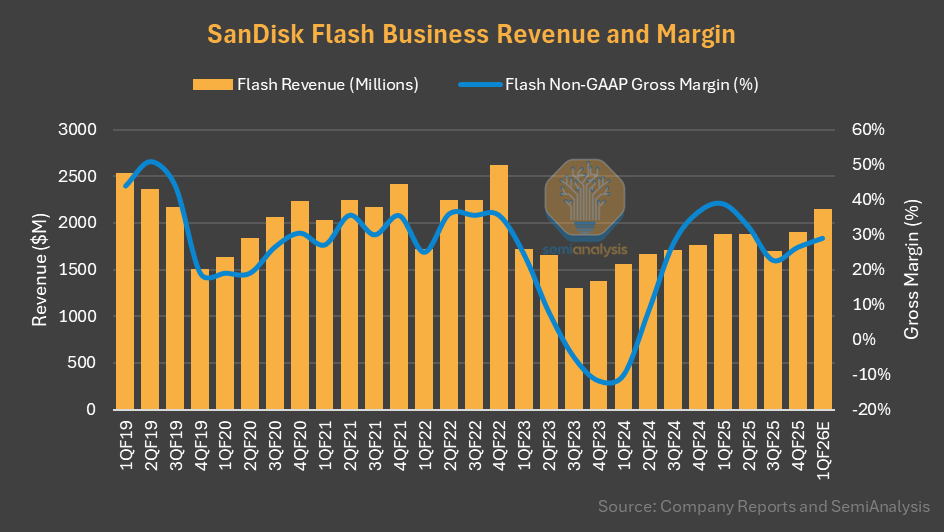

Revenue up 12% q/q and 8% y/y to $1.9B. Bit shipments & ASPs MSD % q/q. All end markets up q/q. Underutilization continues. Under shipping demand will continue through '26. Near-term capital intensity to be above target as SNDK ramps BiCS8. Not pulling out from China, like MU. HBF partnership with Hynix.Source: Sravan Kundojjala

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.